- United States

- /

- Software

- /

- NYSE:CRCL

Spotlight On Alnylam Pharmaceuticals And 2 Other Stocks Possibly Trading Below Fair Value

Reviewed by Simply Wall St

As the U.S. stock market wraps up a strong week, with major indices like the S&P 500 and Dow Jones Industrial Average extending their winning streaks, investors are keenly observing opportunities amid fluctuating tech performances and economic shifts. Despite the Nasdaq's recent monthly dip, this environment presents a chance to explore stocks potentially trading below their fair value, such as Alnylam Pharmaceuticals, which may offer intriguing prospects for those seeking undervalued investments in today's market climate.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Webull (BULL) | $9.33 | $17.89 | 47.8% |

| Warrior Met Coal (HCC) | $78.29 | $154.26 | 49.2% |

| Sotera Health (SHC) | $17.48 | $33.65 | 48% |

| Perfect (PERF) | $1.79 | $3.45 | 48.1% |

| Nicolet Bankshares (NIC) | $125.98 | $242.17 | 48% |

| Freshworks (FRSH) | $12.14 | $23.89 | 49.2% |

| First Busey (BUSE) | $23.54 | $45.34 | 48.1% |

| Elastic (ESTC) | $70.53 | $135.65 | 48% |

| DexCom (DXCM) | $63.47 | $126.38 | 49.8% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $19.03 | $37.29 | 49% |

We'll examine a selection from our screener results.

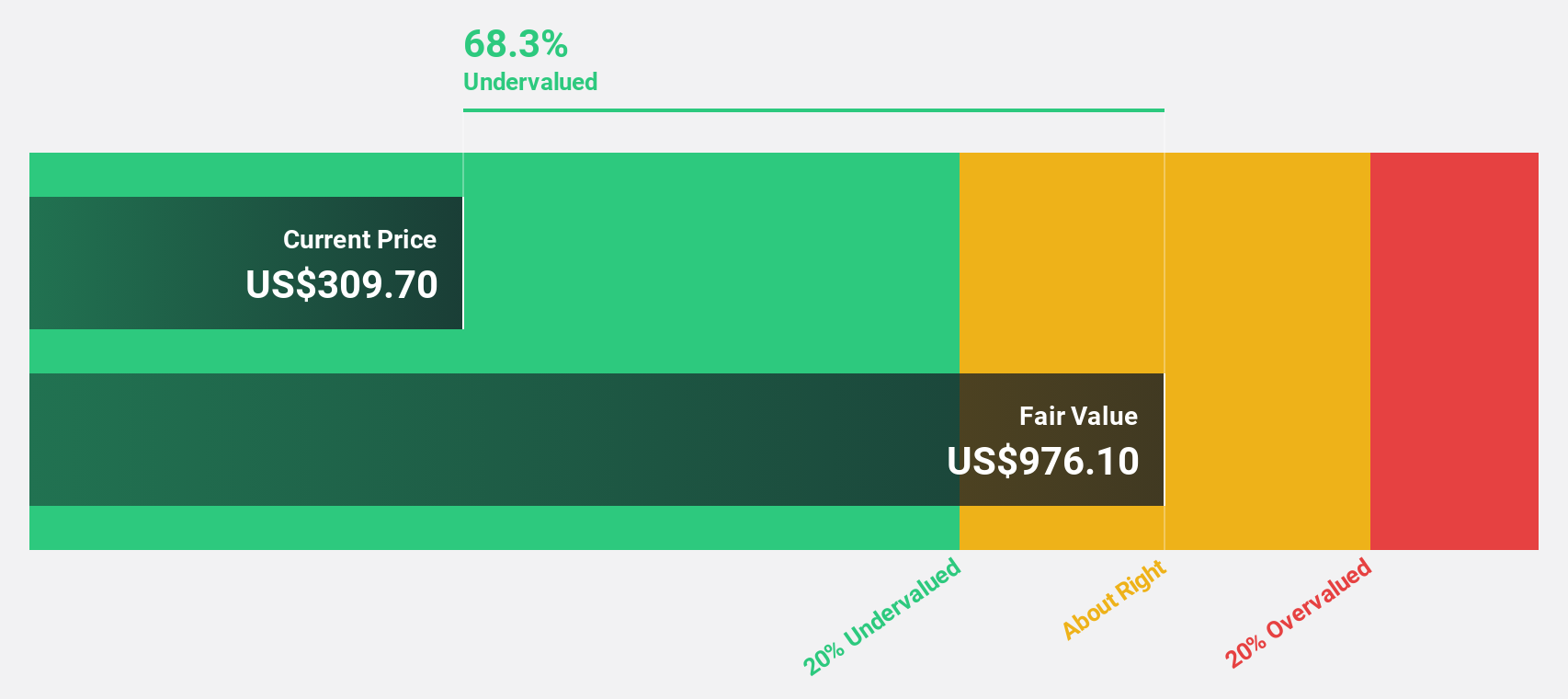

Alnylam Pharmaceuticals (ALNY)

Overview: Alnylam Pharmaceuticals, Inc. focuses on discovering, developing, and commercializing therapeutics based on ribonucleic acid interference and has a market cap of approximately $59.61 billion.

Operations: The company's revenue segment is primarily derived from the discovery, development, and commercialization of RNAi therapeutics, amounting to $3.21 billion.

Estimated Discount To Fair Value: 24.5%

Alnylam Pharmaceuticals is trading at US$451.23, significantly below its estimated fair value of US$597.59, suggesting potential undervaluation based on cash flows. The company has shown strong revenue growth, with recent quarterly revenue reaching US$1.25 billion compared to US$500 million a year ago and becoming profitable this year with a net income of US$251 million for the quarter. However, notable insider selling may warrant caution despite promising financial forecasts and product developments such as AMVUTTRA®.

- Upon reviewing our latest growth report, Alnylam Pharmaceuticals' projected financial performance appears quite optimistic.

- Dive into the specifics of Alnylam Pharmaceuticals here with our thorough financial health report.

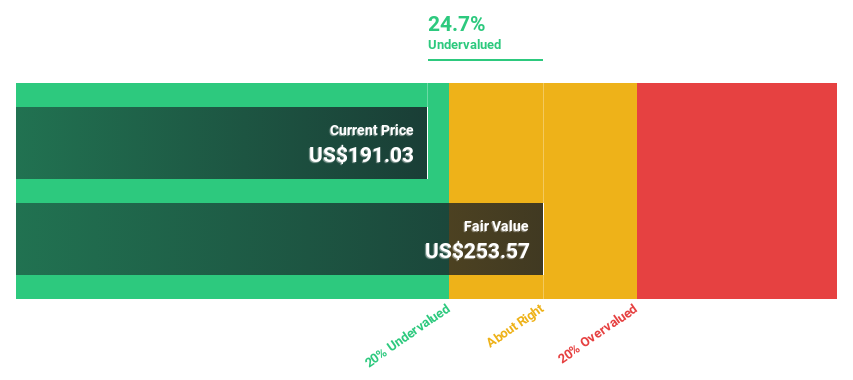

Palo Alto Networks (PANW)

Overview: Palo Alto Networks, Inc. offers cybersecurity solutions across the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan with a market cap of approximately $132.52 billion.

Operations: The company's revenue primarily comes from its Security Software & Services segment, which generated approximately $9.56 billion.

Estimated Discount To Fair Value: 17.1%

Palo Alto Networks is trading at US$190.13, below its estimated fair value of US$229.29, indicating potential undervaluation based on cash flows. Despite a drop in net income to US$334 million from the previous year, earnings are expected to grow faster than the market at 19.6% annually. Recent strategic alliances and product innovations in AI security and quantum-safe solutions could enhance future cash flow generation, though profit margins have decreased from last year’s levels.

- According our earnings growth report, there's an indication that Palo Alto Networks might be ready to expand.

- Unlock comprehensive insights into our analysis of Palo Alto Networks stock in this financial health report.

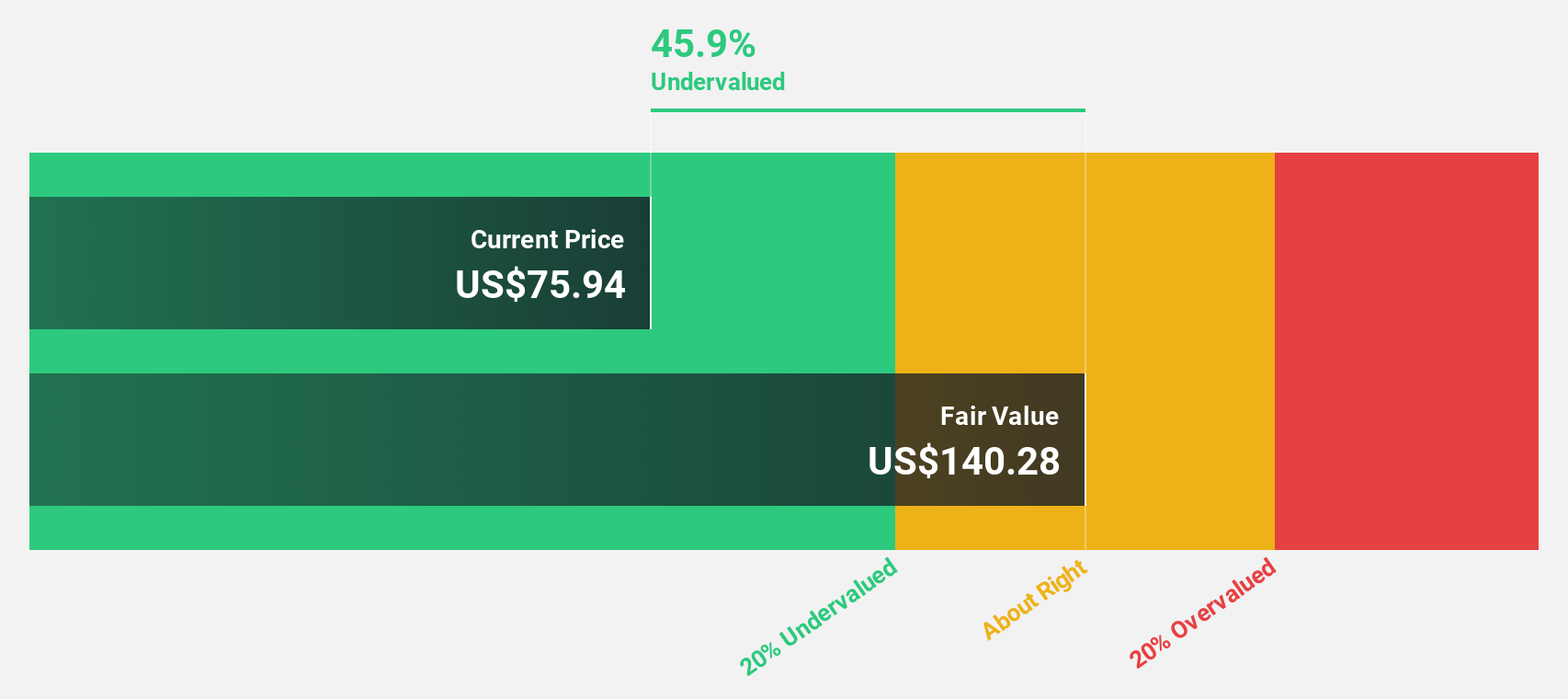

Circle Internet Group (CRCL)

Overview: Circle Internet Group, Inc. operates as a platform, network, and market infrastructure for stablecoin and blockchain applications with a market cap of $18.82 billion.

Operations: The company's revenue is primarily derived from its data processing segment, which generated $2.41 billion.

Estimated Discount To Fair Value: 43%

Circle Internet Group is trading at US$79.93, significantly below its estimated fair value of US$140.28, suggesting it may be undervalued based on cash flows. The company's revenue is forecast to grow 26% annually, surpassing market averages. While recent earnings showed substantial growth in net income to US$214.39 million for Q3 2025, insider selling and high share price volatility present concerns. Strategic partnerships and product developments could bolster future cash flow potential despite these challenges.

- Our expertly prepared growth report on Circle Internet Group implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Circle Internet Group.

Summing It All Up

- Unlock our comprehensive list of 206 Undervalued US Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRCL

Circle Internet Group

Operates as a platform, network, and market infrastructure for stablecoin and blockchain applications.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026