- United States

- /

- Software

- /

- NasdaqGS:PEGA

Does a Surge in Subscription Revenue and Margin Expansion Redefine Pegasystems’ (PEGA) Recurring Revenue Narrative?

Reviewed by Sasha Jovanovic

- Pegasystems reported third-quarter 2025 results last week that surpassed estimates, with subscription revenues contributing 85% of total revenue and backlog up 19% year over year, underpinned by its AI-driven strategy and cloud growth.

- An expanded operating margin and disciplined cost control, alongside robust adoption of cloud and AI offerings, underscore the company's ongoing shift toward recurring revenue streams and improved profitability.

- We’ll explore how the strong boost in subscription revenue growth and margin expansion shapes Pegasystems’ investment narrative going forward.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Pegasystems Investment Narrative Recap

To be a Pegasystems shareholder, you need to believe that its shift to a subscription-based, AI-focused business can drive recurring revenue and long-term profitability, despite competition and unpredictable macroeconomic factors. The strong Q3 results with 20% subscription growth and margin expansion support the short-term catalyst of accelerated cloud adoption, but the complexity of competing AI solutions remains the biggest risk; recent financials do not materially reduce this concern, as market penetration continues to face challenges.

Among recent announcements, the September launch of Pega Infinity ’25 aligns closely with these results, highlighting an enterprise-wide rollout of new AI-driven features. This rollout may reinforce recurring revenue growth and AI adoption, both of which are part of the company's key catalysts for future performance.

However, in contrast to the upbeat earnings, investors should be aware that success still hinges on whether Pegasystems can clearly differentiate its AI offerings in a competitive market...

Read the full narrative on Pegasystems (it's free!)

Pegasystems is expected to reach $1.9 billion in revenue and $292.2 million in earnings by 2028. This outlook is based on a projected annual revenue growth rate of 4.2% and a $72 million increase in earnings from the current $220.2 million.

Uncover how Pegasystems' forecasts yield a $73.09 fair value, a 34% upside to its current price.

Exploring Other Perspectives

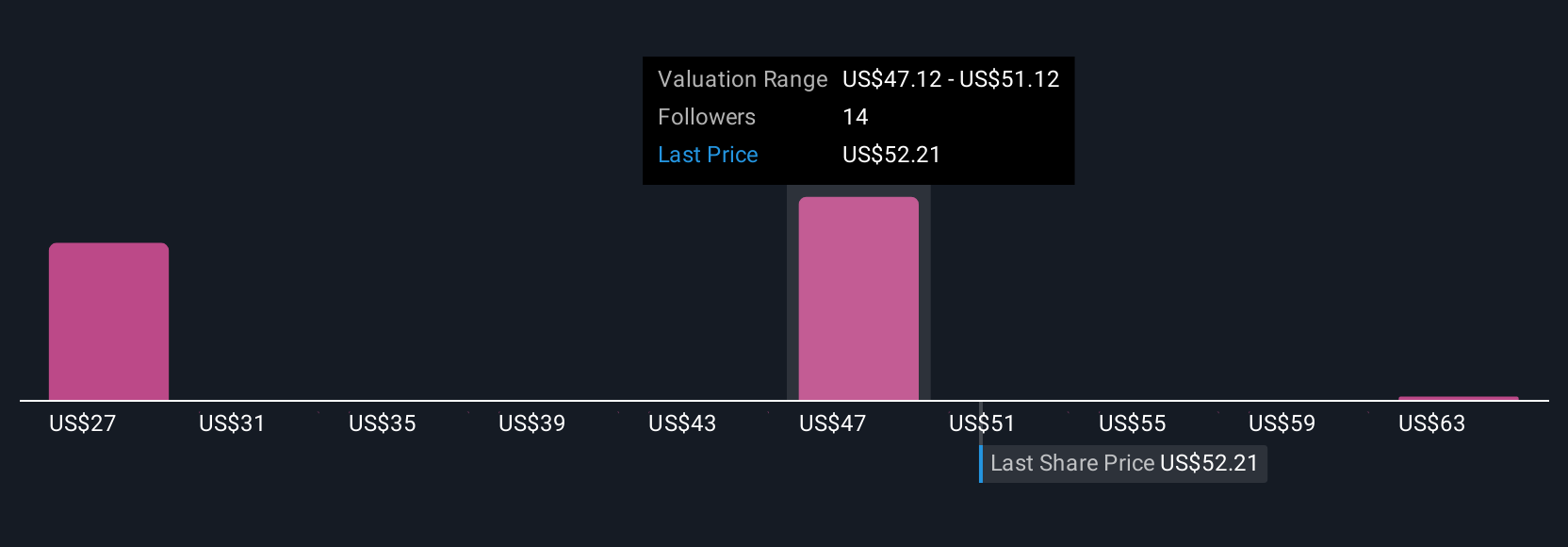

Six fair value estimates from the Simply Wall St Community span from US$26.37 to US$78, underlining widely different views on Pegasystems’ outlook. While subscription growth has fueled recent momentum, uncertainty around market acceptance of its AI solutions could affect results in ways investors should not ignore.

Explore 6 other fair value estimates on Pegasystems - why the stock might be worth less than half the current price!

Build Your Own Pegasystems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pegasystems research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Pegasystems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pegasystems' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEGA

Pegasystems

Develops, markets, licenses, hosts, and supports enterprise software in the United States, rest of the Americas, the United Kingdom, rest of Europe, the Middle East, Africa, and the Asia-Pacific.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success