- United States

- /

- IT

- /

- NYSE:BBAI

How Investors May Respond To BigBear.ai Holdings (BBAI) Authorizing 1 Billion Shares and Adopting New Bylaws

Reviewed by Sasha Jovanovic

- On December 1, 2025, BigBear.ai Holdings shareholders approved an amendment to increase authorized common stock to 1 billion and adopted new bylaw changes affecting voting standards and director nominations.

- This pivotal step marks a significant expansion of BigBear.ai's growth capacity and governance structure, following its acquisition of Ask Sage and international partnership developments.

- We'll explore how the authorization of additional shares and the Ask Sage acquisition shape the outlook for BigBear.ai Holdings.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

BigBear.ai Holdings Investment Narrative Recap

To be a BigBear.ai Holdings shareholder, you need confidence in the company’s ability to build a sustainable, scalable AI platform, primarily for government and defense clients, despite ongoing earnings variability and recent share dilution risks. The authorized share increase and governance changes may ease future capital raising or deal-making, but for now, the most impactful short-term catalyst remains execution on newly acquired business, while the key risk continues to be unpredictable government contract timing; neither appears to be materially altered by these governance shifts.

Among recent announcements, the US$250 million acquisition of Ask Sage stands out for its potential to accelerate recurring revenue streams and reinforce BigBear.ai's standing in secure generative AI for federal agencies, an important context given current volatility in contract awards and funding. While this adds scale and technology leverage, the business remains deeply reliant on federal clients, amplifying exposure to lumpy revenue cycles and external procurement delays.

However, investors should be aware, in contrast to this expansion, that the approval to double authorized common shares could present future dilution pressure on existing holders if...

Read the full narrative on BigBear.ai Holdings (it's free!)

BigBear.ai Holdings' narrative projects $162.2 million revenue and $10.3 million earnings by 2028. This requires 2.1% yearly revenue growth and a $454.2 million increase in earnings from -$443.9 million today.

Uncover how BigBear.ai Holdings' forecasts yield a $6.67 fair value, a 10% upside to its current price.

Exploring Other Perspectives

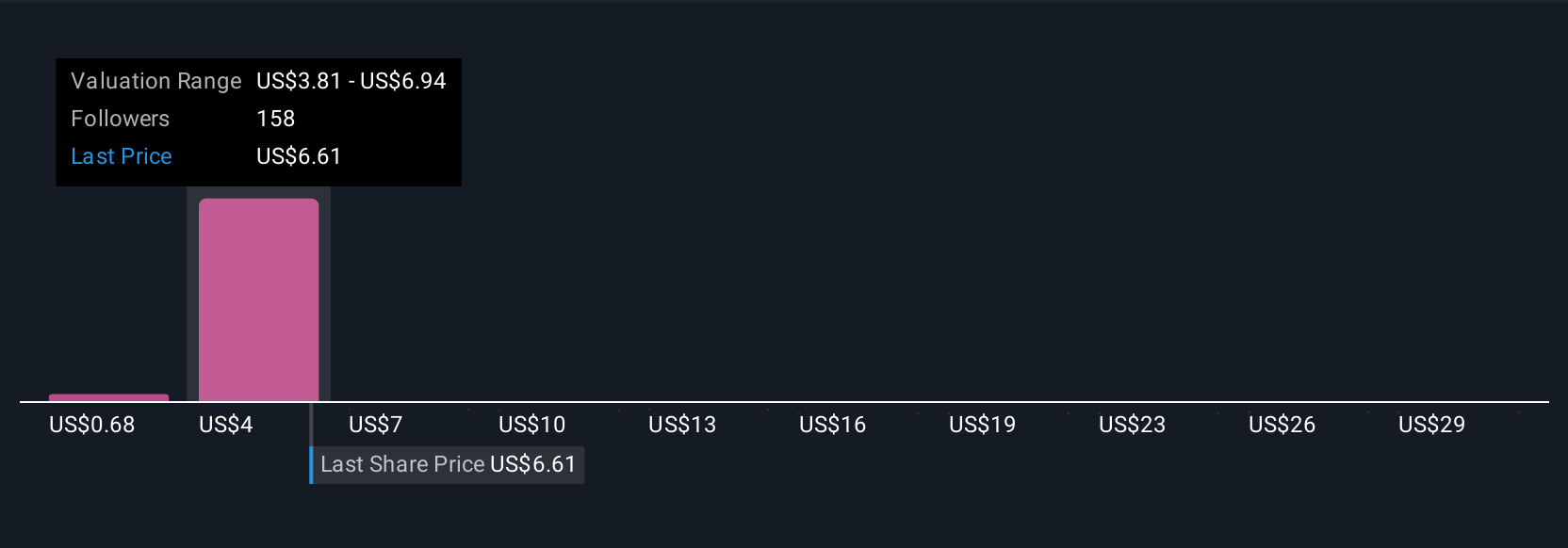

Thirty-three members of the Simply Wall St Community estimate BigBear.ai's fair value from US$0.68 to US$15.26 per share. Investor opinions differ widely, with many also watching for potential revenue volatility linked to government contracts amid recent company expansion.

Explore 33 other fair value estimates on BigBear.ai Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own BigBear.ai Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BigBear.ai Holdings research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free BigBear.ai Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BigBear.ai Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BigBear.ai Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBAI

BigBear.ai Holdings

Provides artificial intelligence-powered decision intelligence solutions.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026