- United States

- /

- Software

- /

- NasdaqGS:PANW

Palo Alto Networks (PANW): Valuation in Focus Following Analyst Upgrades and New AI Security Launches

Reviewed by Simply Wall St

Recent upbeat analyst outlook, active institutional investor moves, and the buzz around Palo Alto Networks (PANW) introducing new AI security platforms have combined to create real anticipation ahead of the company’s upcoming earnings report.

See our latest analysis for Palo Alto Networks.

Palo Alto Networks has captured market attention this year with strategic acquisitions, buzzworthy AI-powered product launches, and a surge of positive analyst upgrades. The stock’s 90-day share price return stands at 21.03%, capping off a year where momentum has picked up and total shareholder return reached 4.40% over the past twelve months. Long-term holders have seen outstanding multi-year gains.

If the recent moves in cybersecurity have caught your eye, it’s a smart time to see who else is innovating. Check out See the full list for free..

Palo Alto Networks is trading near its all-time highs, lifted by enthusiastic analyst upgrades and strong institutional support. With growth expectations running high, the real question is whether this momentum leaves any room for a buying opportunity, or if the market has already priced in what comes next.

Most Popular Narrative: 3.5% Undervalued

With a fair value estimate of $217.67 set just above the last close of $210.04, the dominant narrative signals that Palo Alto Networks' latest rally still leaves a small window below its consensus price tag. As investors weigh the company’s recent surge, the underlying factors shaping this target are crucial to understand.

Ongoing industry consolidation, as enterprises seek to simplify and maximize the effectiveness of their security stack, has strengthened the trend towards platformization. This has resulted in larger multi-platform deal sizes, improved cross-sell, higher net retention rates (120%), and near zero churn among platformized clients. All of these factors support future margin expansion and earnings growth.

Curious what’s driving this premium? The story hinges on ambitious growth projections, profits scaling up and a bold vision of margin expansion. There is one crucial financial leap at the core; see which assumptions analysts are really betting on before deciding if this price is justified.

Result: Fair Value of $217.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing integration challenges or intensifying competition could quickly test investors’ confidence in Palo Alto Networks’ bullish narrative.

Find out about the key risks to this Palo Alto Networks narrative.

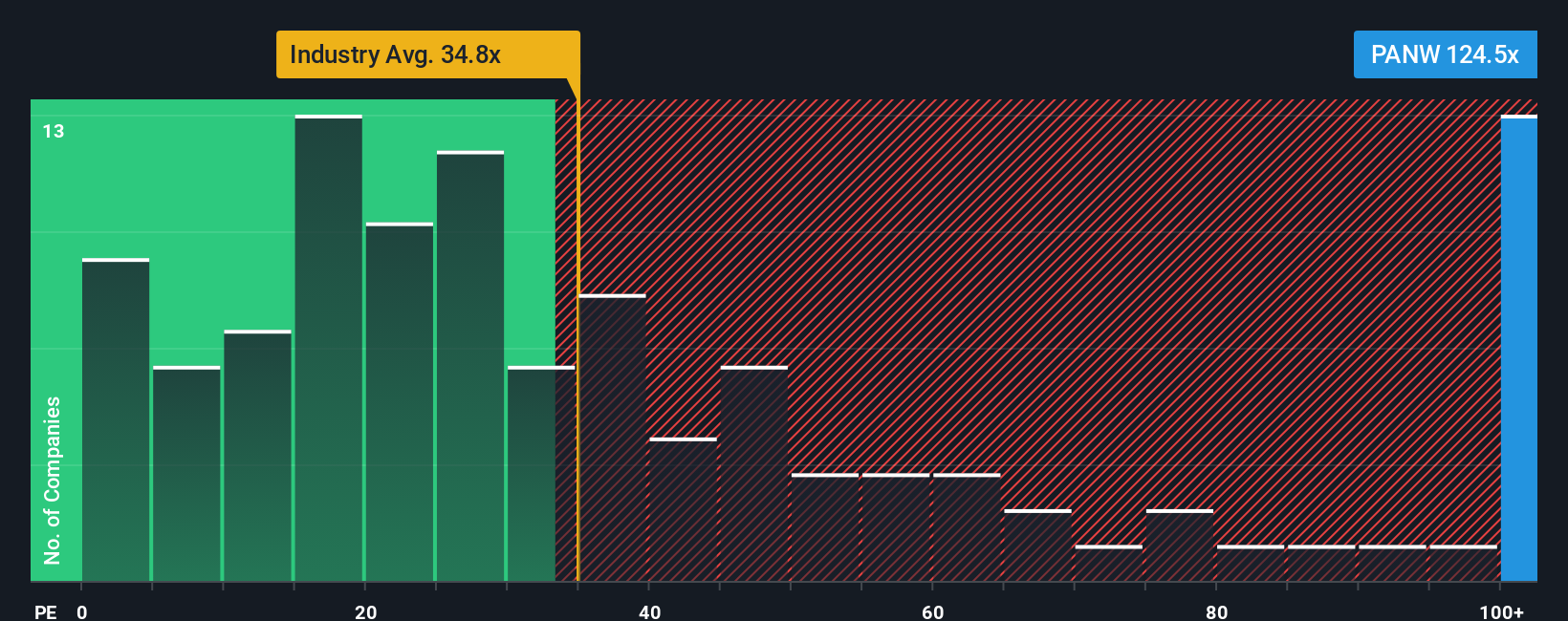

Another View: Multiples Signal Caution

While fair value estimates suggest Palo Alto Networks is undervalued, a look at its current price-to-earnings ratio sparks debate. The company trades at 125.4 times earnings, which is far above both the US Software industry’s average of 32.1x and a fair ratio of 44.8x. This significant premium implies investors expect sustained, rapid growth. Could this leave little margin for error if growth stumbles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Palo Alto Networks Narrative

If your perspective differs or you’re eager to dig deeper into the numbers, you can easily craft your own take on Palo Alto Networks in just a few minutes. Do it your way.

A great starting point for your Palo Alto Networks research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep their radar open for the next opportunity. Don’t miss the chance to spot innovative leaders, fast growers, or reliable payers in sectors shaping tomorrow’s markets.

- Unlock hidden value and growth potential in overlooked markets by reviewing these 3585 penny stocks with strong financials that combine strong financials with untapped promise.

- Capture the momentum of technological transformation with these 27 AI penny stocks at the forefront of artificial intelligence, automation, and groundbreaking software innovation.

- Strengthen your portfolio’s income stream by selecting from these 14 dividend stocks with yields > 3% with robust yields and consistent dividend histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PANW

Palo Alto Networks

Provides cybersecurity solutions the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives