- United States

- /

- Software

- /

- NYSE:QBTS

D-Wave Quantum (QBTS) Is Up 11.1% After Third-Quarter Revenue Doubles on Major European Contract

Reviewed by Sasha Jovanovic

- D-Wave Quantum announced that its third-quarter 2025 revenue doubled year-over-year, driven by growing enterprise use cases and a major system sale in Europe.

- This surge in commercial adoption highlights increasing interest from global organizations in practical quantum computing applications across diverse industries.

- We'll now assess how the leap in enterprise customer wins, including the large European contract, shapes D-Wave's investment narrative.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

What Is D-Wave Quantum's Investment Narrative?

For D-Wave Quantum, the core investment thesis revolves around the belief in practical quantum computing’s transformative potential and the company’s ability to convert technical advances into commercial traction. The recent surge in Q3 2025 revenue, driven by high-profile enterprise wins and a pivotal European system sale, signals real adoption of D-Wave’s technology, which is an important short-term catalyst that could enhance its reputation and attract further institutional and commercial interest. This development also partially offsets prior concerns about limited near-term revenue visibility and demonstrates that clients are beginning to pay for large-scale quantum solutions. However, while the news marks progress, risks remain prominent: D-Wave continues to incur large net losses, has a high operating cost base, and faces dilution risk following substantial equity offerings and insider selling. There’s also significant competition from other quantum-focused technology firms and established tech giants. After this news, short-term momentum may shift more positively, but the core risks around cash burn and the need for clearer profitability remain. On the flip side, shareholder dilution and ongoing cash burn are still material headwinds that demand attention.

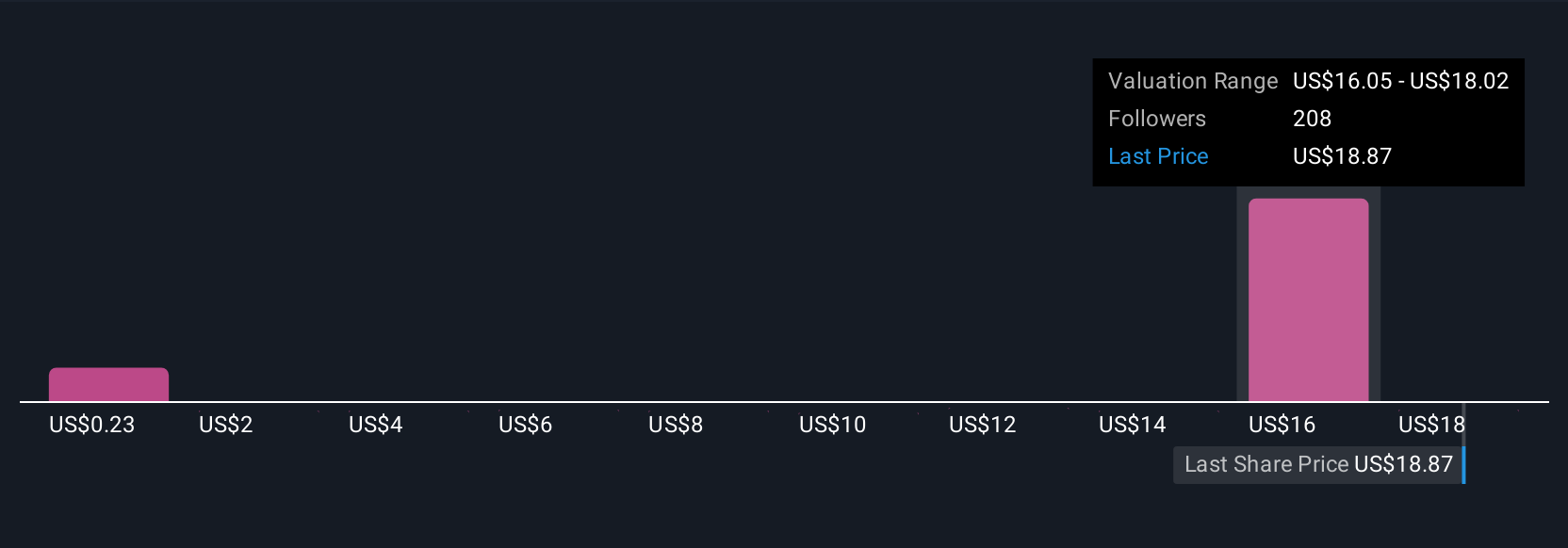

Our comprehensive valuation report raises the possibility that D-Wave Quantum is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore 89 other fair value estimates on D-Wave Quantum - why the stock might be worth less than half the current price!

Build Your Own D-Wave Quantum Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your D-Wave Quantum research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free D-Wave Quantum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate D-Wave Quantum's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QBTS

D-Wave Quantum

Develops and delivers quantum computing systems, software, and services worldwide.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026