- United States

- /

- Software

- /

- NYSE:ESTC

3 High-Growth Companies With Insider Ownership Up To 33%

Reviewed by Simply Wall St

As the U.S. stock market wrapped up a robust week with major indexes posting their best performance since June, the Nasdaq's seven-month winning streak came to an end, highlighting the volatility and shifting dynamics within different sectors. In such an environment, growth companies with significant insider ownership can be particularly appealing as they often indicate strong confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 14.0% | 50.7% |

| StubHub Holdings (STUB) | 23.3% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 29.2% | 114.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| FTC Solar (FTCI) | 22.6% | 78.8% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.9% | 29.1% |

| AppLovin (APP) | 27.5% | 26.5% |

Here's a peek at a few of the choices from the screener.

Bitdeer Technologies Group (BTDR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bitdeer Technologies Group is a technology company specializing in blockchain and high-performance computing (HPC) with operations in Singapore, the United States, Bhutan, and Norway, and has a market cap of approximately $3.18 billion.

Operations: The company's revenue is primarily derived from its data processing segment, which generated $464.44 million.

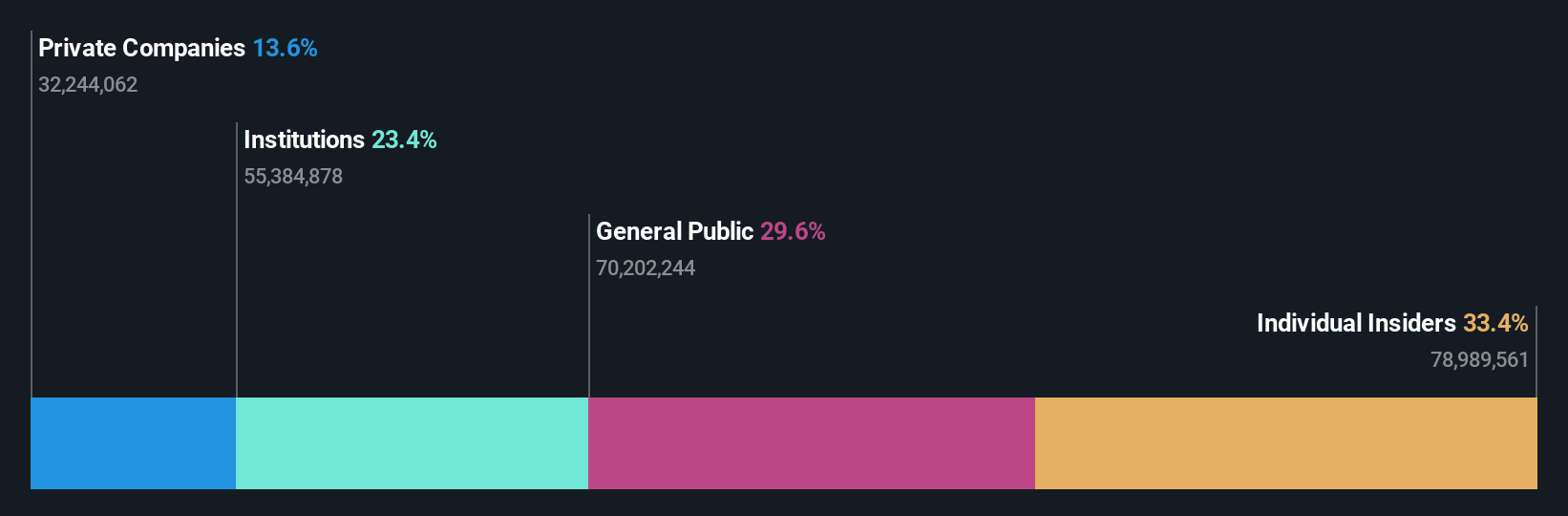

Insider Ownership: 33.4%

Bitdeer Technologies Group is poised for significant growth, with revenue expected to increase at 64.6% annually, outpacing the US market. Despite recent shareholder dilution and a volatile share price, Bitdeer is trading significantly below its estimated fair value. The company reported substantial sales growth but also faced increased net losses. Recent product innovations in mining technology aim to enhance efficiency and sustainability, supporting large-scale operations and potentially driving future profitability improvements.

- Dive into the specifics of Bitdeer Technologies Group here with our thorough growth forecast report.

- Our expertly prepared valuation report Bitdeer Technologies Group implies its share price may be lower than expected.

Firefly Aerospace (FLY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Firefly Aerospace Inc. is a space and defense technology company that offers mission solutions for national security, government, and commercial clients, with a market cap of $2.82 billion.

Operations: Firefly Aerospace generates its revenue from the Aerospace & Defense segment, amounting to $111.22 million.

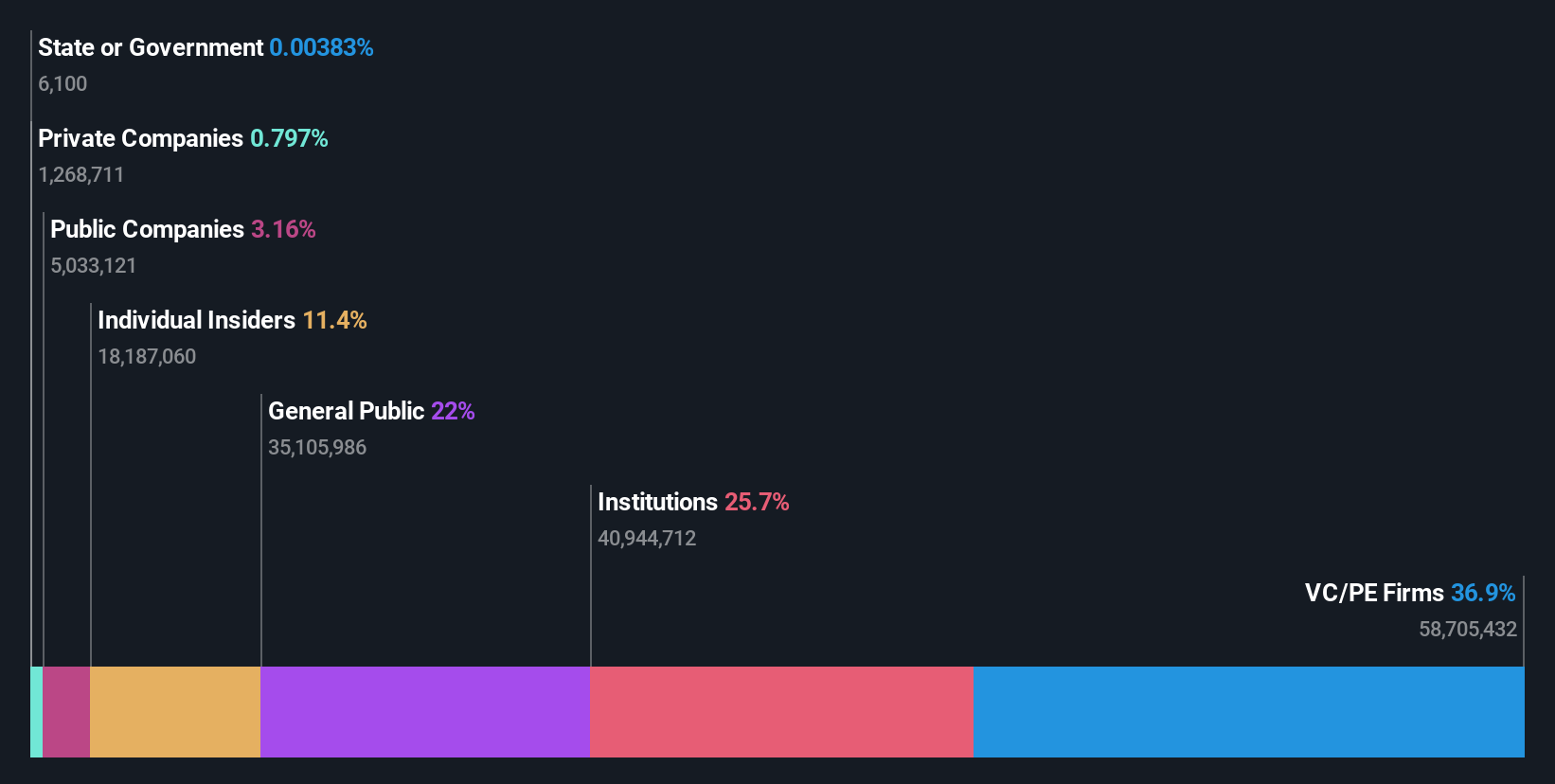

Insider Ownership: 11.4%

Firefly Aerospace's revenue is forecast to grow at 47% annually, surpassing the US market. Despite trading below its estimated fair value, it faces challenges with high volatility and increasing net losses. Recent filings include a $203 million shelf registration, indicating potential capital raising efforts. Legal issues have emerged from alleged misleading IPO documents affecting investor confidence. However, Firefly's strategic initiatives in space technology continue to position it for future growth opportunities.

- Delve into the full analysis future growth report here for a deeper understanding of Firefly Aerospace.

- Our expertly prepared valuation report Firefly Aerospace implies its share price may be too high.

Elastic (ESTC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Elastic N.V. is a search AI company that offers software platforms for hybrid, public or private clouds, and multi-cloud environments globally, with a market cap of approximately $7.43 billion.

Operations: Elastic's revenue is primarily derived from its Software & Programming segment, which generated approximately $1.61 billion.

Insider Ownership: 12.2%

Elastic's projected revenue growth of 12.1% annually outpaces the US market, although it remains below 20%. Despite being valued attractively at 48% below its estimated fair value, insider selling has been significant recently. The company is expected to achieve profitability within three years with strong earnings growth forecasts. Recent initiatives include a $114.15 million share buyback and innovations in OpenTelemetry and AI solutions, enhancing operational efficiency and developer capabilities across its platforms.

- Take a closer look at Elastic's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Elastic's current price could be quite moderate.

Seize The Opportunity

- Click here to access our complete index of 197 Fast Growing US Companies With High Insider Ownership.

- Seeking Other Investments? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Elastic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESTC

Elastic

A search artificial intelligence (AI) company, provides software platforms to run in hybrid, public or private clouds, and multi-cloud environments in the United States and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026