- United States

- /

- IT

- /

- NYSE:FSLY

Fastly (FSLY): Assessing Valuation Following CTO Share Sale and Planned Move to Nasdaq

Reviewed by Simply Wall St

Fastly (FSLY) shares drew attention this week after its Chief Technology Officer sold a substantial block of shares. This coincided with the company’s decision to move its stock listing from the NYSE to Nasdaq this coming month.

See our latest analysis for Fastly.

Fastly's recent momentum has been hard to ignore, with the stock delivering a 40.6% share price gain over the past month and a 56.5% return over the last 90 days. While the high-profile executive share sale and exchange switch stirred some volatility, the longer-term total shareholder return remains positive at 18.1% for the year. However, the five-year total return is still deeply negative, reflecting both the company’s transformation efforts and the risks ahead.

If this kind of tech sector movement has you watching the horizon for the next breakout name, it might be time to broaden your search and discover fast growing stocks with high insider ownership

With Fastly's price rally and high-profile changes grabbing headlines, the critical question for investors is whether the recent excitement still leaves room for upside or if the market has already reflected all expected growth.

Most Popular Narrative: 11.9% Overvalued

At a recent closing price of $11.66, Fastly trades well above the most widely followed narrative’s fair value estimate of $10.42. This difference highlights stretched valuation expectations and sets the tone for discussion on the company’s future growth potential.

The acceleration of cloud migration and edge computing, combined with Fastly's increased product velocity (especially in Compute and adaptive observability analytics at the edge), expands the company's addressable market and supports durable multi-year revenue growth.

Fastly’s elevated pricing assumes a surge in future revenue, margin expansion, and operational leverage. But which catalyst tips the scale in this scenario? Behind this headline number is an ambitious growth plan and an earnings trajectory that many companies would seek. The underlying narrative depends on a key set of bold financial forecasts. Curious to see which assumptions drive that fair value?

Result: Fair Value of $10.42 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued pricing pressure in Fastly’s core CDN segment and dependency on a handful of large customers could present challenges to the optimistic outlook.

Find out about the key risks to this Fastly narrative.

Another View: What Does Our DCF Model Suggest?

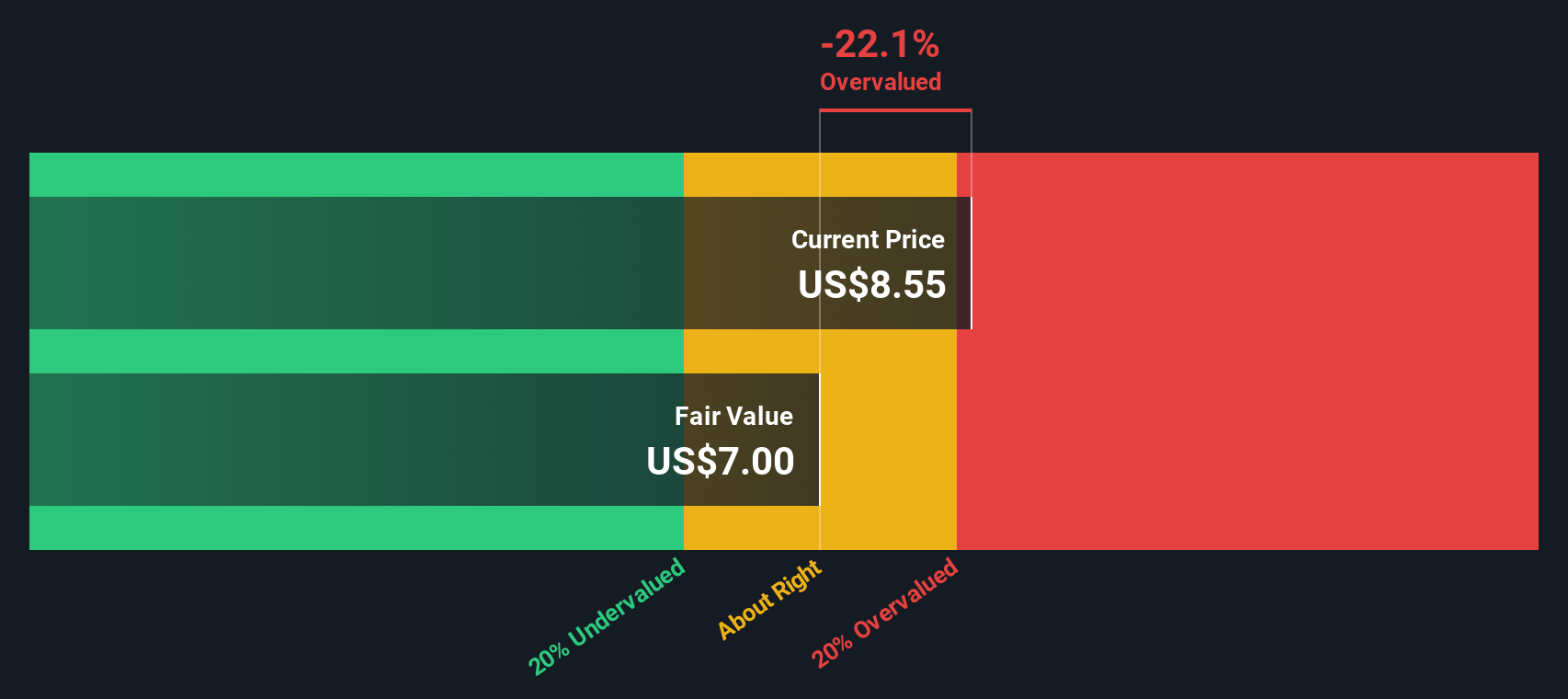

While the earlier analysis relies on market multiples, the SWS DCF model offers a different perspective. According to this approach, Fastly appears overvalued at current levels, trading at $11.66 compared to our fair value estimate of $5.54. This raises the question of whether the market is factoring in too much optimism, or if there is unrecognized potential.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Fastly Narrative

If you think there’s more to the story or would like to dive into the numbers yourself, you can quickly build your own view and see how it stacks up. Do it your way.

A great starting point for your Fastly research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Winning Stock Ideas?

Don’t let the excitement end here. With the right strategy, you can spot tomorrow’s market leaders today and gain the edge every smart investor seeks.

- Uncover growth potential in companies shaping artificial intelligence. Check out these 25 AI penny stocks that are propelling innovation and opportunity in this rapidly evolving sector.

- Capture consistent income with access to these 15 dividend stocks with yields > 3% that stand out for their reliable yields above 3%, offering stability even in uncertain times.

- Seize your chance in undervalued shares by reviewing these 915 undervalued stocks based on cash flows ready for smart investors to make their move before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FSLY

Fastly

Operates an edge cloud platform for processing, serving, and securing its customer’s applications in the United States, the Asia Pacific, Europe, and internationally.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026