- United States

- /

- IT

- /

- NYSE:IBM

Will IBM Cloud Powering Zyphra’s AMD-Based Frontier AI Training Change International Business Machines' (IBM) Narrative?

Reviewed by Sasha Jovanovic

- In November 2025, Zyphra released a technical report detailing ZAYA1, the first large-scale Mixture-of-Experts foundation model trained entirely on an integrated AMD platform, delivered through IBM Cloud infrastructure for frontier-scale AI development.

- This collaboration highlights IBM Cloud’s role as a high-performance backbone for advanced AI workloads, underscoring IBM’s positioning within the evolving AI and hybrid cloud ecosystem.

- We’ll now explore how IBM Cloud’s role in enabling Zyphra’s frontier-scale AMD-based AI training may influence IBM’s broader investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

International Business Machines Investment Narrative Recap

To own IBM today, you need to believe its hybrid cloud and AI focus can offset macro and legacy headwinds while supporting steady earnings and cash generation. The Zyphra ZAYA1 milestone reinforces IBM Cloud’s relevance in high-performance AI, but it does not fundamentally change the near term picture, where the main catalyst remains execution on hybrid cloud and AI software growth, and the key risk is a macro-driven slowdown in consulting and consumption-based software demand.

The most relevant recent announcement here is IBM’s continued earnings outperformance, with revenue growth and repeated upside surprises versus consensus. That backdrop matters, because if IBM can keep translating AI and hybrid cloud wins like the Zyphra collaboration into measurable revenue and margin contribution, it supports the existing growth thesis; if not, it reinforces concerns that high profile AI wins remain too small relative to consulting and legacy revenue pressures.

Yet beneath the optimism around AI wins, investors also need to be aware of the risk that IBM’s high debt load and acquisition spending could...

Read the full narrative on International Business Machines (it's free!)

International Business Machines' narrative projects $74.4 billion revenue and $10.5 billion earnings by 2028. This requires 5.1% yearly revenue growth and about a $4.6 billion earnings increase from $5.9 billion today.

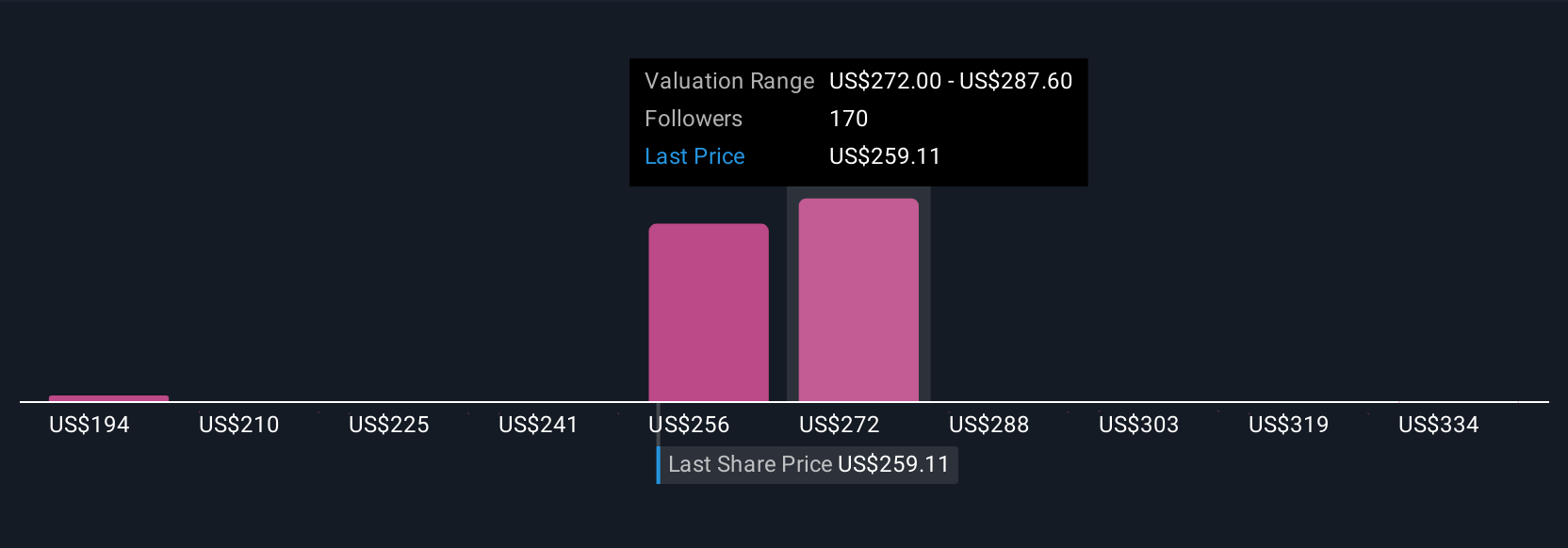

Uncover how International Business Machines' forecasts yield a $290.89 fair value, a 6% downside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts already expected IBM to lift revenue to about US$76,600,000,000 and earnings to roughly US$12,100,000,000 by 2028, so Zyphra’s AMD based AI milestone could either validate that bullish view or expose how much still has to go right for IBM’s newer AI and cloud businesses to outgrow legacy pressures.

Explore 17 other fair value estimates on International Business Machines - why the stock might be worth 36% less than the current price!

Build Your Own International Business Machines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your International Business Machines research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free International Business Machines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate International Business Machines' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026