- United States

- /

- Software

- /

- NYSE:FICO

Fair Isaac (FICO): Reassessing Valuation After Recent Share Price Rebound

Reviewed by Simply Wall St

Fair Isaac (FICO) has seen steady movement in its stock price lately, and investors are taking a closer look at what might be driving the changes. With recent shifts in performance, the focus is on updated company fundamentals and long-term trends.

See our latest analysis for Fair Isaac.

Fair Isaac’s share price has staged a strong rebound over the last quarter with a 33.2% gain, trimming losses from earlier this year. Even so, the stock’s 1-year total shareholder return still sits at -25.3%, underlining a year of shifting sentiment. Momentum appears to be building again as recent gains hint at improving growth potential and investor confidence returning to the story.

If you’re keeping tabs on standout performers or looking for fresh ideas, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With strong recent gains but a year of volatile returns, the question now is whether Fair Isaac’s improving fundamentals make it undervalued or if the market has already factored in all the potential upside. Is this a genuine buying opportunity?

Most Popular Narrative: 12.9% Undervalued

Fair Isaac's fair value, as calculated by the most widely followed narrative, stands at $2,016, which is higher than the latest close of $1,756. This creates a compelling case for investors to explore why the market and this narrative have different views.

The ongoing transition to SaaS and cloud-based delivery, evidenced by double-digit growth in FICO Platform ARR and emphasis on conversion to next-generation AI-driven decisioning solutions, is increasing recurring revenues, supporting margin expansion and greater earnings predictability. Sustained investment in explainable AI and machine learning, as showcased by new FICO-focused foundation models and decisioning innovations, is enhancing competitive differentiation and supporting premium product offerings, increasing average selling prices and net margins.

Ever wondered which financial levers justify this valuation premium? The assumptions backing this fair value estimate include ambitious growth rates and upward-trending margins, grounded in a future vision shared by analysts. The exact expectations and what's driving the bullish price target might surprise you. Find out what really powers this narrative.

Result: Fair Value of $2,016 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory changes and increased competition from alternative credit scoring models could challenge Fair Isaac’s current market dominance and future profit margins.

Find out about the key risks to this Fair Isaac narrative.

Another View: What Do Earnings Ratios Say?

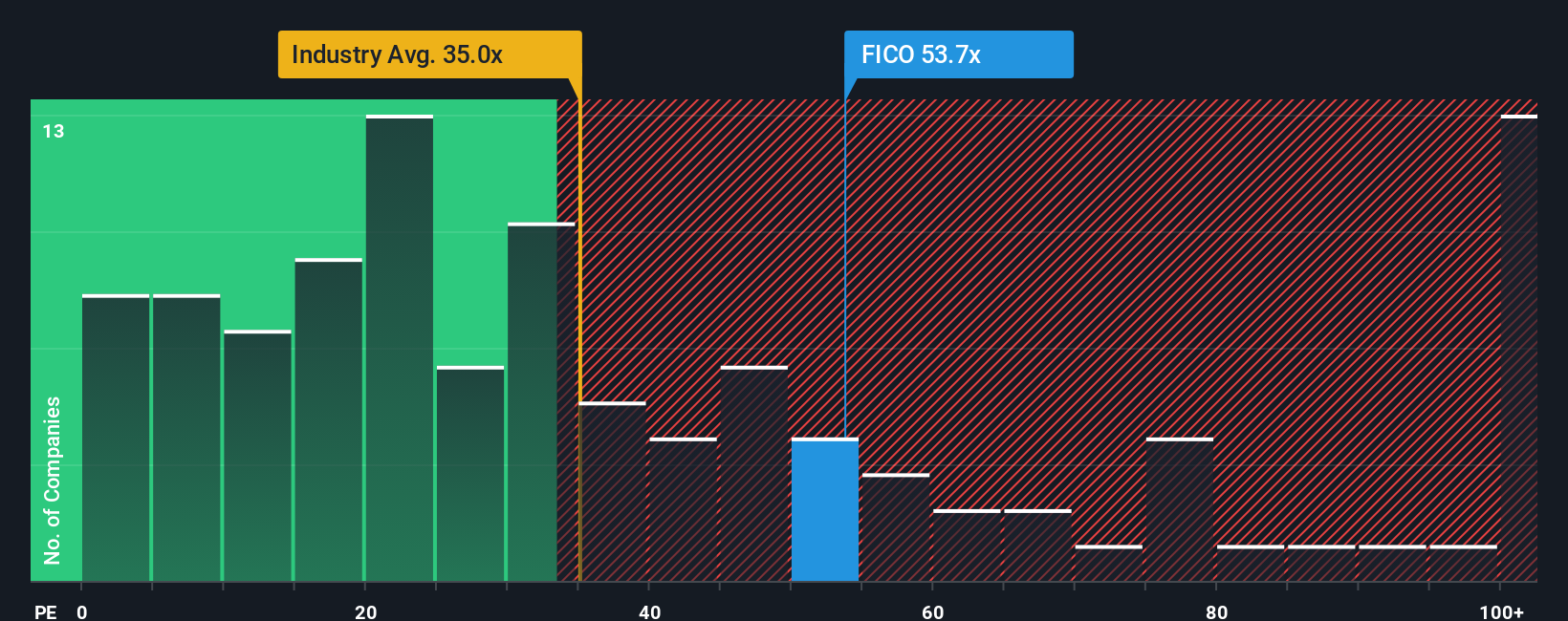

Looking at valuation through the lens of the price-to-earnings ratio presents a different story. Fair Isaac trades at 63.9x, much higher than both the software industry average of 32.5x and the fair ratio of 39.4x. This suggests shares may already be fully priced or even overvalued on this metric. Will the market eventually pull the stock closer to this fair ratio, or can strong growth keep the premium alive?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fair Isaac Narrative

If you see things differently or consider yourself a hands-on investor, you can shape your own perspective in just a few minutes. Do it your way

A great starting point for your Fair Isaac research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for just one opportunity when the market offers a variety of smart alternatives. Put yourself ahead of the curve with these top trends:

- Uncover value by targeting stocks trading below their estimated worth and maximize potential returns through these 867 undervalued stocks based on cash flows.

- Capitalize on powerful trends in medical innovation by using these 32 healthcare AI stocks to find companies driving advances in healthcare AI.

- Tap into the surge of digital finance by exploring these 82 cryptocurrency and blockchain stocks and discover which blockchain pioneers are outpacing the rest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FICO

Fair Isaac

Provides analytics software in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record with limited growth.

Similar Companies

Market Insights

Community Narratives