- United States

- /

- Software

- /

- NasdaqGS:ZS

Should Analyst Optimism on Zscaler's (ZS) AI Security Strength Influence Investor Decisions?

Reviewed by Sasha Jovanovic

- In recent days, leading analysts at Wedbush and Barclays have reiterated their positive outlook on Zscaler, highlighting the company's strong position in cloud and AI-driven cybersecurity solutions for large enterprise clients.

- This wave of analyst support emphasizes Zscaler's successful adaptation to growing enterprise demand and product innovation amid an evolving threat landscape.

- We'll explore how analysts' increasing confidence in Zscaler's AI security capabilities may influence the company's long-term investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Zscaler Investment Narrative Recap

For me, being a shareholder in Zscaler means believing in the company’s ability to lead in cloud and AI-driven cybersecurity amid rapid digital transformation. The latest round of analyst upgrades points to strong momentum behind Zscaler's platform innovation, but does not materially change the fact that the biggest near-term catalyst remains enterprise adoption of its AI-powered security offerings, while the main risk continues to be intensifying competition from both public cloud providers and established players.

Among recent announcements, Zscaler’s enhancements to its Digital Experience (ZDX) platform stand out, as they directly support the company’s ambitions in AI-driven security. Expanding ZDX’s network intelligence and application monitoring capabilities may help drive upsell opportunities, supporting the same enterprise growth that analysts recently cited as a reason for their bullishness.

Yet, as encouraging as these analyst endorsements may be, investors should not overlook mounting pressures from public cloud giants and the possibility that…

Read the full narrative on Zscaler (it's free!)

Zscaler's outlook anticipates $4.7 billion in revenue and $139.8 million in earnings by 2028. This is based on a 20.5% annual revenue growth rate and a $181.3 million increase in earnings from the current level of -$41.5 million.

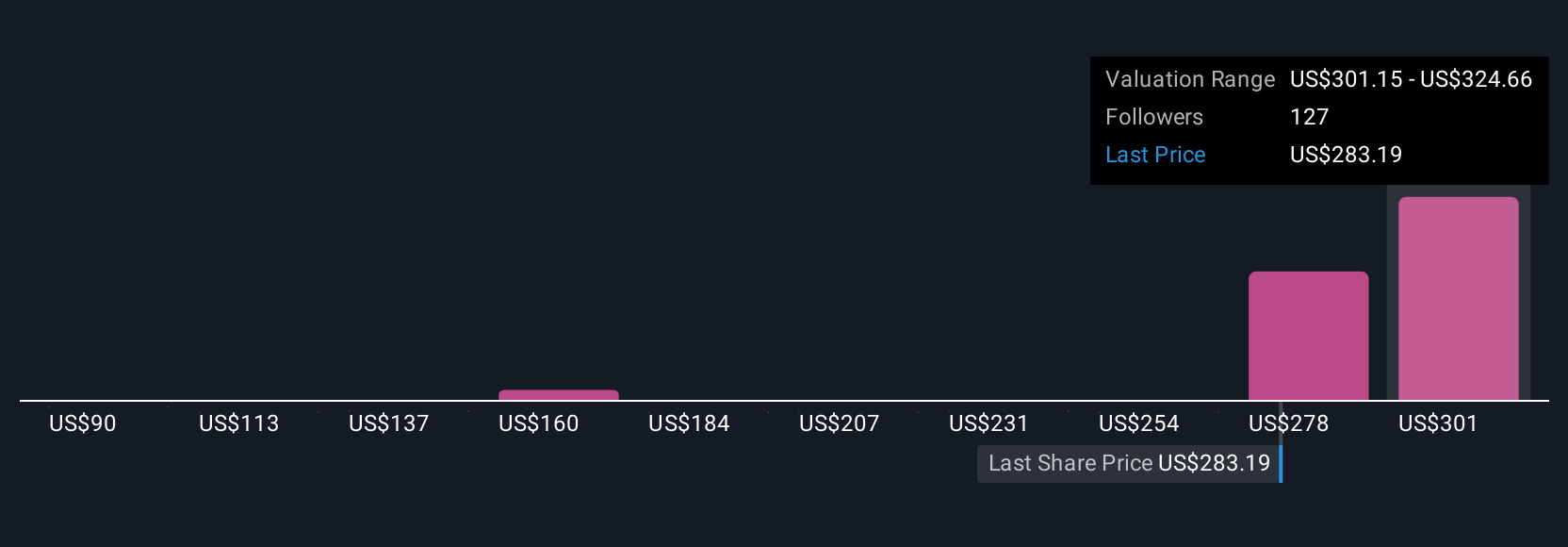

Uncover how Zscaler's forecasts yield a $324.66 fair value, in line with its current price.

Exploring Other Perspectives

Nine members of the Simply Wall St Community valued Zscaler between US$86.42 and US$324.66, showcasing a wide range of expectations. While many see substantial upside, the risk that public cloud providers could erode Zscaler's market share may weigh on future performance, take a closer look at these varied viewpoints for a fuller picture.

Explore 9 other fair value estimates on Zscaler - why the stock might be worth less than half the current price!

Build Your Own Zscaler Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zscaler research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Zscaler research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zscaler's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zscaler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZS

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives