- United States

- /

- IT

- /

- NYSE:GDDY

Did GoDaddy's (GDDY) New AI Agents Redefine Its Role in the Small Business Digital Ecosystem?

Reviewed by Sasha Jovanovic

- GoDaddy recently expanded its Airo.ai online experience with six new AI agents designed to streamline marketing, operations, and website management for small businesses, while also announcing significant progress on its Agent Name Service (ANS) by releasing public developer access and standards.

- These advancements position GoDaddy at the forefront of trusted AI for small businesses, simplifying digital operations and enhancing agent identity for the growing online economy.

- We'll examine how the rollout of multiple AI-powered tools for SMBs may shift GoDaddy's investment outlook and ecosystem ambitions.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

GoDaddy Investment Narrative Recap

To be a GoDaddy shareholder, you must believe in the company's ability to compete against larger all-in-one website and commerce platforms by building a compelling ecosystem around small business digital operations. While the rollout of new Airo.ai agents further supports GoDaddy’s AI-driven growth ambitions, it does not materially change the immediate risk of customer churn and margin compression from fierce competition in the SMB space.

Among the most relevant updates is GoDaddy's public release of its Agent Name Service (ANS) API, which enables developers to integrate identity and verification for AI agents. With ANS, GoDaddy is aiming to make its ecosystem more trustworthy as it scales AI solutions, supporting the short-term catalyst of deeper AI-powered cross-sell and up-sell within its core SMB base.

In contrast, investors should also be mindful of the risk that if GoDaddy’s new AI features don’t gain meaningful adoption...

Read the full narrative on GoDaddy (it's free!)

GoDaddy's narrative projects $5.9 billion in revenue and $1.3 billion in earnings by 2028. This requires a 7.7% yearly revenue growth and a $491.5 million earnings increase from the current $808.5 million.

Uncover how GoDaddy's forecasts yield a $175.06 fair value, a 37% upside to its current price.

Exploring Other Perspectives

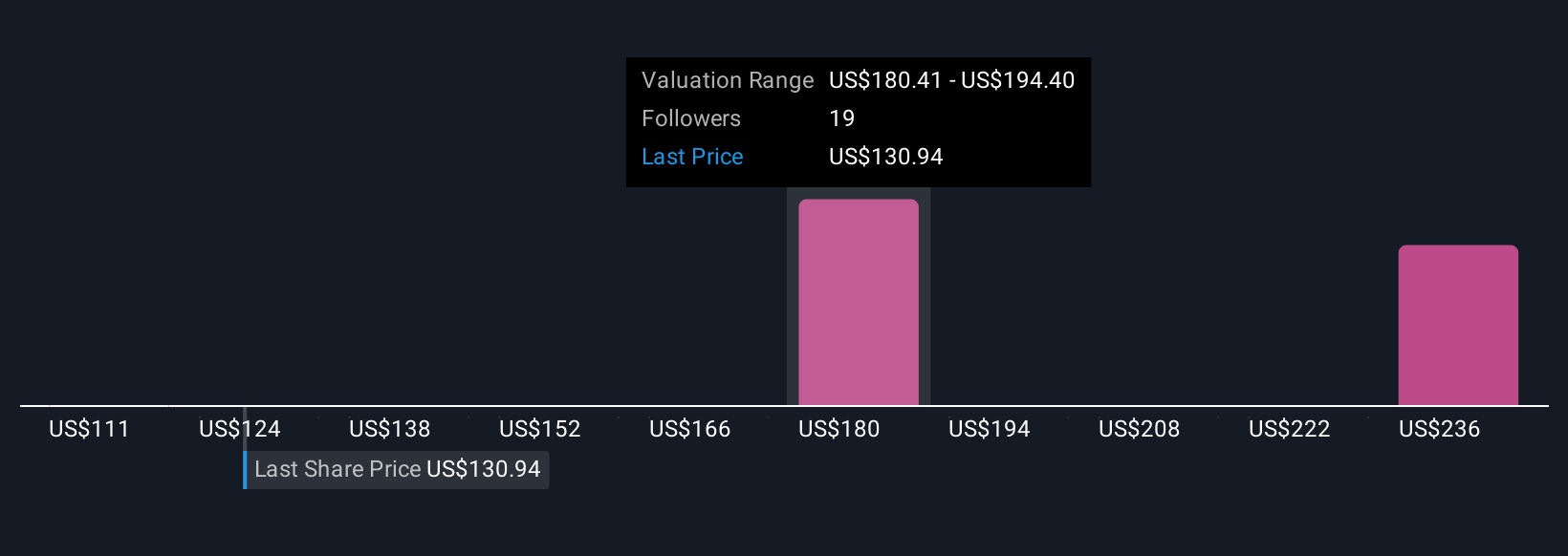

Simply Wall St Community members provide three fair value estimates for GoDaddy ranging from US$150 to US$256.57 per share. Against this backdrop of widely differing opinions, the key challenge remains execution risk in scaling AI-driven offerings in a market crowded with integrated competitors.

Explore 3 other fair value estimates on GoDaddy - why the stock might be worth just $150.00!

Build Your Own GoDaddy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GoDaddy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free GoDaddy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GoDaddy's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GDDY

GoDaddy

Engages in the design and development of cloud-based products in the United States and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026