- United States

- /

- Software

- /

- NasdaqGS:ZS

Is Now a Good Time to Reassess Zscaler After 85% Stock Price Surge in 2025?

Reviewed by Bailey Pemberton

- Thinking about whether Zscaler is a smart buy right now? You are not alone. Its eye-popping gains and recent headlines have put it squarely on investors’ radar.

- In fact, Zscaler’s stock price is up 85.1% year-to-date and has climbed 81.9% over the last year, with impressive gains of 10.1% in the last month alone.

- Markets have been buzzing about Zscaler’s strategic partnerships and focus on cloud security, both of which are drawing bullish attention from analysts. The company’s expansion into new verticals has only amplified the conversation, fueling recent optimism and capital flows.

- If you’re wondering how all of this excitement translates to valuation, Zscaler currently scores 1 out of 6 on our valuation checks. We will break down those valuation methods, and there is an even better way to assess value you will not want to miss at the end of this article.

Zscaler scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Zscaler Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to their value today. This method helps investors gauge the company’s intrinsic worth using cash flow projections rather than relying solely on market sentiment.

For Zscaler, the current Free Cash Flow stands at approximately $736.8 million. Analyst projections indicate Free Cash Flow may increase in the coming years, with forecasts reaching $1.09 billion in 2027 and $2.40 billion in 2030. While analyst consensus typically covers up to five years, Simply Wall St models provide further extrapolations to offer a more comprehensive long-term perspective.

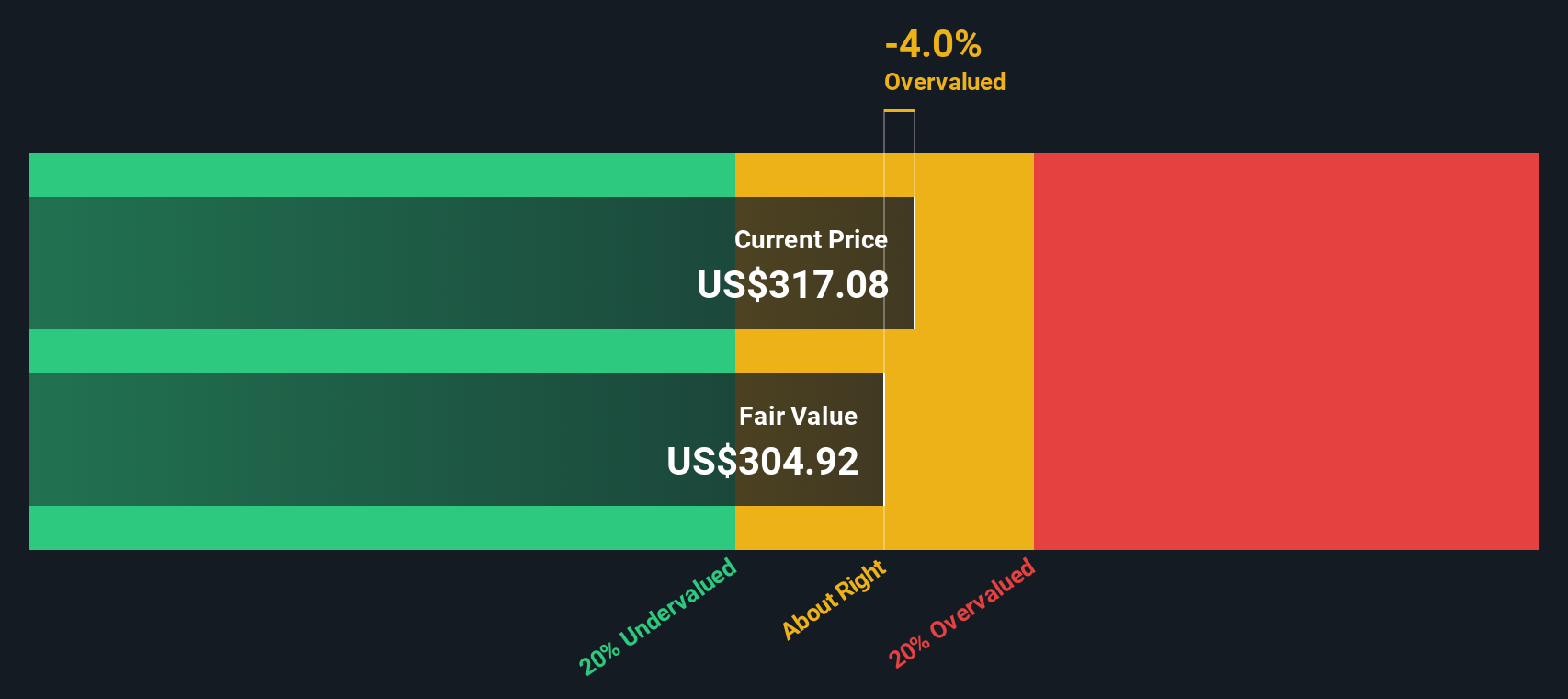

Using a 2 Stage Free Cash Flow to Equity model, Zscaler’s estimated intrinsic value is calculated at $297.44 per share. The DCF calculation suggests the stock is currently trading at a 13.1% premium to its intrinsic value, which may indicate it is overvalued at present prices.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Zscaler may be overvalued by 13.1%. Discover 843 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Zscaler Price vs Sales

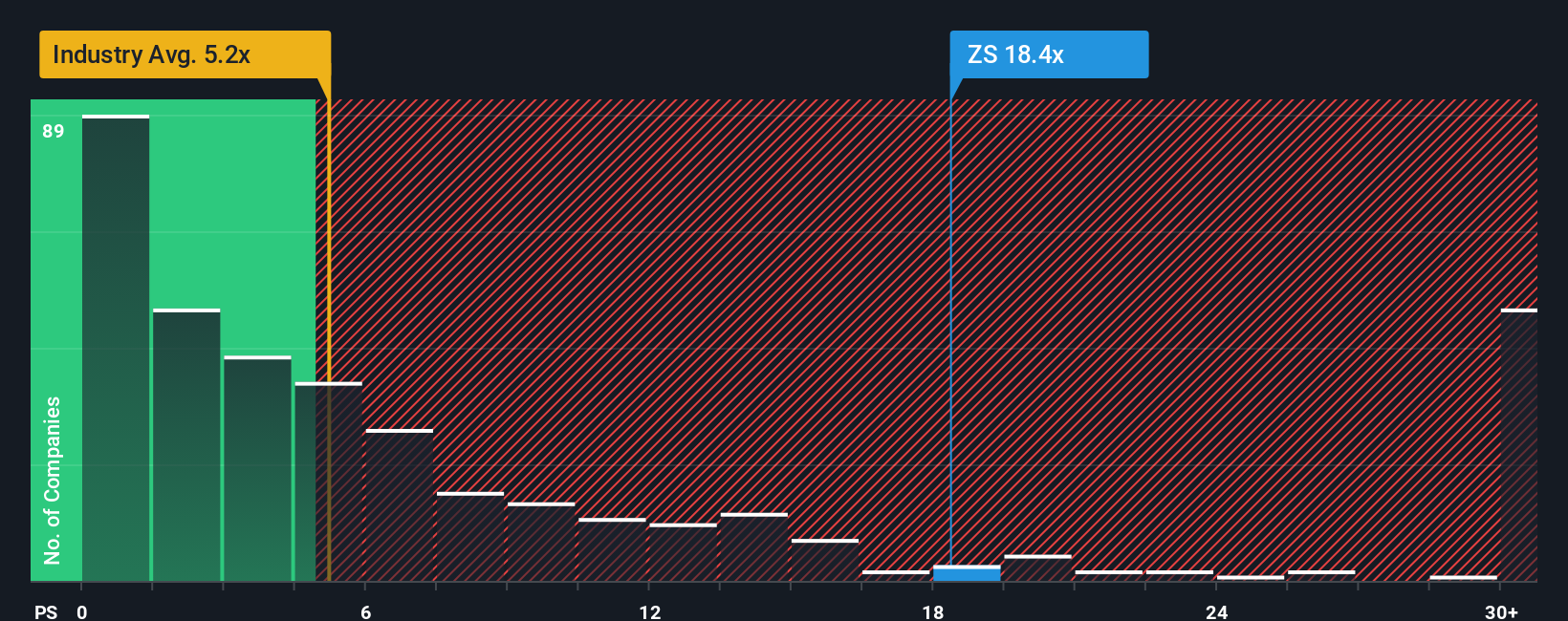

The Price-to-Sales (P/S) ratio is a popular valuation metric for software companies like Zscaler, where revenues often grow rapidly while profits may lag due to ongoing reinvestment. This makes the P/S ratio especially useful for evaluating businesses with strong top-line growth but limited near-term earnings.

Generally, a company with higher growth expectations and lower risk deserves a higher P/S multiple. Conversely, slower-growing or riskier companies warrant a lower multiple. Factors such as profit margins, competitive position, and market volatility can all impact what is considered a fair multiple.

Currently, Zscaler trades at a P/S ratio of 19.91x. Compared to the software industry average of 5.25x and a peer average of 20.10x, Zscaler is trading roughly in line with its highest-growth competitors but well above the broader industry baseline.

Simply Wall St’s "Fair Ratio" for Zscaler is 13.11x. This figure calibrates for the company’s growth prospects, risk profile, margin structure, market cap, and industry dynamics. The Fair Ratio provides a more tailored benchmark than simply comparing to peers or industry averages, as it reflects the unique characteristics and future potential specific to Zscaler.

Comparing Zscaler’s current 19.91x P/S with its Fair Ratio of 13.11x suggests the stock is currently overvalued according to this framework.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Zscaler Narrative

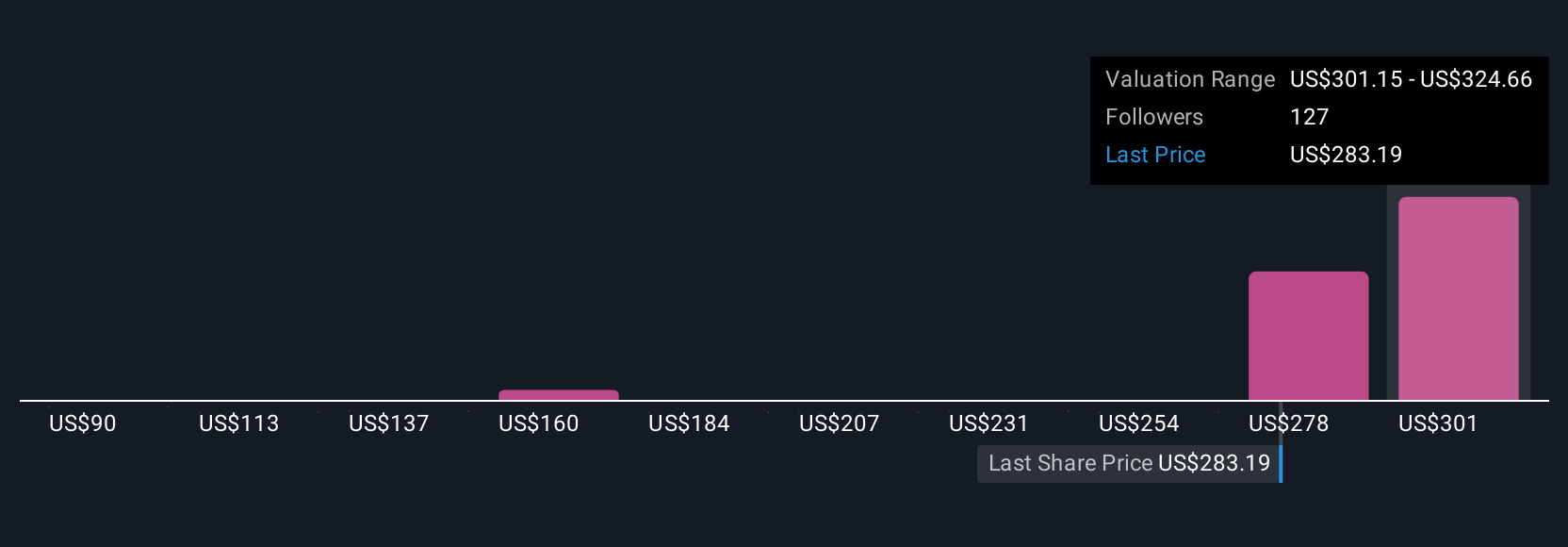

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story or perspective about a company, connecting what you believe about its future (like revenue, profit margins, and key risks or catalysts) to a financial forecast and, ultimately, a fair value. Narratives help you go beyond static numbers by allowing you to factor in why you think Zscaler will outperform (or underperform), and instantly see how that view compares to the current share price. On Simply Wall St’s Community page, millions of investors easily create, update, and share their Narratives, so you can see a range of fair values and assumptions, all dynamically kept up-to-date as new earnings reports or news emerge.

For example, some Zscaler Narratives use optimistic forecasts, highlighting rapid adoption of cloud security and AI-led growth, resulting in a high fair value. Others are more cautious, citing intense competition and margin pressure, which leads to much lower fair values. By comparing your Narrative to others and tracking real-time updates, you get actionable, tailored insights to help decide how to approach the stock, grounded in both the numbers and the story behind them.

For Zscaler, the most bullish analyst Narrative sees a fair value of $385.00 per share, while the most conservative puts it at just $251.00, so your view truly matters.

Do you think there's more to the story for Zscaler? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zscaler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZS

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives