- United States

- /

- Software

- /

- NYSE:XZO

High Growth Tech Stocks In The US Market To Watch

Reviewed by Simply Wall St

As the United States market enters December with a downturn in major indices like the Dow Jones, S&P 500, and Nasdaq due to risk-off sentiment impacting big tech and crypto-tied shares, investors are closely monitoring high growth opportunities within the tech sector. In this environment of fluctuating market conditions, identifying stocks with strong innovation potential and resilience can be crucial for those looking to navigate the complexities of today's investment landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ADMA Biologics | 20.01% | 24.80% | ★★★★★☆ |

| Pelthos Therapeutics | 47.08% | 110.99% | ★★★★★☆ |

| Palantir Technologies | 27.16% | 29.98% | ★★★★★★ |

| Workday | 11.27% | 32.61% | ★★★★★☆ |

| Circle Internet Group | 26.03% | 84.68% | ★★★★★☆ |

| RenovoRx | 71.45% | 71.45% | ★★★★★☆ |

| Zscaler | 15.83% | 45.89% | ★★★★★☆ |

| Viridian Therapeutics | 56.32% | 54.10% | ★★★★★☆ |

| Duos Technologies Group | 53.36% | 152.11% | ★★★★★☆ |

| Procore Technologies | 11.61% | 116.48% | ★★★★★☆ |

Click here to see the full list of 73 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

monday.com (MNDY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: monday.com Ltd. develops software applications across various regions including the United States, Europe, the Middle East, Africa, and the United Kingdom with a market capitalization of approximately $7.73 billion.

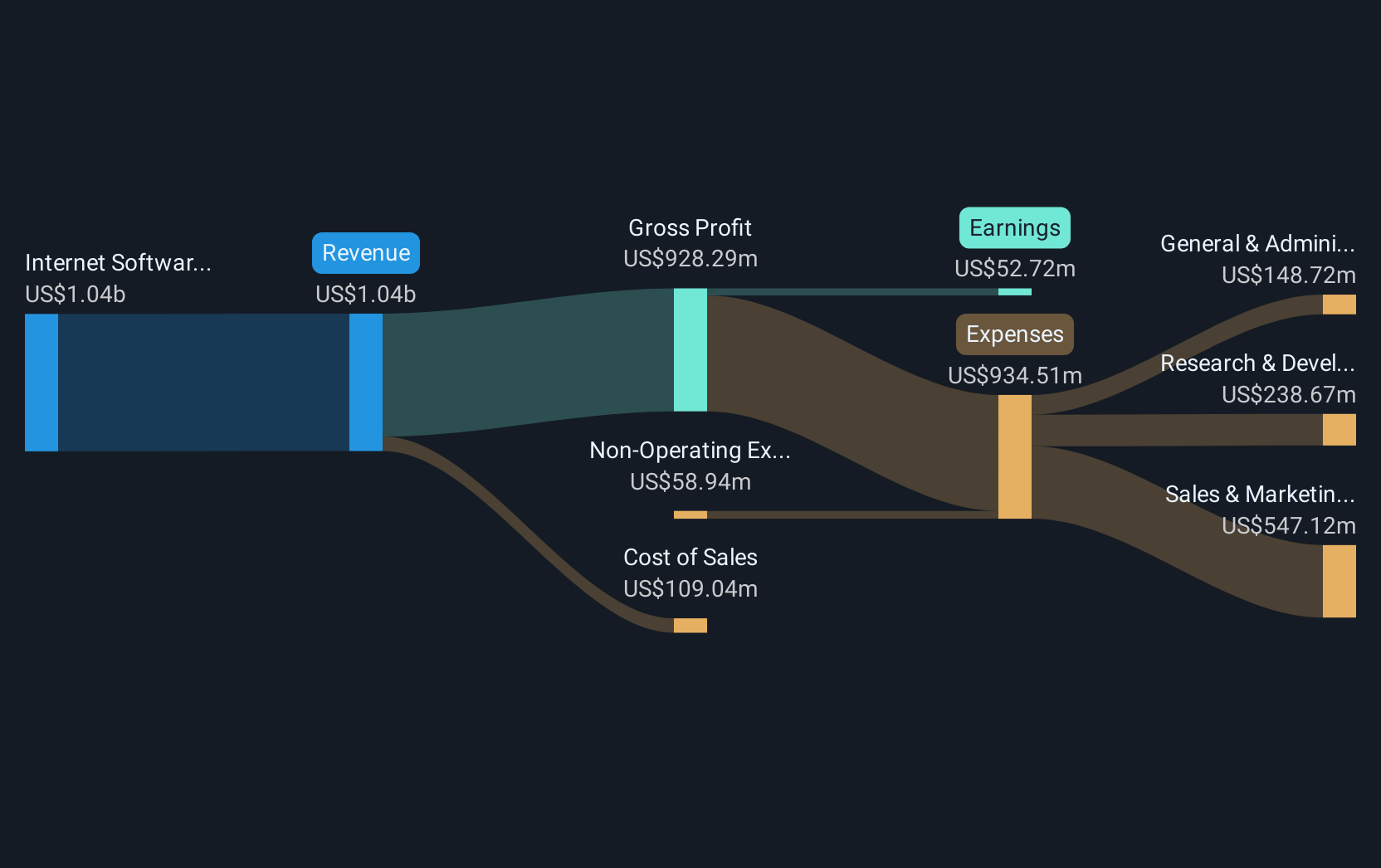

Operations: The company generates revenue primarily through its Internet Software & Services segment, which accounts for $1.17 billion. Its operations span multiple regions, contributing to a diverse customer base and broad market presence.

Monday.com, a global software company, has recently shown impressive growth through strategic partnerships and innovative AI-driven product launches. The firm reported a significant revenue increase to $316.86 million in Q3 2025, up from $251 million the previous year, with net income swinging to $13.05 million from a loss of $12.03 million. This financial turnaround is bolstered by their new role as the Official Global Work Management Partner for the Bonds Flying Roos SailGP team, enhancing their visibility and operational scope across continents. Additionally, monday.com's commitment to R&D is evident in its launch of advanced AI capabilities like monday agents and monday vibe at its Elevate conference, promising enhanced workflow automation and enterprise efficiency which are critical as they project a revenue upsurge to between $1,226 million and $1,228 million by year-end. This trajectory is supported by an aggressive share repurchase program announced recently valued at up to $870 million worth of shares which underscores confidence in their financial strategy and future prospects.

- Click here and access our complete health analysis report to understand the dynamics of monday.com.

Examine monday.com's past performance report to understand how it has performed in the past.

HubSpot (HUBS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: HubSpot, Inc. offers a cloud-based customer relationship management platform for businesses across the Americas, Europe, and the Asia Pacific with a market capitalization of approximately $19.56 billion.

