- United States

- /

- IT

- /

- NasdaqGS:SHOP

Is Shopify’s Stock Growth Justified After International Expansion and Surging Investor Optimism?

Reviewed by Bailey Pemberton

- Curious whether Shopify stock is currently a bargain or priced for perfection? You are not alone if you are wondering about its true value in today’s market.

- Shopify’s share price has climbed 3.9% in the last week, an impressive 16.8% in the past month, and a remarkable 122.0% over the last year. These gains have sparked questions about growth potential and shifting risk outlooks.

- Recent headlines have highlighted Shopify's continued expansion into international markets and new partnerships, which has fueled investor optimism. At the same time, analysts are watching how these moves may shape the company’s longer-term strategy and growth trajectory.

- When it comes to valuation, Shopify scores 0 out of 6 on our valuation checklist. This means it does not meet the mark for being undervalued on any of the core metrics we track. In this article, we will break down how this score is determined using different valuation tools and share a perspective that goes beyond the numbers in the conclusion.

Shopify scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Shopify Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This helps investors understand what the business is worth based on its real cash-generating ability, rather than current stock price trends or market sentiment.

For Shopify, the DCF model uses a 2 Stage Free Cash Flow to Equity approach. The company’s latest reported Free Cash Flow stands at $1.80 billion. Analysts forecast significant growth over the coming years, with Free Cash Flow estimated to reach $5.34 billion by 2029. After the initial analyst estimates, future projections are extrapolated, allowing valuation models to extend out a decade for a more thorough picture of Shopify’s long-term potential.

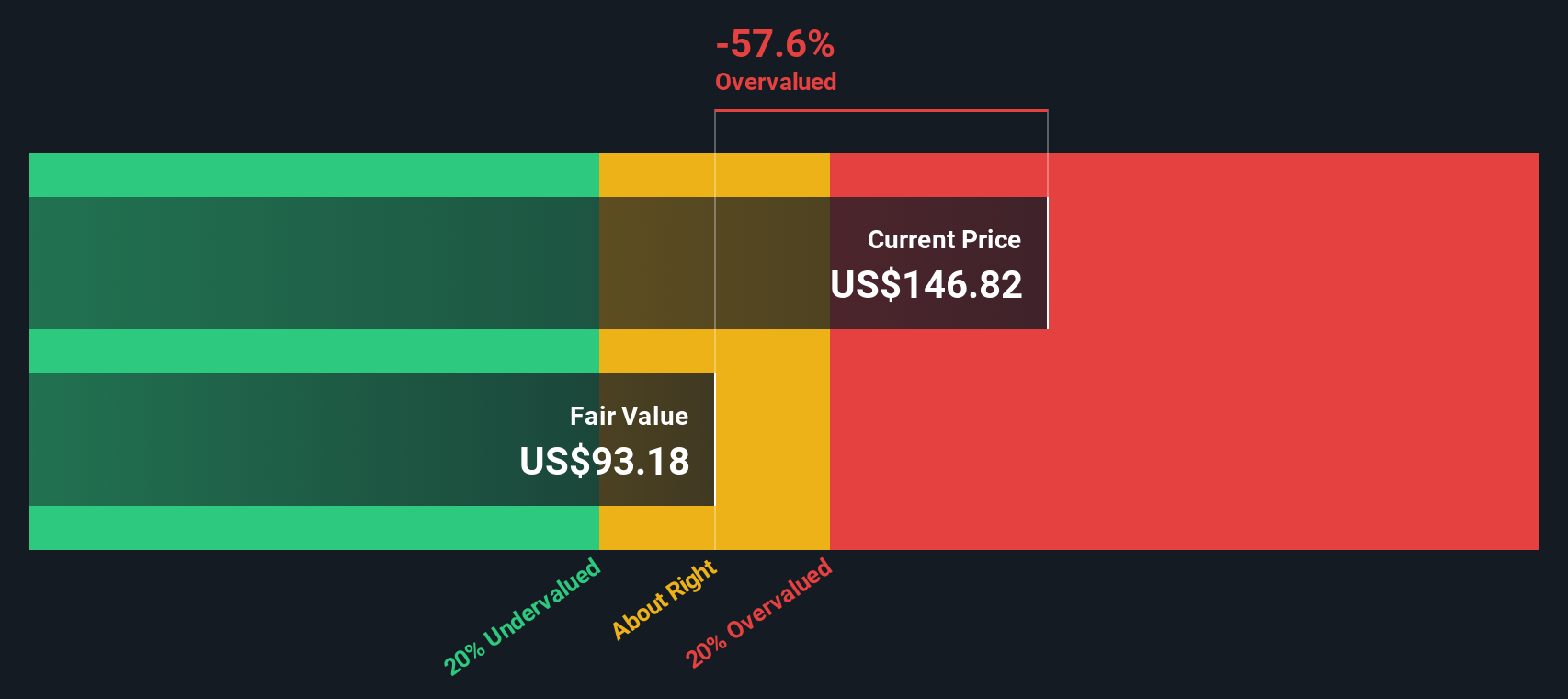

Taking these projections and discounting them back to the present, the DCF model arrives at an intrinsic value of $92.78 per share. Compared to Shopify’s current share price, this means the stock is trading at an 87.1% premium to its estimated fair value. In other words, it is considered highly overvalued according to this method.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Shopify may be overvalued by 87.1%. Discover 831 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Shopify Price vs Earnings

The price-to-earnings (PE) ratio is a widely used valuation metric for profitable companies like Shopify because it reflects how much investors are willing to pay for each dollar of reported earnings. When companies are consistently generating profits, the PE ratio offers a straightforward way to judge if a stock's valuation is reasonable compared to its earnings power.

It's important to remember that what qualifies as a "normal" or "fair" PE ratio depends on expectations for future growth as well as the risks facing a business. Generally, investors are willing to pay higher multiples for companies with strong earnings growth and manageable risks, while lower multiples can signal lower expectations or greater risks.

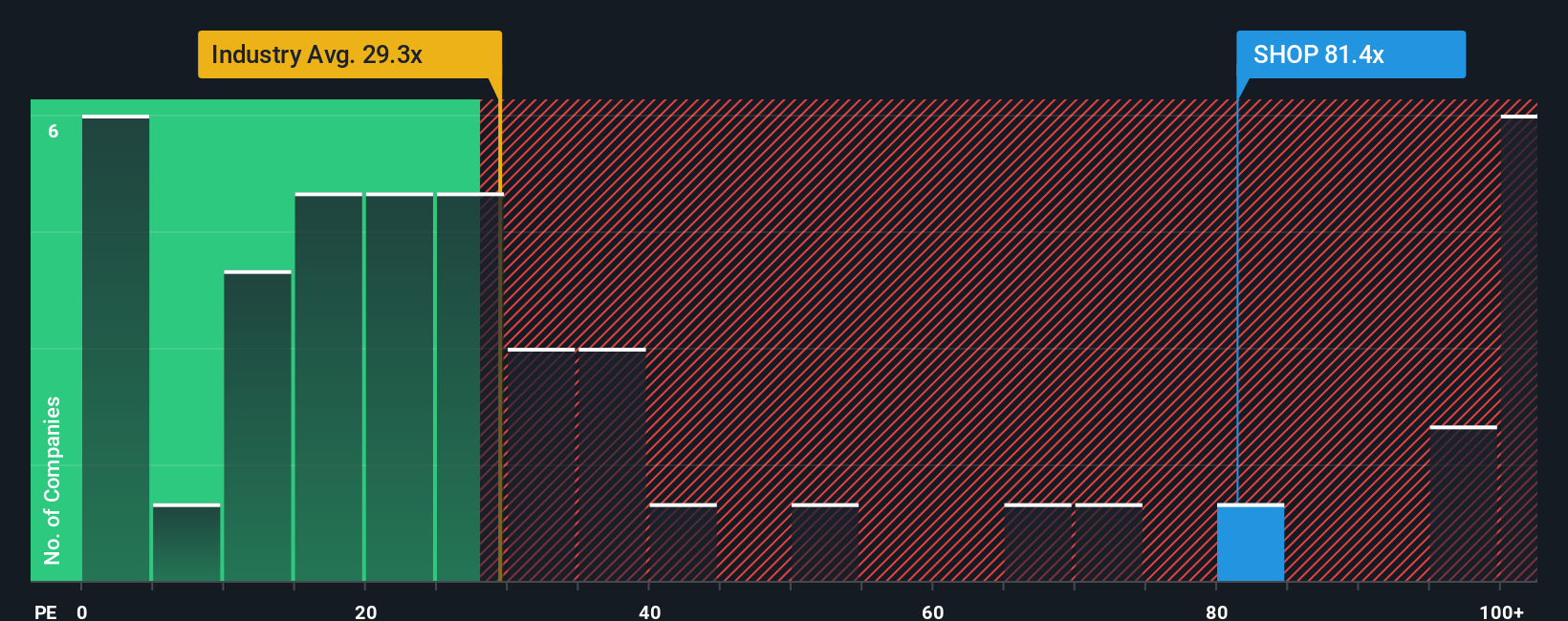

Currently, Shopify trades at a PE ratio of 96.2x, which is more than double the average of its industry peers (41.5x) and significantly above the broad IT industry average (29.3x). This elevated multiple suggests high growth expectations and strong investor demand. However, Simply Wall St offers an additional perspective with the "Fair Ratio," a custom-calculated benchmark that adjusts for Shopify's growth rate, risk profile, profit margin, industry context, and market cap. Shopify’s Fair Ratio is estimated at 43.7x, providing a more tailored and nuanced yardstick than simple peer or industry comparisons.

By comparing Shopify’s current PE ratio of 96.2x to its Fair Ratio of 43.7x, it is evident that the stock trades at more than double its fair valuation, indicating a premium price that may not be fully justified given the fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1394 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Shopify Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Think of a Narrative as your own story for a company like Shopify. It connects your view of where the business is headed with assumptions about future revenues, profits, and margins, all grounded in the information you think matters most.

Narratives link a company’s business story directly to a financial forecast, then to a fair value estimate, so you can see in real time how your perspective fits with the current market price. They are easy to build and explore on Simply Wall St’s Community page, where millions of investors refine their thinking and debate the outlook for stocks like Shopify every day.

This approach makes decision making smarter. Narratives help you decide when to buy or sell by making the rationale behind your fair value visible, and letting you compare your own forecast with those from other investors and industry analysts.

Best of all, Narratives are dynamically updated, adjusting automatically when significant news releases or earnings updates hit, so your story stays relevant and accurate as conditions change.

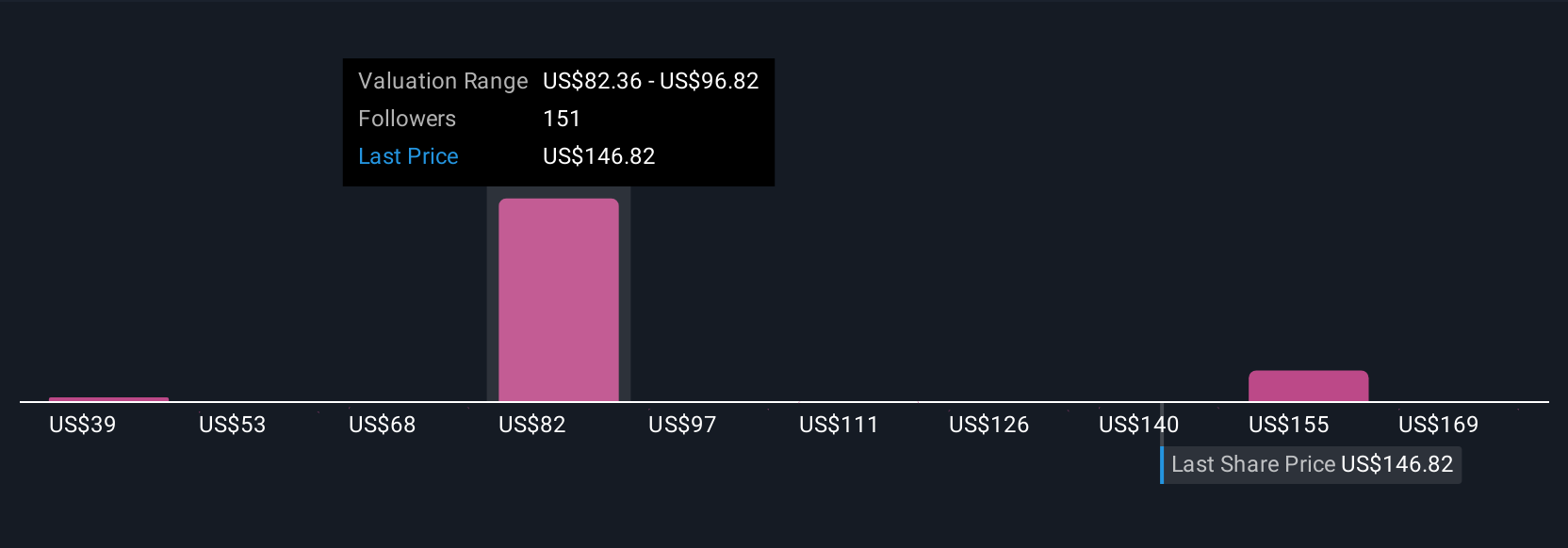

For example, some investors see international expansion and AI integration driving Shopify’s fair value up to $200 per share, while more cautious voices set their target as low as $114, highlighting how Narratives capture real-world debates and evolving sentiment.

Do you think there's more to the story for Shopify? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives