- United States

- /

- Software

- /

- NYSE:KVYO

A Fresh Look at Klaviyo (KVYO) Valuation as Analyst Sentiment Turns Positive on Earnings Prospects

Reviewed by Simply Wall St

Recent analyst reports have turned more optimistic regarding Klaviyo (KVYO). Updated earnings estimates and stronger sentiment are pointing to a possible earnings outperformance. This shift has caught the attention of investors watching the company’s next move.

See our latest analysis for Klaviyo.

Despite recent swings, Klaviyo’s share price return tells a story of volatility. A one-month gain of nearly 10% has only partially offset a year-to-date decline of over 31%, while its one-year total shareholder return remains deep in negative territory. After a challenging stretch, a subtle rebound suggests momentum could be shifting as investors weigh improved earnings sentiment against the company’s long-term growth narrative.

If you’re interested in discovering where momentum and insider conviction meet, now’s the perfect time to explore fast growing stocks with high insider ownership

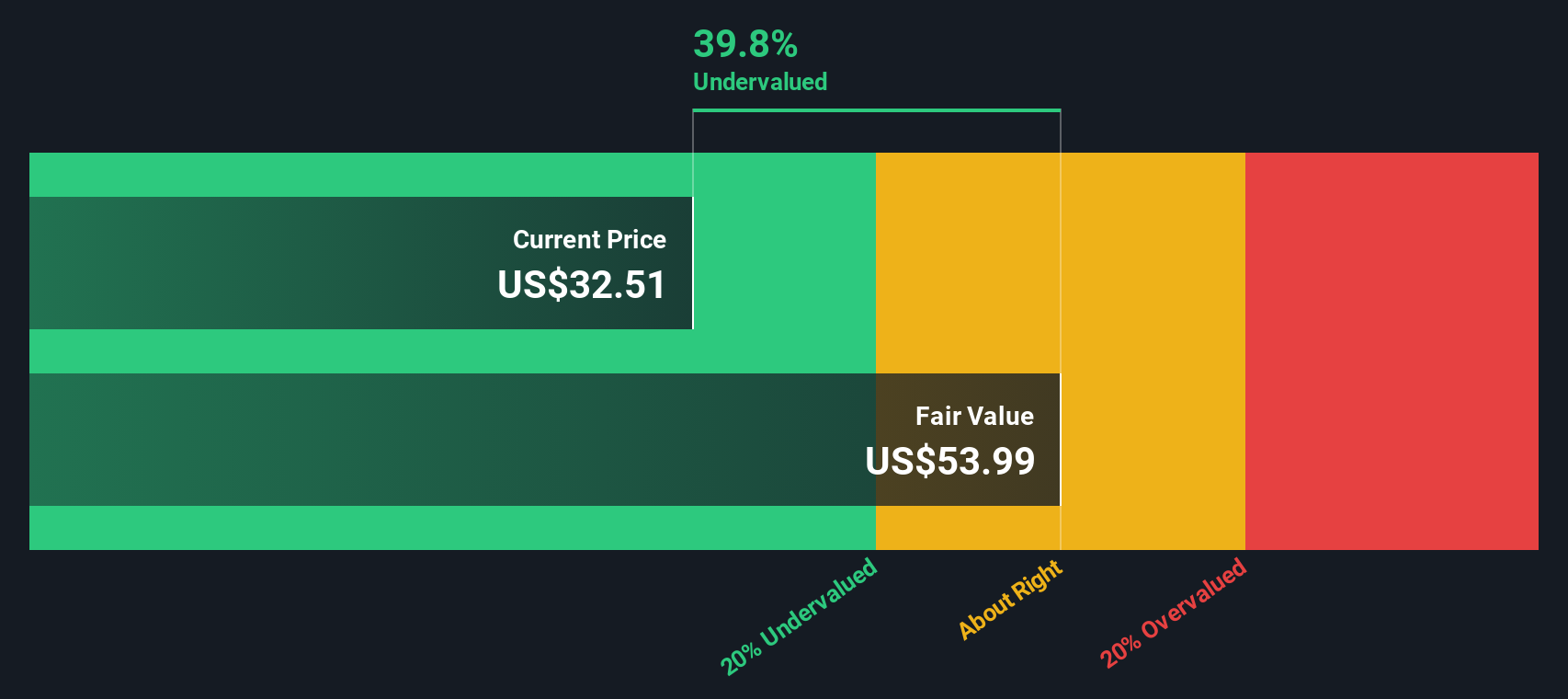

With shares trading at a notable discount to analyst targets and earnings revisions on the rise, the question for investors is whether Klaviyo is genuinely undervalued or if the market has already factored in its future growth prospects.

Most Popular Narrative: 34.6% Undervalued

Klaviyo’s prevailing narrative stakes a fair value of $43.68 per share, significantly above the latest close of $28.56. This makes its current valuation hard to ignore for investors monitoring a potential turnaround.

The rapid innovation and rollout of new AI-first products, including Conversational Agent, Helpdesk, and analytics, expands Klaviyo's addressable market from just marketing automation into broader B2C CRM and customer service. This sets up significant opportunities for higher ARPU and long-term revenue growth.

What is driving analysts to set such a bold target for Klaviyo right now? Hint: the forecast hinges on a future profit transformation and a step-change in growth. The real surprise comes from quantitative leaps that could position Klaviyo among sector leaders. Discover what underpins this aggressive valuation and what could upend expectations next.

Result: Fair Value of $43.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure from rising infrastructure costs and uncertainty around the impact of new AI products could challenge Klaviyo’s bullish outlook.

Find out about the key risks to this Klaviyo narrative.

Another View: The SWS DCF Model Paints a Different Picture

While many investors focus on analyst price targets and market multiples, the SWS DCF model offers a more grounded perspective. According to our DCF model, Klaviyo’s fair value comes in much lower than today’s share price. This suggests the stock could be overvalued if future growth falls short. Which approach will the market trust more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Klaviyo Narrative

If you'd rather chart your own course or want to see the numbers differently, you can put together your own narrative in just minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Klaviyo.

Looking for More Investment Ideas?

Want your next portfolio move to count? Don’t wait for the crowd; be the friend who seizes new opportunities before they hit the headlines.

- Unlock growth by tracking the innovators behind the AI revolution with these 25 AI penny stocks. These companies are shaping the technologies transforming our daily lives.

- Secure resilient returns by tapping into these 15 dividend stocks with yields > 3%, offering robust yields for investors seeking long-term income, not just capital gains.

- Spot tomorrow’s market leaders among these 3556 penny stocks with strong financials. These undervalued gems may offer outsized upside for those willing to act early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Klaviyo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KVYO

Klaviyo

A technology company, provides a software-as-a-service platform in the United States, other Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026