- United States

- /

- Banks

- /

- NasdaqGS:HBAN

3 Prominent Stocks Estimated To Be Undervalued By At Least 40.2%

Reviewed by Simply Wall St

As December begins, major U.S. stock indexes have slipped, with big tech and crypto-tied shares experiencing declines amid a risk-off sentiment in the market. In this environment, identifying undervalued stocks can be crucial for investors looking to capitalize on potential opportunities that may arise from current market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Webull (BULL) | $9.33 | $17.89 | 47.8% |

| Warrior Met Coal (HCC) | $78.29 | $154.26 | 49.2% |

| Sotera Health (SHC) | $17.48 | $33.65 | 48% |

| Perfect (PERF) | $1.79 | $3.45 | 48.1% |

| Nicolet Bankshares (NIC) | $125.98 | $242.17 | 48% |

| Freshworks (FRSH) | $12.14 | $23.89 | 49.2% |

| First Busey (BUSE) | $23.54 | $45.34 | 48.1% |

| Elastic (ESTC) | $70.53 | $135.65 | 48% |

| DexCom (DXCM) | $63.47 | $126.38 | 49.8% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $19.03 | $37.29 | 49% |

Below we spotlight a couple of our favorites from our exclusive screener.

Celsius Holdings (CELH)

Overview: Celsius Holdings, Inc. is involved in the development, manufacturing, marketing, and distribution of functional energy drinks across various global markets with a market cap of $10.55 billion.

Operations: The company generates revenue of $2.13 billion from its non-alcoholic beverages segment, focusing on functional energy drinks distributed across the United States, North America, Europe, the Asia Pacific, and other international markets.

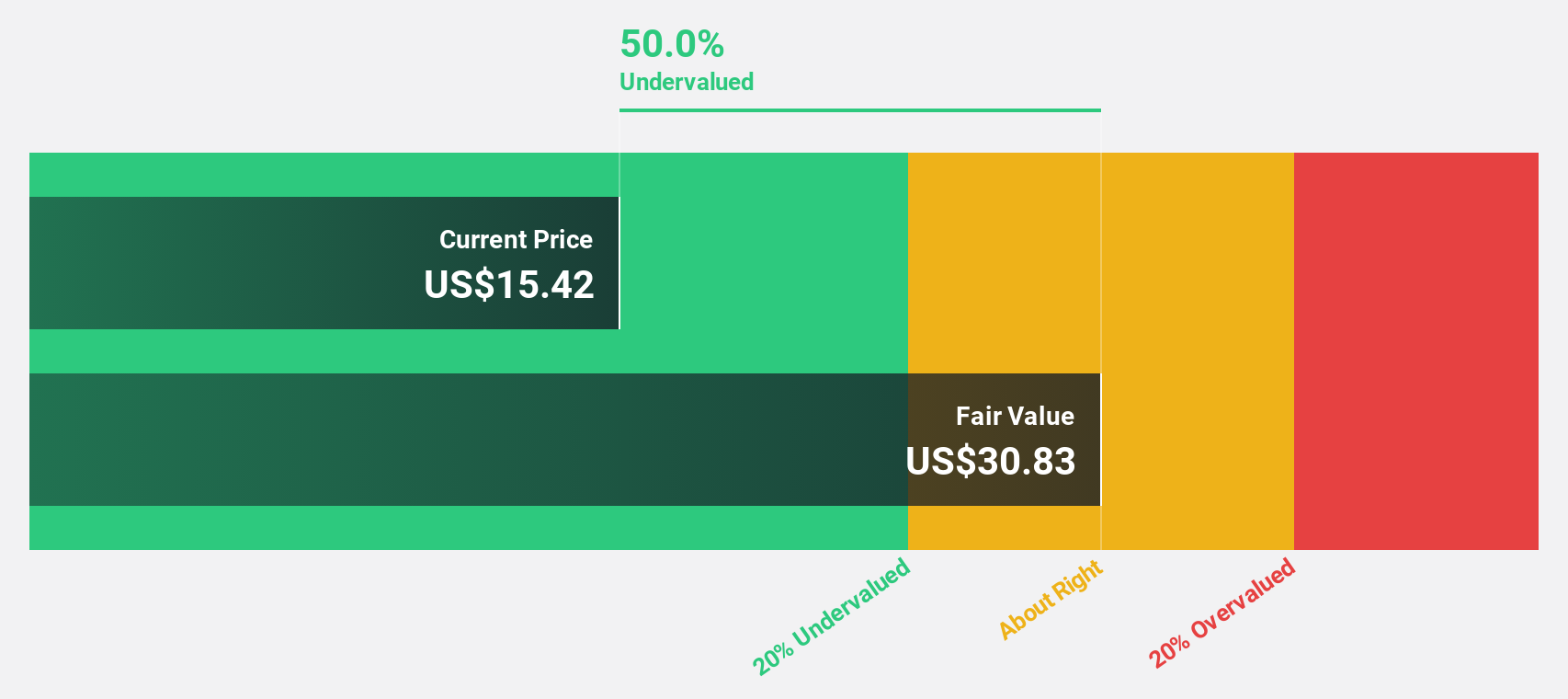

Estimated Discount To Fair Value: 40.5%

Celsius Holdings appears undervalued, trading at US$40.94 against an estimated fair value of US$68.78, suggesting a discount over 20%. Despite recent net losses and reduced profit margins, the company's earnings are forecast to grow significantly at 48.3% annually, outpacing the broader U.S. market. Additionally, a substantial share repurchase program worth up to US$300 million could enhance shareholder value amidst high expected revenue growth compared to the market average.

- The growth report we've compiled suggests that Celsius Holdings' future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Celsius Holdings.

Huntington Bancshares (HBAN)

Overview: Huntington Bancshares Incorporated is a bank holding company for The Huntington National Bank, offering commercial, consumer, and mortgage banking services in the United States with a market cap of $25.63 billion.

Operations: The company's revenue is primarily derived from Consumer & Regional Banking, contributing $5.10 billion, and Commercial Banking, which adds $2.81 billion.

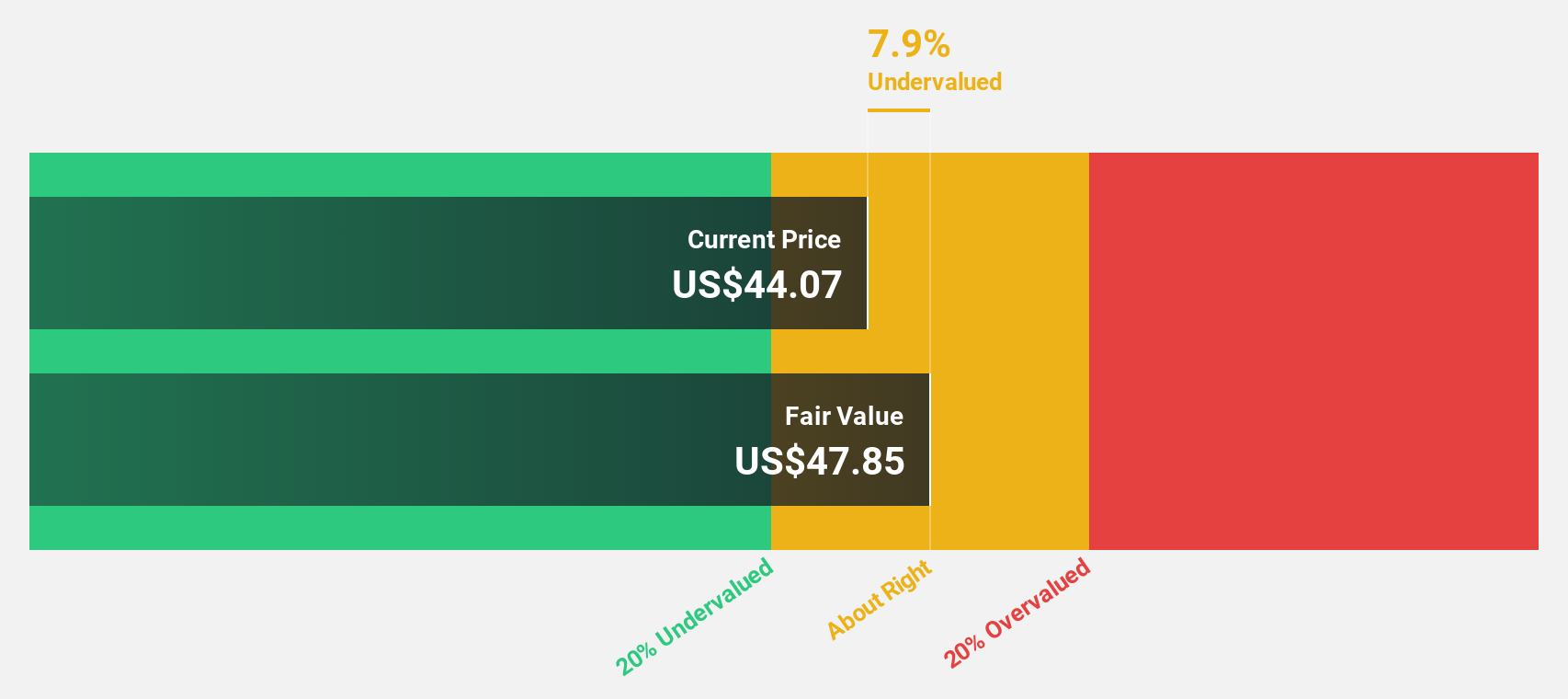

Estimated Discount To Fair Value: 47.8%

Huntington Bancshares is trading at a significant discount, with its share price of US$16.3 well below the estimated fair value of US$31.2. The company's earnings have grown by 38.9% over the past year and are expected to continue growing at 29.68% annually, surpassing U.S. market averages. Despite its low forecasted return on equity, Huntington's strategic expansion in the Carolinas and stable dividend yield enhance its investment appeal amidst robust revenue growth projections.

- Our comprehensive growth report raises the possibility that Huntington Bancshares is poised for substantial financial growth.

- Navigate through the intricacies of Huntington Bancshares with our comprehensive financial health report here.

Atlassian (TEAM)

Overview: Atlassian Corporation offers collaboration software designed to enhance organizational productivity globally, with a market cap of approximately $39.34 billion.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated $5.46 billion.

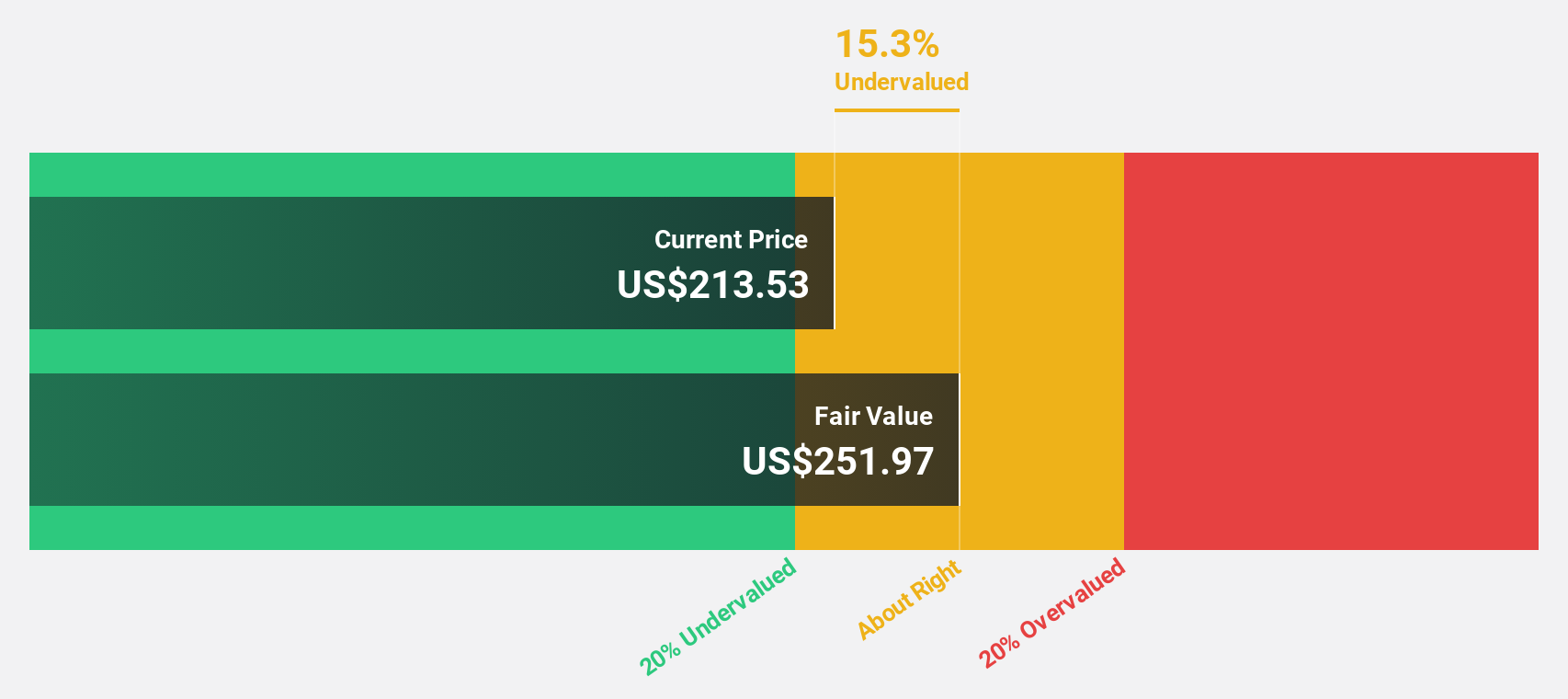

Estimated Discount To Fair Value: 40.2%

Atlassian's current share price of US$149.52 is significantly below its estimated fair value of US$250.05, highlighting its potential undervaluation based on cash flows. The company is expected to become profitable in the next three years, with revenue projected to grow 14.9% annually, surpassing the U.S. market average growth rate. Despite recent insider selling and a net loss reduction from last year, Atlassian's ongoing share buyback program underscores management's confidence in its long-term prospects.

- In light of our recent growth report, it seems possible that Atlassian's financial performance will exceed current levels.

- Dive into the specifics of Atlassian here with our thorough financial health report.

Next Steps

- Discover the full array of 206 Undervalued US Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huntington Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HBAN

Huntington Bancshares

Operates as the bank holding company for The Huntington National Bank that provides commercial, consumer, and mortgage banking services in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026