- United States

- /

- Software

- /

- NYSE:ASAN

Why Asana (ASAN) Is Up 5.9% After Launching FedRAMP-Compliant Platform Aimed at Government Clients

Reviewed by Sasha Jovanovic

- On November 19, 2025, Asana announced the launch of Asana Gov, a FedRAMP-in-process platform designed to help government agencies and regulated industries manage mission-critical work with enhanced security and compliance.

- This move positions Asana to address the complex needs of the public sector, aiming to support digital transformation and collaboration in a highly regulated environment.

- We'll explore how Asana Gov's entry into the government market could influence the company's investment narrative and growth outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Asana Investment Narrative Recap

To be a shareholder in Asana, one must believe in the company’s ability to turn innovative work management solutions, especially its AI and security-driven offerings, into long-term enterprise adoption, despite ongoing competition and profitability challenges. The recent launch of Asana Gov could help address the most important short-term catalyst: expanding into new markets like government and regulated industries. However, this does not meaningfully reduce the immediate risk of persistent retention pressure from large enterprise renewals.

Among recent announcements, the September launch of AI Teammates is particularly relevant. Asana’s emphasis on AI-powered workflow tools aligns with its push for greater customer adoption and platform differentiation, especially in complex environments like government, supporting its efforts to maintain platform stickiness despite market commoditization.

Yet for investors, a key concern remains: Unlike government adoption, retention among Asana’s largest enterprise accounts is still facing pressure from renewal downgrades…

Read the full narrative on Asana (it's free!)

Asana's narrative projects $966.9 million revenue and $126.6 million earnings by 2028. This requires 9.4% yearly revenue growth and a $358.4 million earnings increase from -$231.8 million today.

Uncover how Asana's forecasts yield a $16.38 fair value, a 27% upside to its current price.

Exploring Other Perspectives

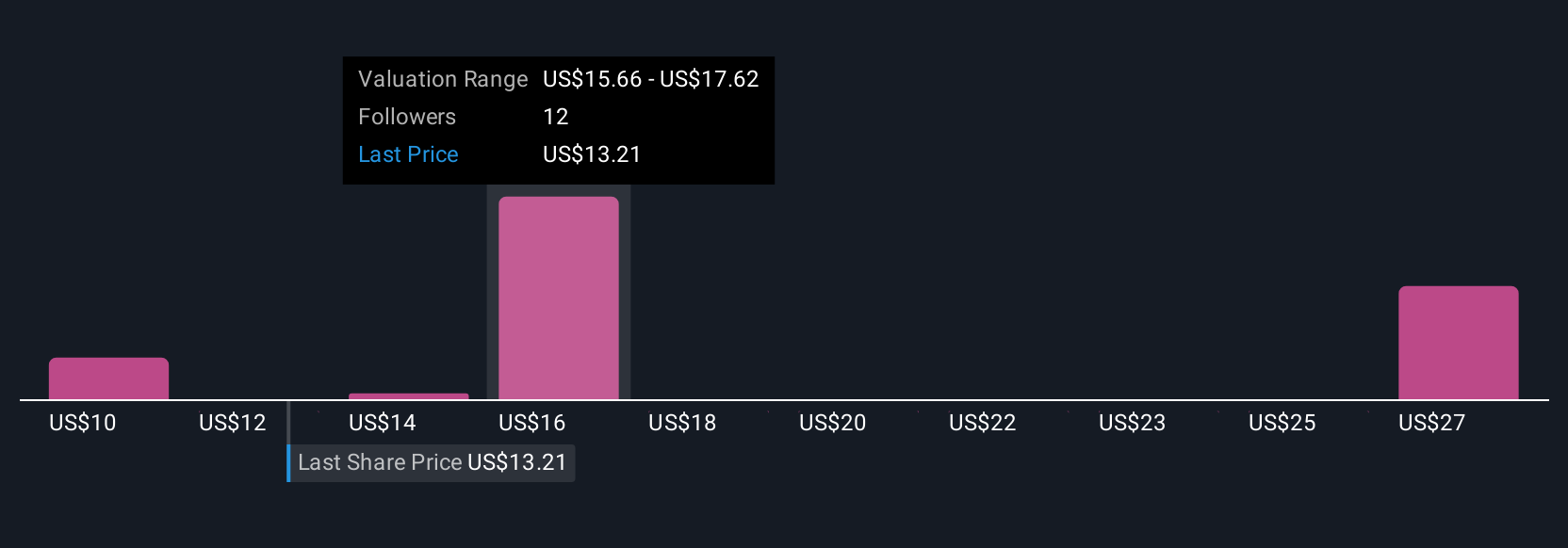

Retail investors in the Simply Wall St Community estimate Asana’s fair value between US$9.79 and US$30.33, with seven different analyses highlighting wide expectations. Persistent customer retention challenges could weigh on results, so it’s worth comparing these views before making up your mind.

Explore 7 other fair value estimates on Asana - why the stock might be worth 24% less than the current price!

Build Your Own Asana Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Asana research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Asana research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Asana's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASAN

Asana

Operates a work management software platform for individuals, team leads, and executives in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026