- United States

- /

- IT

- /

- NYSE:ACN

Is Accenture Attractively Priced After Share Price Drop and Cloud Expansion in 2025?

Reviewed by Bailey Pemberton

- Wondering whether Accenture is a hidden bargain or fairly priced in today’s market? You’re not alone, and it all comes down to what you believe about its valuation story.

- After a tough year with the stock down 30.2% over the last 12 months (and still down 29.0% year-to-date), Accenture’s short-term moves, such as the recent 2.6% climb in the past week, are sparking fresh discussion about its true worth and risk profile.

- Industry chatter has highlighted Accenture’s expansion into cloud and AI consulting, along with its latest high-profile partnerships. These factors are fueling optimism that the company is adapting fast in a competitive environment, even as uncertainty weighs on tech sector valuations in general.

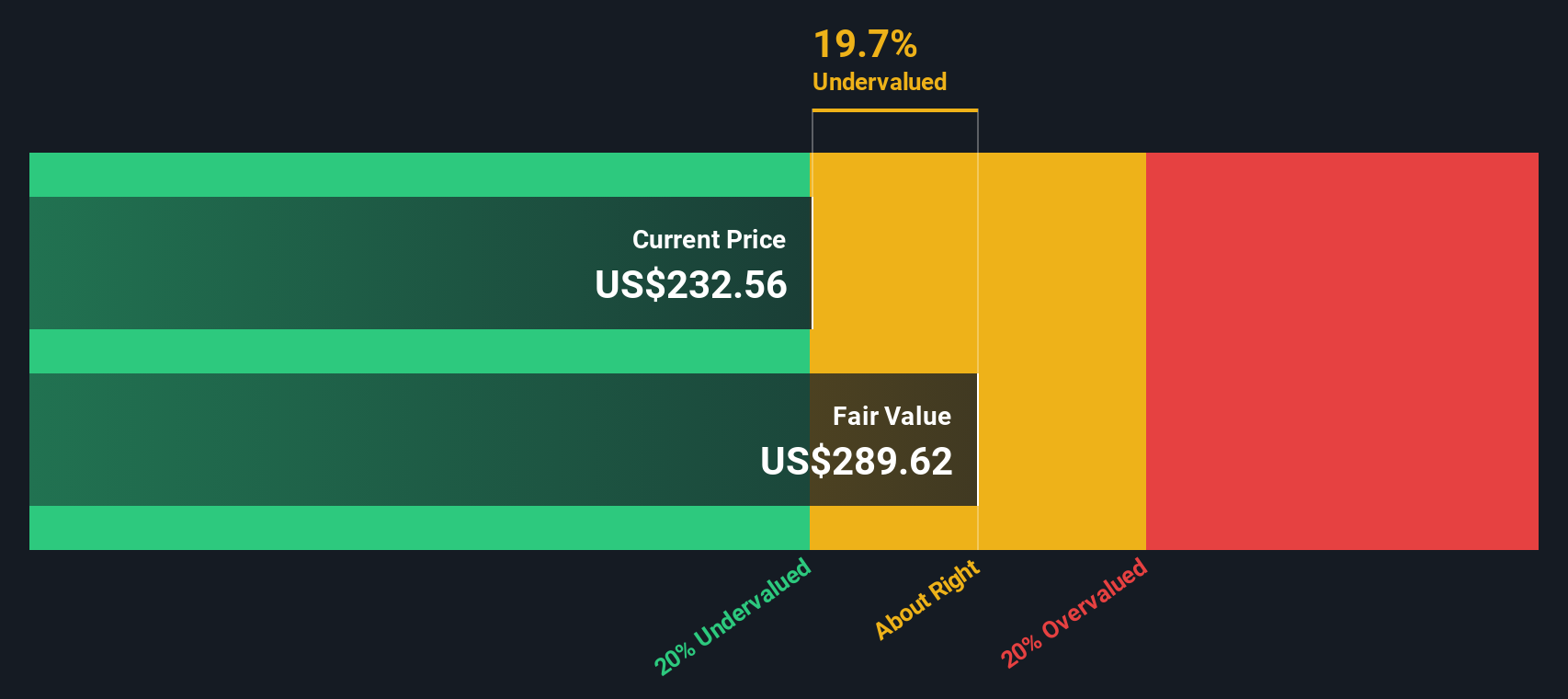

- On our valuation checklist, Accenture scores 4 out of 6 for undervaluation, suggesting an attractive profile on several metrics. Next, we’ll look at exactly how these scores are calculated using a few traditional methods, and then we’ll introduce a smarter way to judge value that goes beyond the numbers.

Find out why Accenture's -30.2% return over the last year is lagging behind its peers.

Approach 1: Accenture Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. This method helps determine what Accenture’s shares might be worth, based on actual cash generation potential rather than just current earnings or market trends.

Currently, Accenture generates Free Cash Flow (FCF) of about $10.9 billion, according to the latest data. Analysts provide cash flow forecasts for the next several years, with expectations reaching just over $12.3 billion by 2029. For years beyond that, independent projections extend these trends, indicating steady growth through the decade.

This comprehensive DCF analysis arrives at an intrinsic value of $276.47 per share for Accenture, which is roughly 10.5% above where the stock currently trades. In practical terms, the calculation suggests that Accenture is undervalued, providing potential for upside if the business continues to deliver against its growth projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Accenture is undervalued by 10.5%. Track this in your watchlist or portfolio, or discover 878 more undervalued stocks based on cash flows.

Approach 2: Accenture Price vs Earnings

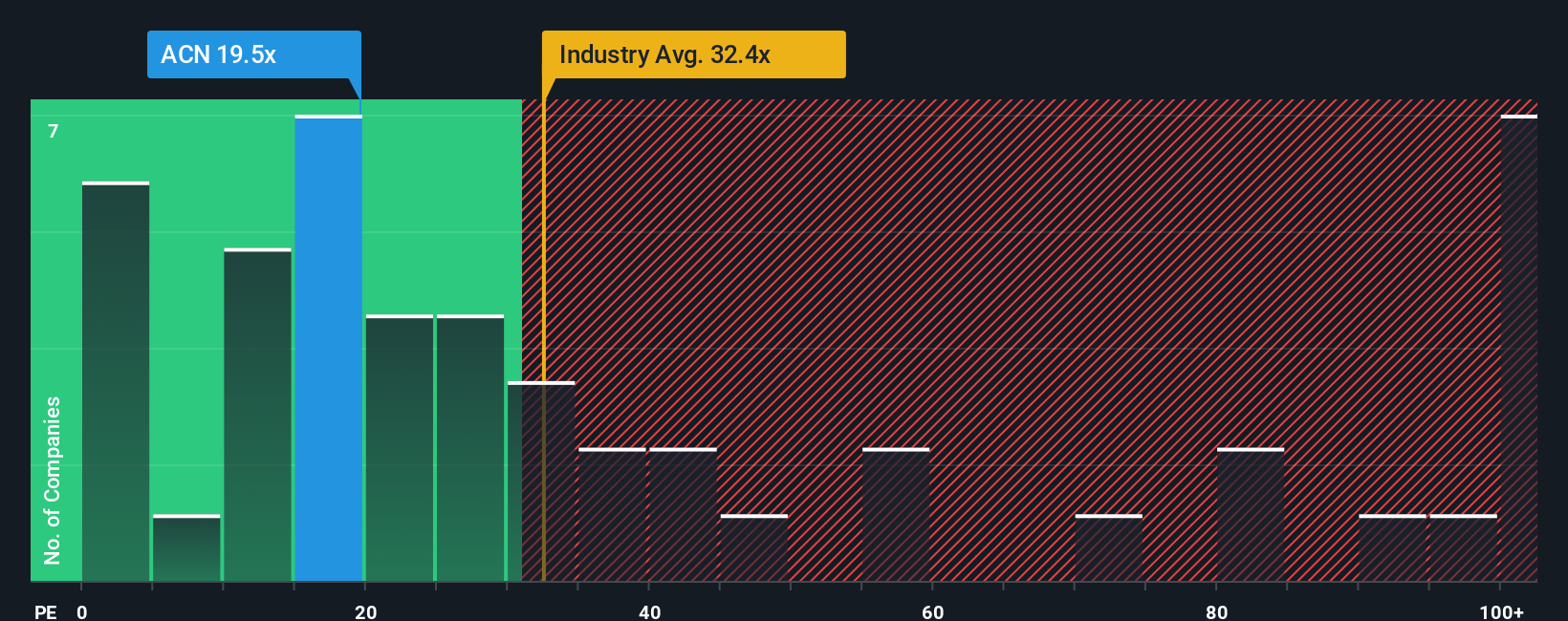

The Price-to-Earnings (PE) ratio is a widely used way to gauge the value of profitable companies like Accenture. It tells investors how much they are paying for each dollar of a company's earnings, and is especially useful because it puts the company’s profits at the center of the valuation discussion.

Growth expectations and risk are key factors that shape what a “normal” or “fair” PE ratio should be. Investors typically pay higher PE ratios for companies that have above-average growth prospects or lower business risk, since they expect future profits to increase or remain stable.

Currently, Accenture trades at a PE ratio of 20.0x. That is not only below the IT industry average of 31.3x, but also well under the 26.8x level where many of its peers are priced. Simply Wall St’s proprietary “Fair Ratio” model, however, goes a step further, calculating a fair PE for Accenture by factoring in company-specific growth, profit margins, risk, its industry, and overall market value. For Accenture, the Fair Ratio comes in at 38.3x, which is significantly above its present multiple.

Unlike a simple industry or peer comparison, the Fair Ratio incorporates Accenture’s unique strengths and risks, making it a more tailored and reliable benchmark for investors looking for a complete picture of value.

Since Accenture’s current PE multiple is much lower than its Fair Ratio, this suggests the stock may be undervalued from this perspective.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Accenture Narrative

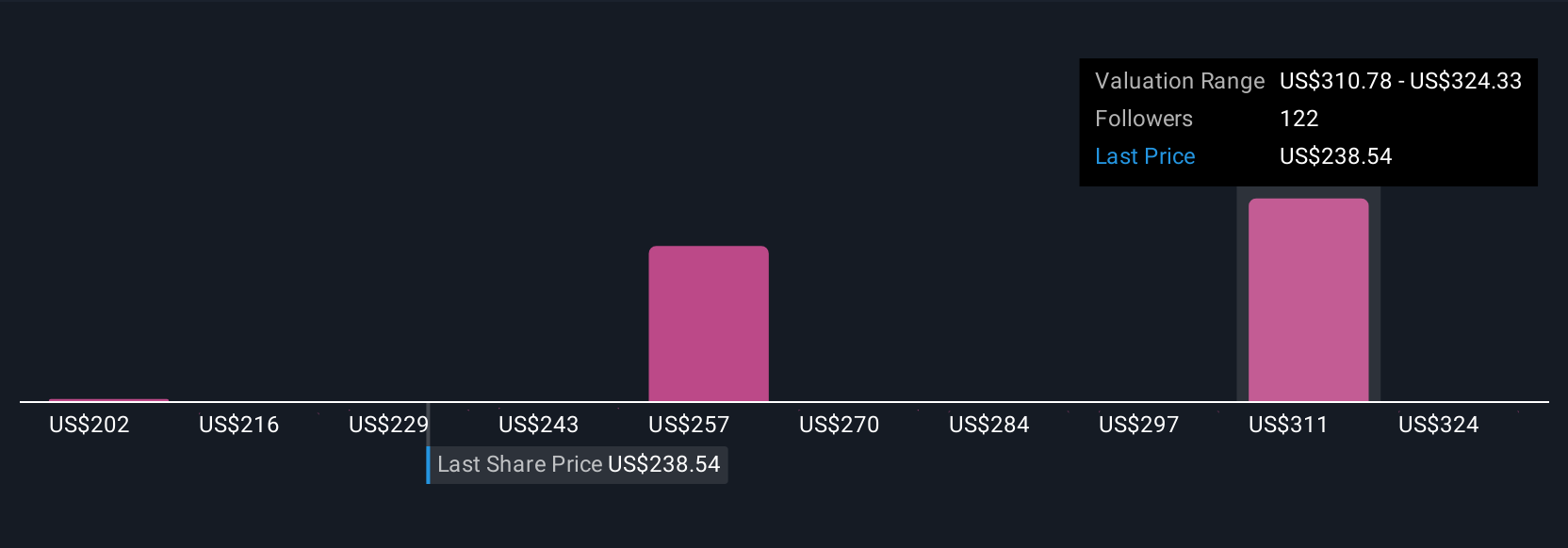

Earlier we mentioned that there's an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is simply the story an investor tells about a company, summarizing their perspective on what drives its future, wrapped up in numbers like fair value, revenue, earnings, and margins.

With Narratives, you connect Accenture’s business outlook and key events to your own financial forecast and see a clear estimate of what the shares should be worth today. This approach takes you beyond static ratios and gives you a live, tailored view of fair value, helping you make confident decisions about when to buy or sell.

Narratives are available right on Simply Wall St’s Community page, used by millions of investors. You can compare your Narrative to others, see how your view stacks up, and adjust it based on new company news, earnings, or broader market shifts. Your Narrative updates automatically.

For example, some investors see Accenture’s fair value near $202 (expecting modest growth and margin headwinds), while others believe it could reach above $372 (driven by bullish AI adoption and margin expansion).

No matter your outlook, Narratives make sophisticated valuation accessible, dynamic, and truly personal. You are always empowered with the story behind the numbers.

For Accenture, however, we'll make it really easy for you with previews of two leading Accenture Narratives:

Fair Value: $277.60

Undervalued by 10.8%

Projected Revenue Growth: 5.71%

- Strategic investments in Gen AI and acquisitions are expected to drive future revenue as digital transformations accelerate.

- Cloud and security business lines are delivering strong double-digit growth, supporting potential margin expansion and long-term shareholder returns.

- Risks include slowing federal revenue, margin pressure, currency fluctuations and macroeconomic uncertainties. Consensus price targets indicate 20%+ upside from current levels if forecasts play out.

Fair Value: $202.38

Overvalued by 22.3%

Projected Revenue Growth: 5.44%

- Valuation has reset close to long-term averages, and while profitability and free cash flow are strong, shares trade above the bear narrative’s fair value estimate.

- Momentum in AI-related bookings, EPS growth, and ongoing buybacks are positives. However, recent bookings softness and elongated decision cycles present risks to near-term growth.

- The primary swing factor is whether GenAI conversions and overall bookings re-accelerate. If not, further downside to multiples is possible despite the company’s high quality profile.

Do you think there's more to the story for Accenture? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACN

Accenture

Provides strategy and consulting, industry X, song, and technology and operation services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives