- United States

- /

- Software

- /

- NasdaqGS:ZS

Zscaler (ZS): Evaluating Valuation After Strong Earnings and Billings Miss Spark Divergent Reactions

Reviewed by Simply Wall St

Zscaler (ZS) reported quarterly results that beat expectations and lifted its full-year guidance; however, the stock dropped sharply as investors zeroed in on a miss in billings. The conflicting signals have refocused attention on growth sustainability.

See our latest analysis for Zscaler.

It’s been a volatile stretch for Zscaler, with the share price dropping over 21% in the past month as investors reacted to missed billings despite strong revenue gains and upgraded guidance. Over the longer term, though, momentum remains firmly positive, as Zscaler reports a 21.74% total shareholder return over the past year and a 94.98% total return across three years. These figures reflect both growth optimism and higher risk sensitivity as expectations rise.

If you’re weighing your next move in the cybersecurity space, why not check out more high-growth tech and AI innovators using our curated screener? See the full list for free.

With revenue and profitability metrics pointing upward, but concerns about billings weighing on sentiment, the question for investors now is clear: does Zscaler present an undervalued opportunity, or is the market already pricing in its future potential?

Most Popular Narrative: 23% Undervalued

Zscaler’s most widely followed narrative places its fair value at $327.98 per share, a significant premium to the recent close of $251.50. This striking gap highlights optimism around long-term growth levers and signals room for upside, even as short-term volatility dominates the headlines.

Explosive growth in AI/ML traffic and emerging threats is creating new security challenges that Zscaler is rapidly addressing with differentiated AI security and agentic operations products. This positions the company to capture a rising share of incremental cyber budgets and expand recurring ARR over the long term.

Curious what future earnings, revenue targets, and profit assumptions drive this bullish valuation? There is a surprising blend of innovation bets and aggressive analyst projections built into the fair value math. Discover which growth expectations and margin forecasts could make or break this future price tag.

Result: Fair Value of $327.98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including tougher competition from cloud giants and potential margin pressure if Zscaler's profit growth does not keep pace.

Find out about the key risks to this Zscaler narrative.

Another View: Market Multiples Tell a Different Story

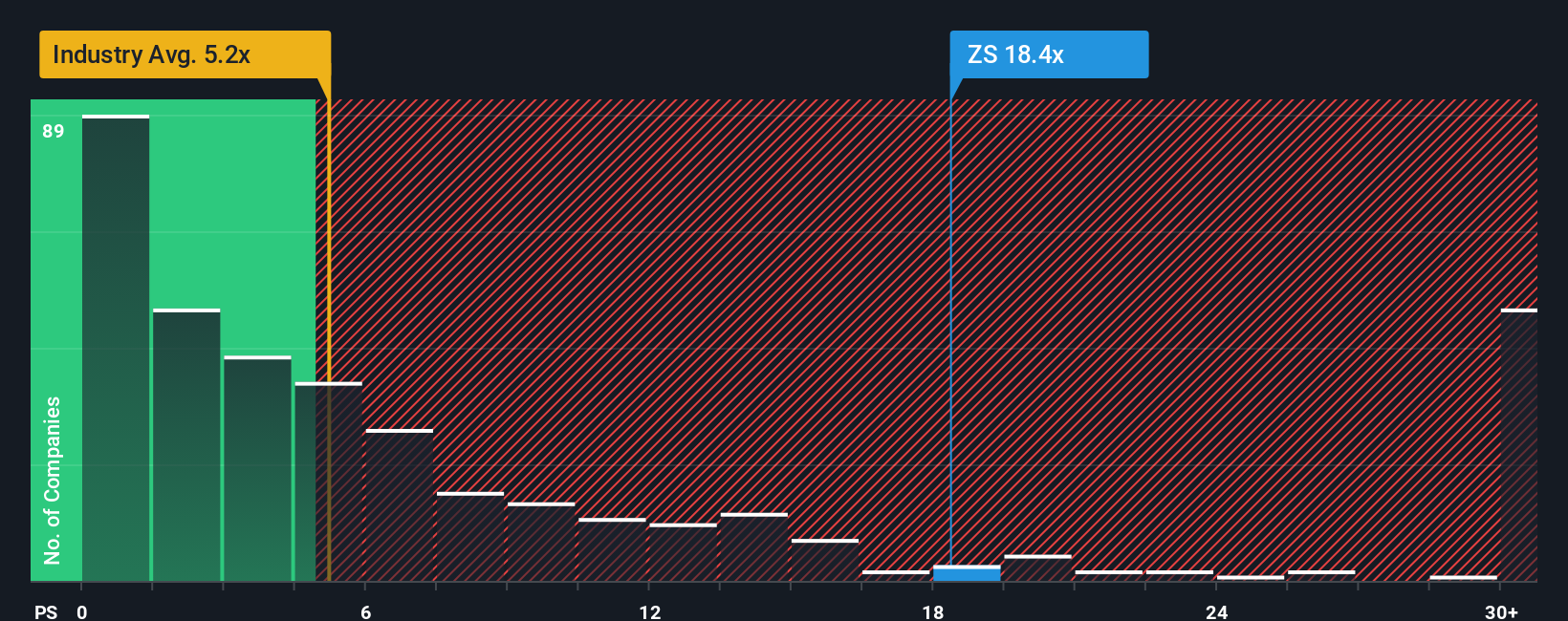

While the narrative and DCF-based valuation point to Zscaler being undervalued, looking at it through the lens of sales multiples offers a twist. The stock trades at 14.2x sales, significantly above the US Software industry’s 4.9x and higher than its fair ratio of 12.3x. This premium suggests the market is pricing in a lot of growth, raising the stakes for future performance. Is the optimism warranted, or could there be downside if Zscaler does not deliver?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zscaler Narrative

If you see the story differently, or want to put your own analysis to the test, you can craft a personal narrative in just a few minutes. Do it your way.

A great starting point for your Zscaler research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Make your next smart move by targeting stocks that align with your goals and a changing market. Opportunities like these do not wait around. Use the Simply Wall Street Screener to get ahead.

- Uncover potential bargains and unleash value by checking out these 913 undervalued stocks based on cash flows, where strong fundamentals meet attractive price tags.

- Earn while you invest by tapping into income opportunities with these 15 dividend stocks with yields > 3%, featuring companies offering reliable yields above 3%.

- Ride the artificial intelligence wave and stay on the cutting edge through these 25 AI penny stocks, spotlighting innovators with serious AI momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zscaler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZS

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026