- United States

- /

- Software

- /

- NYSE:QTWO

How Investors May Respond To Q2 Holdings (QTWO) Slowing ARR Growth And Persistent Margin Pressures

Reviewed by Sasha Jovanovic

- In the recent quarter, Q2 Holdings reported annual recurring revenue of US$888.4 million, growing 11.3% year on year, while analysts now project revenue growth of 10.7% over the next 12 months amid intensifying competition.

- An important takeaway is that Q2’s average gross margin of 53.4% over the last year remains relatively low for a software company, suggesting structurally higher infrastructure costs and ongoing profitability pressures.

- We’ll now examine how slowing annual recurring revenue growth may reshape Q2 Holdings’ existing investment narrative around digital banking expansion.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Q2 Holdings Investment Narrative Recap

To own Q2 Holdings, you need to believe that digital banking demand can offset rising competition and relatively low margins, sustaining attractive subscription growth even as ARR momentum cools. The latest results, with ARR at US$888.4 million and growth easing to 11.3% year on year, reinforce that the near term catalyst is continued ARR expansion, while the biggest risk is that intensifying competition and bank consolidation further pressure growth and churn. For now, this news modestly reinforces rather than changes that setup.

Among recent developments, Q2’s move back to profitability in 2025, with year to date net income of US$31.57 million after prior losses, is particularly relevant. It shows the business can generate earnings despite a 53.4% gross margin and softening ARR growth, which matters for investors focused on whether Q2 can absorb higher infrastructure and customer acquisition costs while still converting digital banking demand into sustainable profit growth.

Yet investors should be aware that ongoing consolidation among Q2’s mid sized bank customers could...

Read the full narrative on Q2 Holdings (it's free!)

Q2 Holdings' narrative projects $1.0 billion revenue and $132.9 million earnings by 2028. This requires 11.0% yearly revenue growth and about a $128 million earnings increase from $4.9 million today.

Uncover how Q2 Holdings' forecasts yield a $89.71 fair value, a 22% upside to its current price.

Exploring Other Perspectives

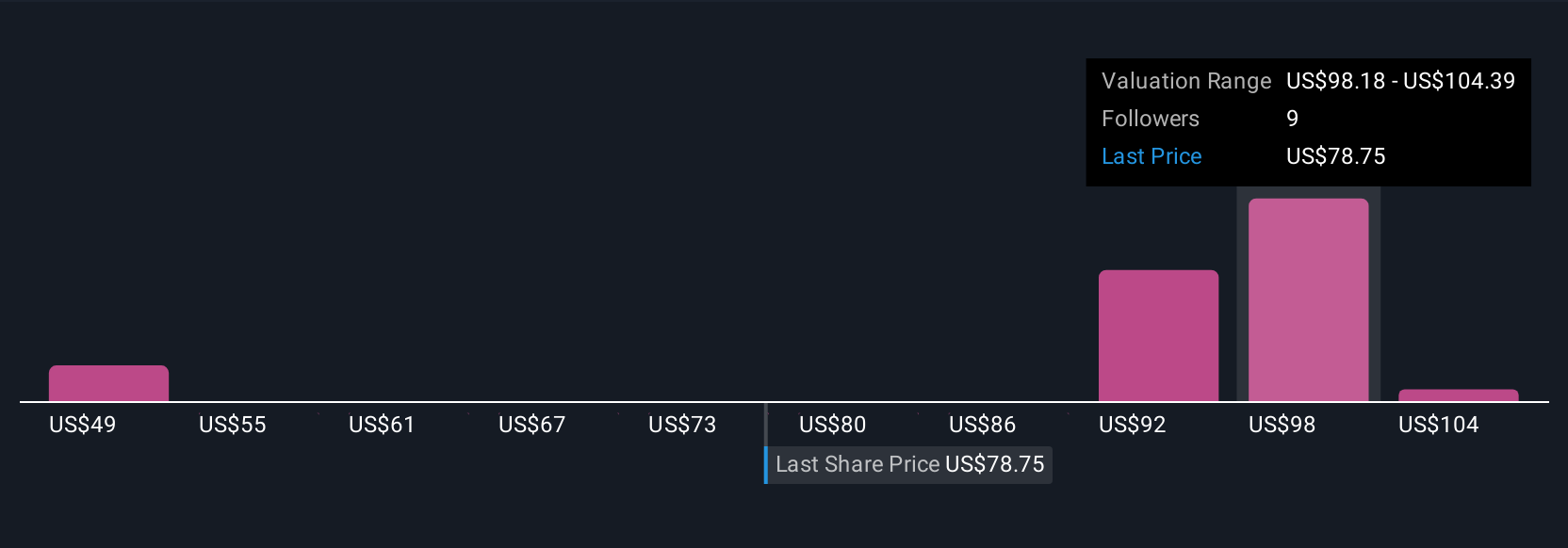

Five fair value estimates from the Simply Wall St Community span roughly US$48.50 to US$110.60, showing how far apart views on Q2 can be. Against that backdrop, the combination of moderating ARR growth and relatively low gross margins becomes a key lens for readers assessing how competitive pressure might influence Q2’s ability to turn digital banking demand into durable earnings performance, so it is worth weighing several different forecasts before forming a view.

Explore 5 other fair value estimates on Q2 Holdings - why the stock might be worth as much as 50% more than the current price!

Build Your Own Q2 Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Q2 Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Q2 Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Q2 Holdings' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Q2 Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QTWO

Q2 Holdings

Provides digital solutions to financial institutions, financial technology companies, FinTechs, and alternative finance companies (Alt-FIs) in the United States.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026