- United States

- /

- Software

- /

- NasdaqGS:PONY

Will Pony AI's (PONY) Fresh HK$6.71 Billion Boost Reshape Its Path to Profitability?

Reviewed by Sasha Jovanovic

- Pony AI Inc. recently completed a follow-on equity offering in Hong Kong, raising HK$6.71 billion through the sale of Class A Ordinary Shares, just ahead of its upcoming financial results announcement on November 25, 2025.

- This capital infusion comes amid significant market interest in the autonomous vehicle sector, as Pony AI pursues commercialization and further development of its self-driving technology.

- We'll explore how this substantial equity offering shapes Pony AI's investment narrative, particularly as the company gears up for its quarterly financial disclosure.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Pony AI's Investment Narrative?

Pony AI’s story remains ambitious, hinging on the success of its commercialization and global expansion efforts in autonomous vehicles, a sector attracting considerable attention but not without volatility. The recent HK$6.71 billion follow-on equity offering adds considerable financial flexibility, potentially enabling Pony AI to accelerate robotaxi deployment and deepen development partnerships. While this capital raise could address prior concerns about negative cash flow and mounting losses, it has not reversed the stock’s steep price declines, and may even heighten short-term share price fluctuation, especially ahead of the critical Q3 2025 results announcement. With a challenging path to profitability and heightened regulatory scrutiny, the biggest risks now center on the company’s ability to convert rapid revenue growth into sustainable profit and to maintain investor confidence amidst emerging competition and government oversight. The way this new funding reshapes both opportunity and near-term risk is a crucial element for shareholders to weigh.

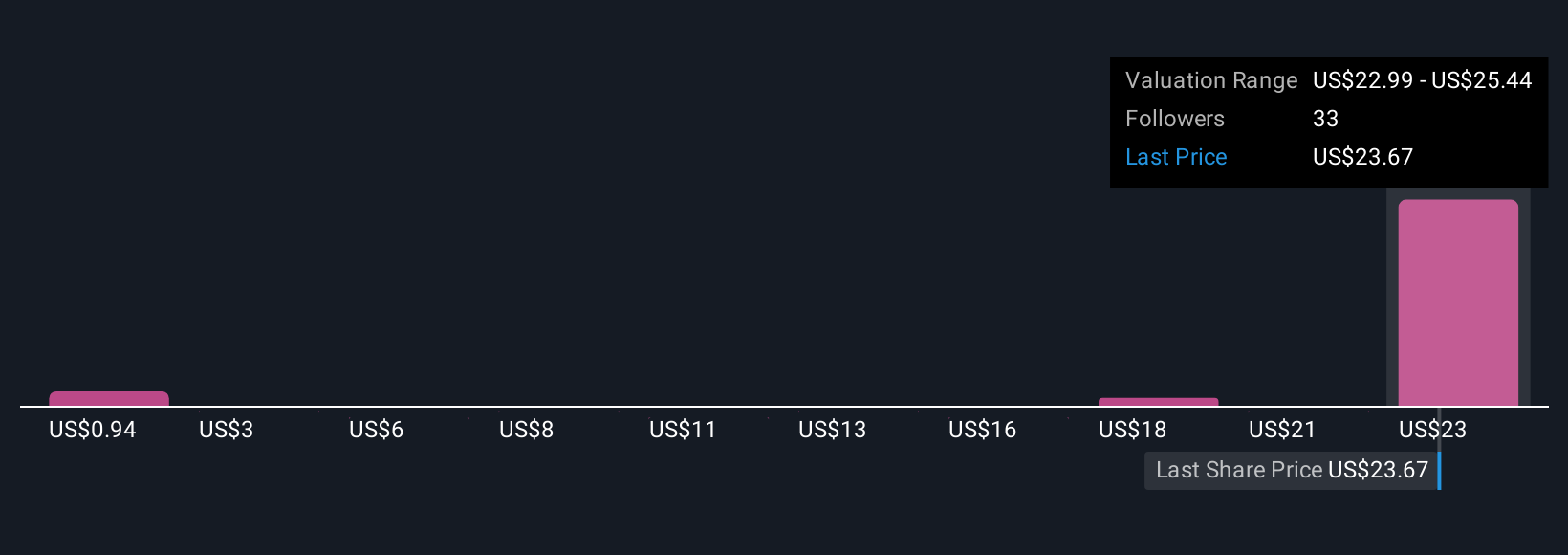

But in contrast, ongoing regulatory scrutiny still presents a risk investors should watch closely. Despite retreating, Pony AI's shares might still be trading 42% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 14 other fair value estimates on Pony AI - why the stock might be worth as much as 86% more than the current price!

Build Your Own Pony AI Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pony AI research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Pony AI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pony AI's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PONY

Pony AI

Through its subsidiaries, engages in the autonomous mobility business in the People’s Republic of China, the United States, and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives