- United States

- /

- IT

- /

- NasdaqCM:TSSI

Why TSS (TSSI) Is Down After Weak Q3 Results Despite Ambitious AI and Expansion Plans

Reviewed by Sasha Jovanovic

- TSS, Inc. reported a sharp year-over-year decline in third-quarter 2025 revenue and a swing to net loss due to operational challenges and lower procurement demand, but raised its full-year adjusted EBITDA outlook amid strong growth in AI integration and a new facility opening.

- The company appointed AI and transformation expert Vivek Mohindra to its Board and announced plans to pursue acquisitions and partnerships in AI, edge computing, and modular systems, highlighting a distinct pivot towards high-performance computing markets.

- We'll explore how TSS's renewed focus on AI infrastructure could impact its long-term investment narrative despite recent quarterly challenges.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is TSS' Investment Narrative?

For anyone considering TSS stock, the investment case revolves around whether the company’s pivot to AI infrastructure and high-performance computing can offset recent operational turbulence and sharply lower procurement demand. The third quarter’s sudden revenue drop and net loss rattled sentiment, as shown by the share price fall. However, the appointment of AI expert Vivek Mohindra to the Board and management’s focus on acquisitions signal determination to pursue new catalysts in AI systems integration and edge computing. These moves could accelerate organic growth if executed well, and management is backing this up with a significantly raised adjusted EBITDA outlook for the year. That said, near-term risks remain front and center. The company’s profit margins are thinner than last year, share price volatility is high, and further earnings setbacks or unsuccessful integration of new investments could pose challenges. On the other hand, recent operational issues highlight that revenue stability isn't guaranteed.

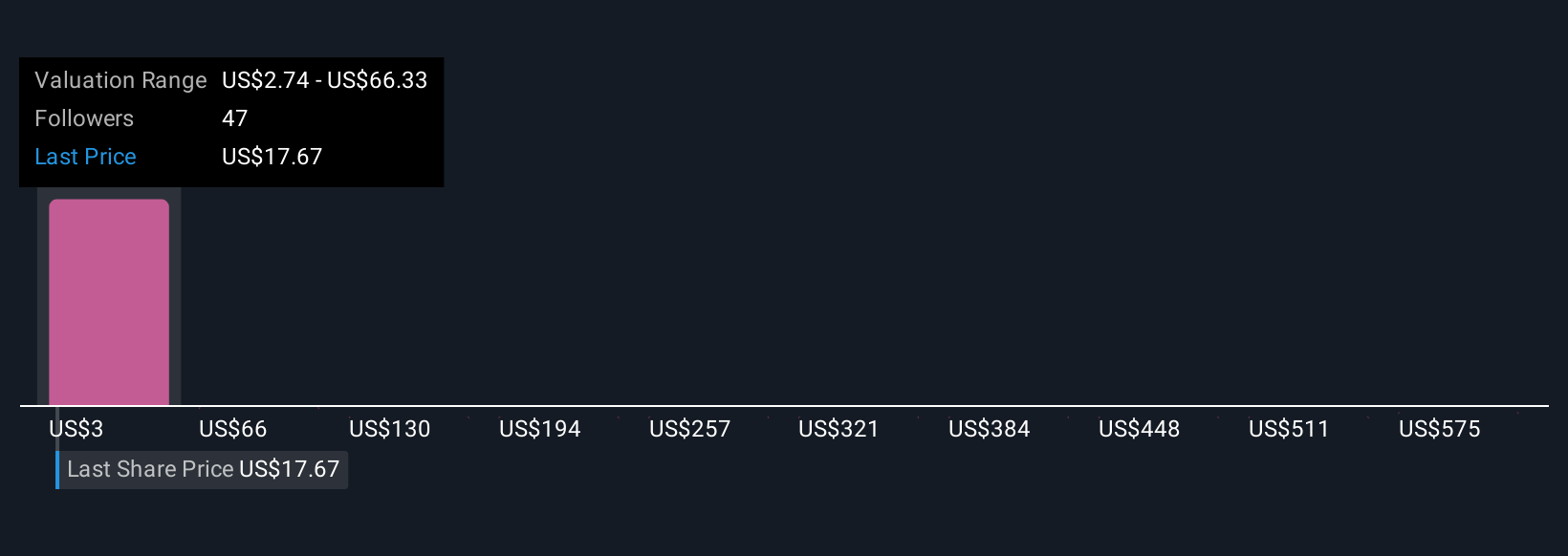

According our valuation report, there's an indication that TSS' share price might be on the expensive side.Exploring Other Perspectives

Explore 22 other fair value estimates on TSS - why the stock might be worth 17% less than the current price!

Build Your Own TSS Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TSS research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free TSS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TSS' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TSS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TSSI

TSS

Engages in the planning, design, deployment, maintenance, refresh, and take-back of end-user and enterprise systems in the United States.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives