- United States

- /

- IT

- /

- NYSE:SNOW

Has Snowflake’s Recent AI Partnership Boosted Its Value Too Far in 2025?

Reviewed by Bailey Pemberton

- Wondering whether Snowflake’s high-flying reputation is matched by real value? You’re not alone. The answer becomes more nuanced when we look beyond the headlines.

- The stock has risen 59.5% so far this year, though the past month saw a dip of 7.4%. This highlights how quickly risk perception can shift, even for popular stocks.

- Recent headlines highlight Snowflake’s ambitious moves, such as announcing partnerships with leading AI innovators and expanding its product ecosystem. These developments have fueled both bullish and bearish reactions, and investor attention remains high as the company positions itself to compete more directly with major cloud players.

- Currently, Snowflake scores a 0/6 on our valuation checks, indicating it is not undervalued according to any of our standard measures. Next, we’ll explore what those methods show, as well as an alternative approach to interpreting Snowflake’s valuation in today’s volatile market.

Snowflake scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Snowflake Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future cash flows and discounting them back to today's value. This reflects their worth in present terms. For Snowflake, the model uses a "2 Stage Free Cash Flow to Equity" approach, drawing on both analyst forecasts and extrapolated projections to estimate future growth.

Currently, Snowflake generates $726.87 Million in Free Cash Flow. According to analysts, this figure is expected to grow rapidly, with projections reaching $1.12 Billion in 2026 and $1.48 Billion in 2027. Beyond 2027, Simply Wall St’s methodology further extrapolates future Free Cash Flow, estimating $3.26 Billion by 2030. These growth rates indicate strong optimism about Snowflake’s expanding business and market reach.

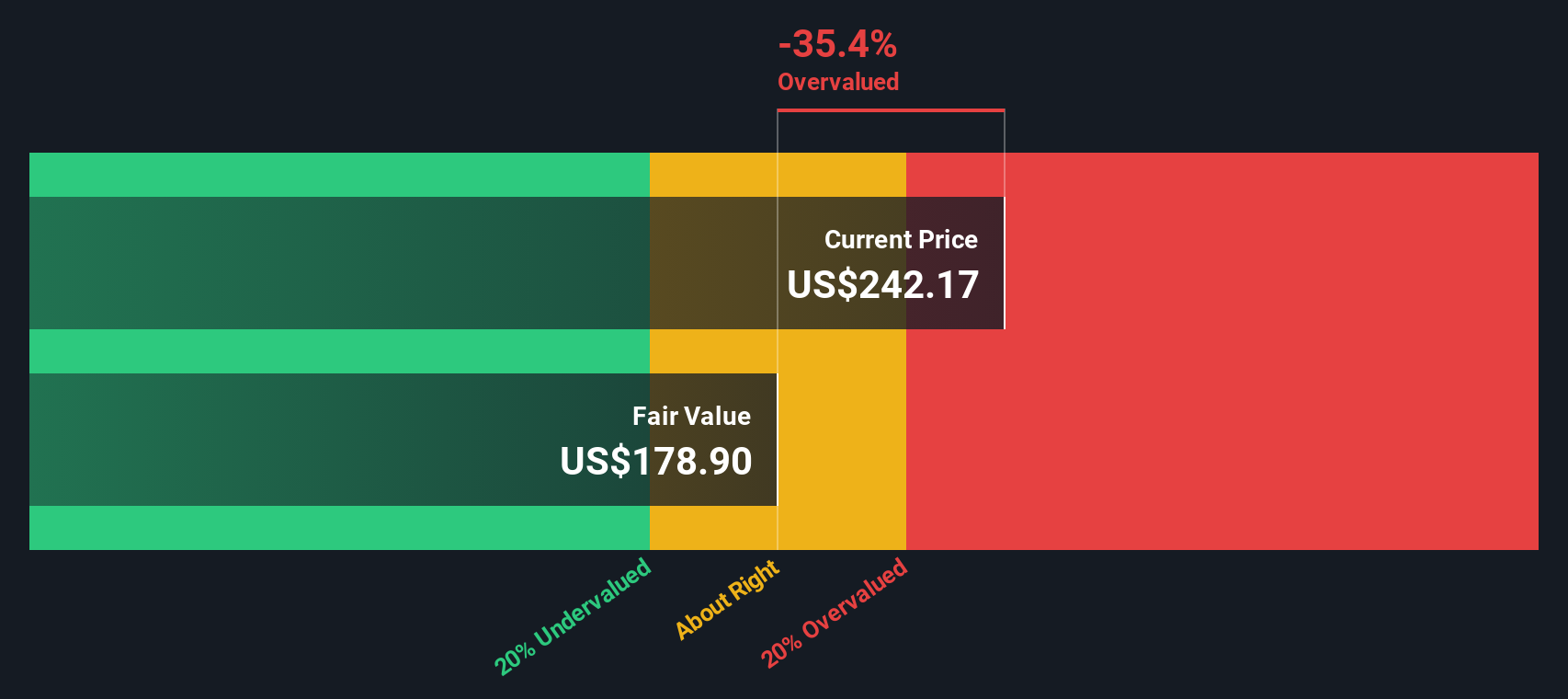

Using these projected cash flows, the DCF model arrives at an estimated fair value of $182.63 per share. However, compared to Snowflake’s current market value, this suggests the stock is 37.6% overvalued.

Based on this DCF analysis, Snowflake offers robust growth potential, but its current share price may not leave much room for error or further upside.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Snowflake may be overvalued by 37.6%. Discover 920 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Snowflake Price vs Sales

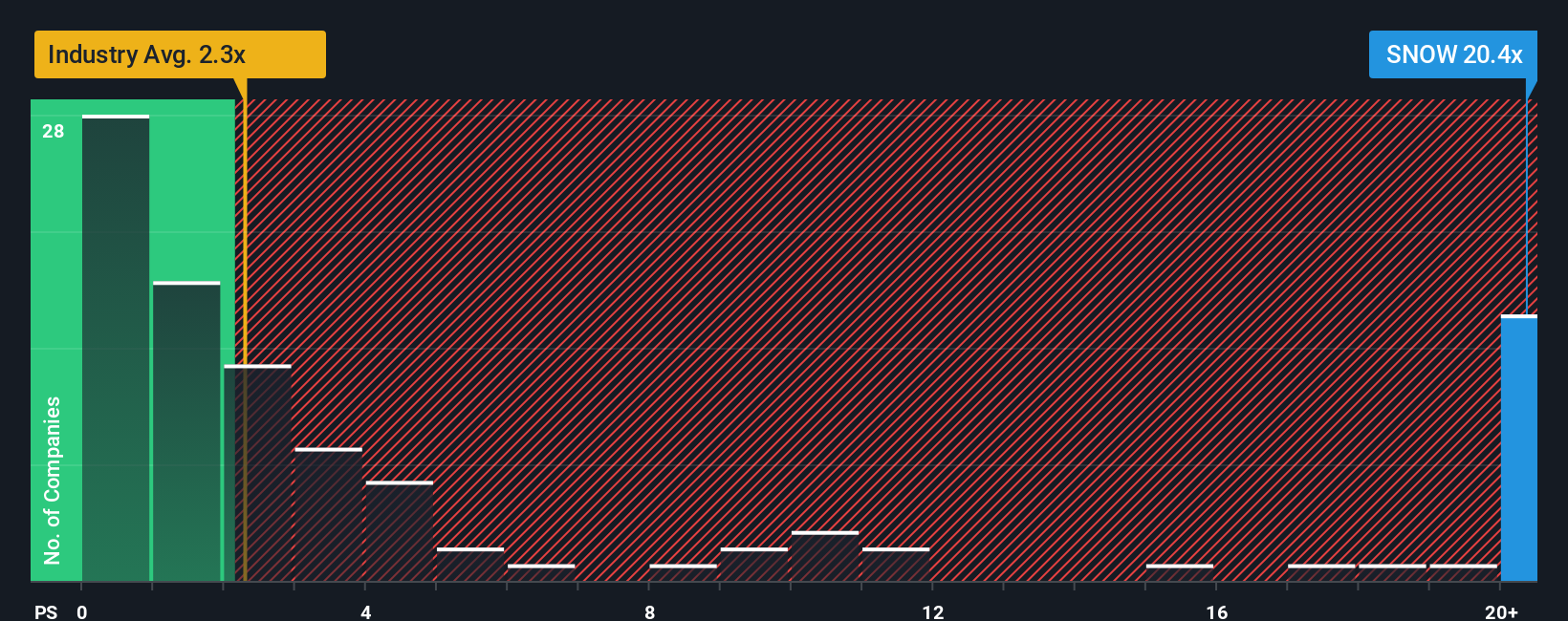

For fast-growing technology companies like Snowflake, the Price-to-Sales (P/S) ratio is often the preferred metric because many are still investing heavily in growth and may not yet be consistently profitable. The P/S ratio allows investors to value these companies relative to their revenue, which typically grows much faster than profits at this stage.

What counts as a reasonable P/S ratio depends on several factors, most notably expectations for future sales growth versus the level of risk. Higher growth usually justifies a higher P/S, while greater risk or slower growth would call for a lower multiple. Snowflake currently trades at 20.68x sales. To put this in context, the industry average P/S is just 2.68x, while direct peers average 20.17x sales.

Simply Wall St's proprietary "Fair Ratio" is designed to go beyond these comparisons. The Fair Ratio weighs the company’s profitability, future growth potential, industry dynamics, market cap, and risk profile to give a holistic view of where the multiple should land for Snowflake specifically. By considering such nuances, it is a more accurate yardstick than simply comparing to peers or the broader industry.

For Snowflake, the Fair Ratio is 15.06x, below its current P/S. This suggests Snowflake’s shares are trading at a premium relative to what its growth and risk profile might justify.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1438 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Snowflake Narrative

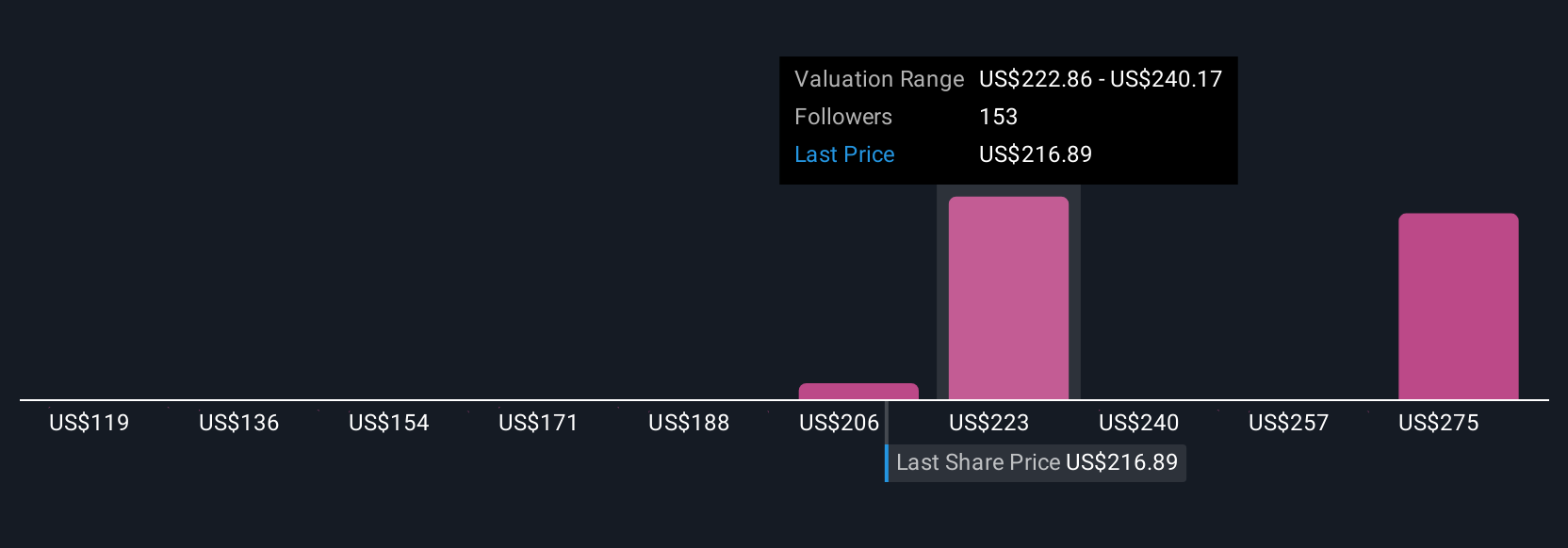

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story, your perspective on a company's future, distilled into the numbers you expect for revenue, earnings, and margins. It is where you connect everything you have learned about a company with a financial forecast, and then see how that translates into a fair value.

Narratives allow you to move beyond headline analysis by building your own view and seeing how the story you believe in stacks up against the current price. On Simply Wall St’s Community page, investors of all experience levels use Narratives as an intuitive tool to help decide when a stock is undervalued, fairly priced, or too expensive. Because they update automatically as news or results emerge, Narratives stay relevant even in fast-changing markets.

For example, the most optimistic Snowflake Narrative sees the share price rising toward $440 based on explosive AI-driven growth, while the most cautious Narrative values shares at $170, reflecting competitive and margin risks. This approach allows you to compare your assessment against both extremes and the consensus in between.

Do you think there's more to the story for Snowflake? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNOW

Snowflake

Provides a cloud-based data platform for various organizations in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.