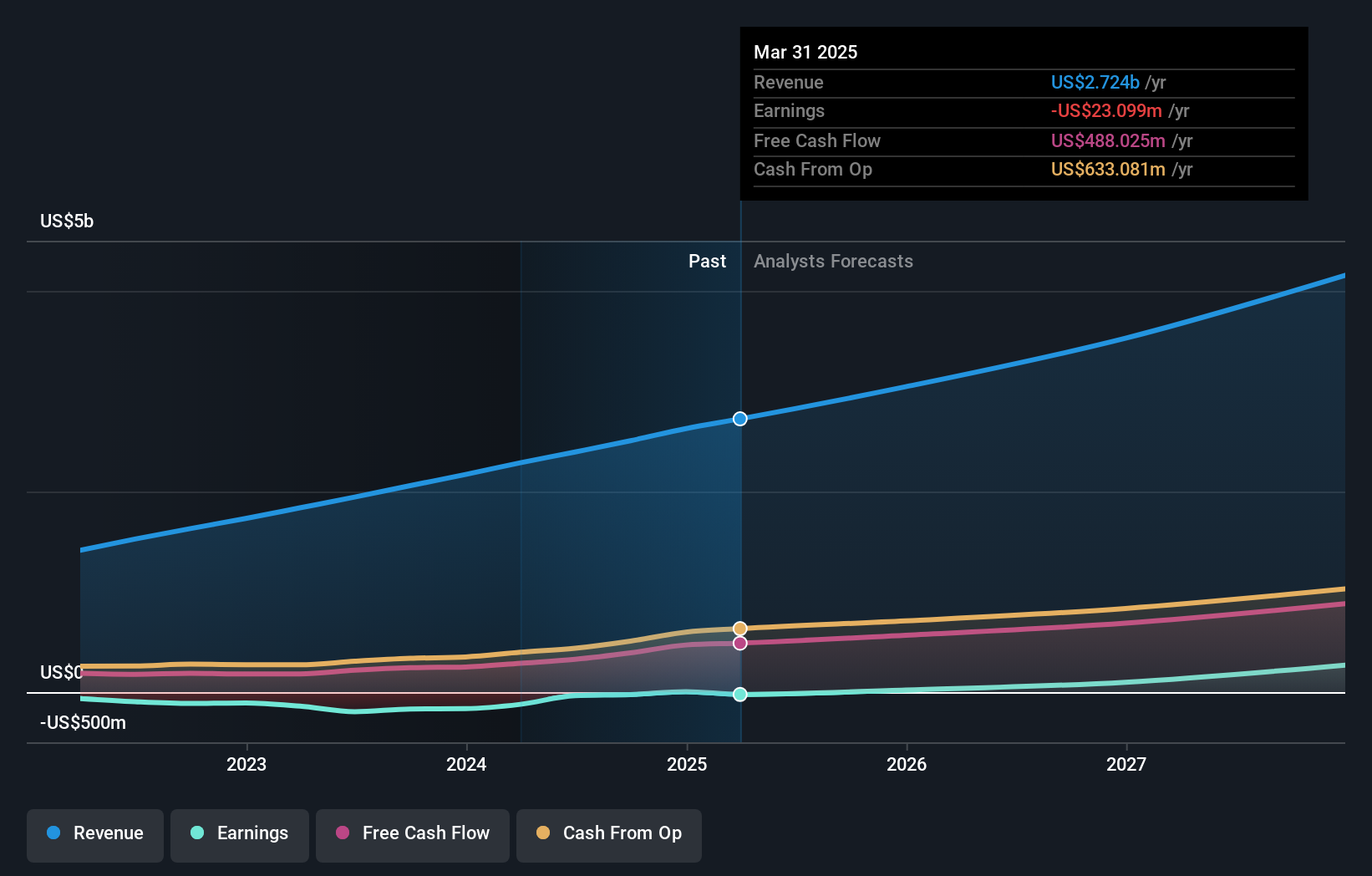

Operations: The company's revenue is primarily derived from its internet software and services segment, totaling approximately $2.99 billion.

HubSpot, despite its unprofitability, is making significant strides in the tech sector with a notable 14.3% annual revenue growth and an anticipated profit surge. The company's recent appointment of AI expert Clara Shih to its board underscores a strategic pivot towards integrating advanced AI across its platforms, enhancing offerings for SMBs. This move complements their impressive R&D commitment, which is set to bolster their market position by driving innovation in customer engagement technologies. Furthermore, HubSpot's robust repurchase of shares totaling $500 million reflects strong confidence in its financial health and strategic direction.

Exzeo Group (XZO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Exzeo Group, Inc. offers comprehensive insurance technology and operational solutions to carriers and agents, with a market capitalization of $1.71 billion.

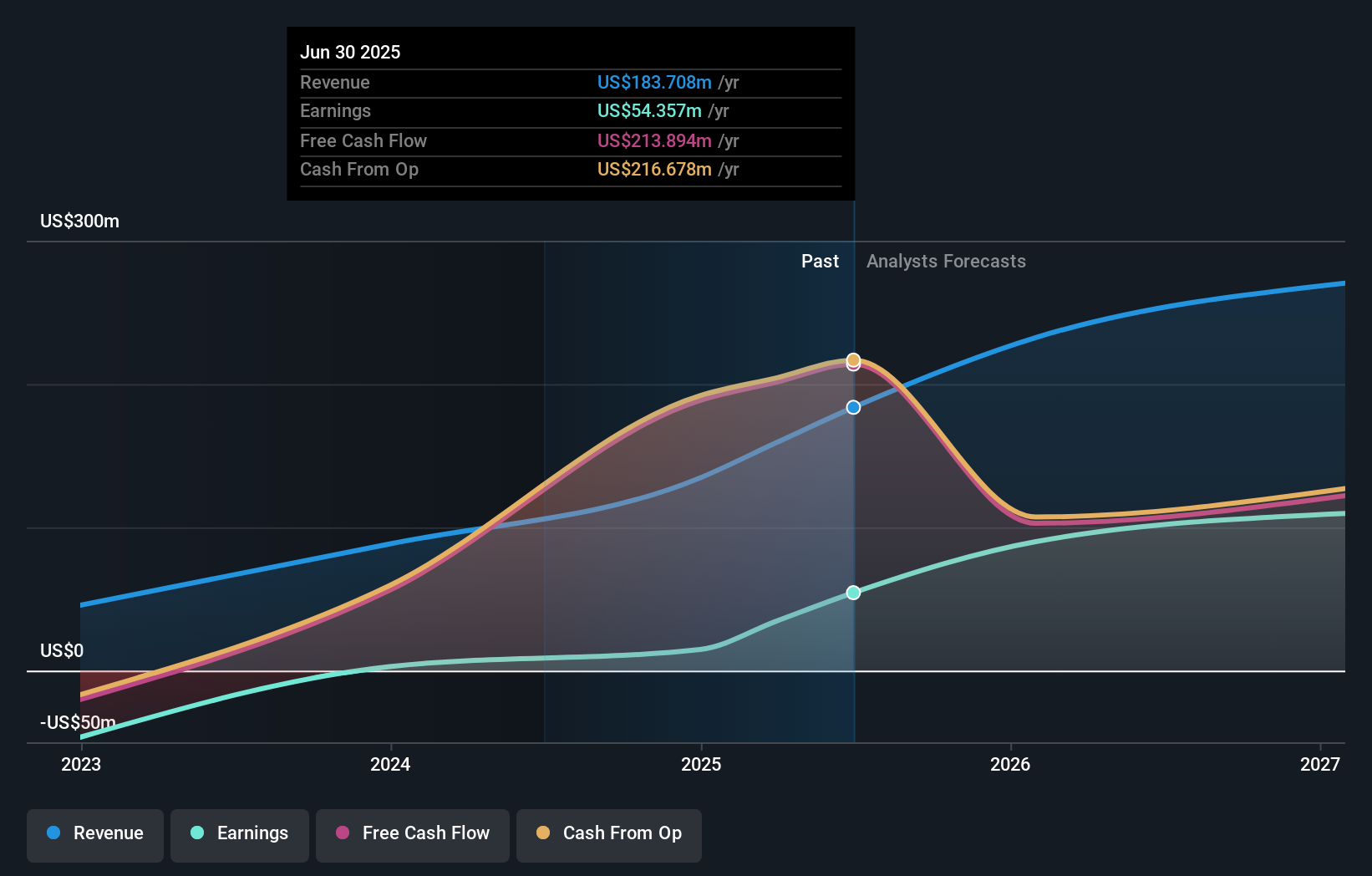

Operations: Exzeo Group, Inc. generates revenue primarily from its insurance technology and operations solutions, with the Property & Casualty segment contributing $183.71 million. The company's gross profit margin stands at 62%.

With a recent IPO raising $168 million, Exzeo Group is making notable strides in the tech landscape. This move, coupled with a 23.1% annual revenue growth and an extraordinary earnings increase of 521.9% over the past year, positions Exzeo as a dynamic player in its sector. The company's commitment to innovation is further underscored by its R&D investments, aligning with industry shifts towards more sustainable and advanced tech solutions. Looking ahead, Exzeo's future appears promising with earnings expected to grow by 39.2% annually, outpacing broader market projections significantly.

- Unlock comprehensive insights into our analysis of Exzeo Group stock in this health report.

Assess Exzeo Group's past performance with our detailed historical performance reports.

Seize The Opportunity

- Access the full spectrum of 73 US High Growth Tech and AI Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exzeo Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XZO

Exzeo Group

Provides turnkey insurance technology and operations solutions to insurance carriers and agents.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

De-Risked Production Ramp with Exceptional Silver Price Leverage

The "Google Maps" of Cancer Biology – Data is the Moat

The "Rare Disease Monopoly" – Commercial Execution Play

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026