- United States

- /

- Software

- /

- NasdaqGS:PANW

Palo Alto Networks (PANW) Strengthens UK Ministry Of Justice's Digital Security And Resilience

Reviewed by Simply Wall St

Palo Alto Networks (PANW) has partnered with the UK's Ministry of Justice to enhance digital service security, utilizing advanced solutions like Prisma SASE and Cortex XSIAM. This collaboration comes amid the company's 17% stock price increase over the last quarter. Similarly, partnerships with Okta and GTT Communications further solidified PANW's market position. This robust performance aligns with the broader market trend, as the S&P 500 experienced record highs. Despite minor fluctuations throughout the quarter, Palo Alto Networks' strategic client collaborations and service expansions added momentum to its share price movement, countering any downward pressure from broader macroeconomic factors.

Palo Alto Networks has 1 possible red flag we think you should know about.

The recent partnership between Palo Alto Networks and the UK's Ministry of Justice could enhance the company's narrative of expanding integrated security solutions. This collaboration, alongside deals with Okta and GTT Communications, is likely to bolster revenue growth by strengthening Palo Alto's position in the international market. Over the past five years, the company's total return, including share price appreciation and dividends, was an impressive 373.92%, indicating strong long-term shareholder value.

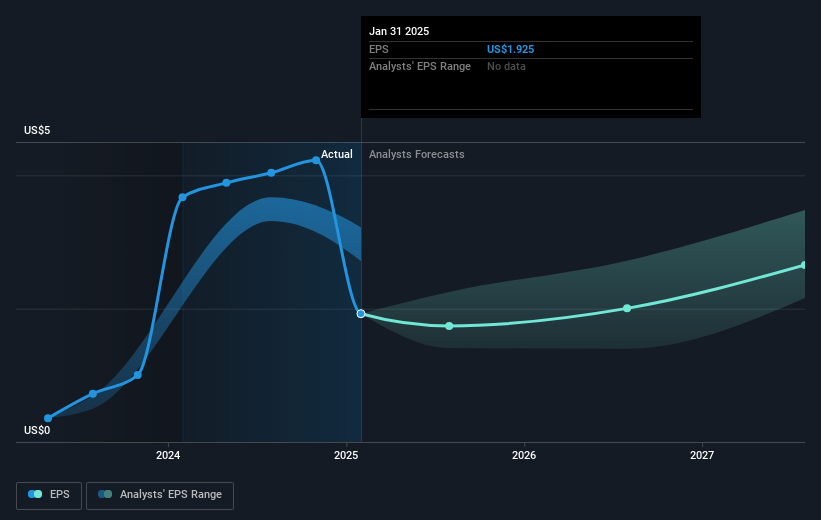

In comparison to the broader market, Palo Alto Networks' shares have outperformed over the last year, despite a challenging competitive landscape. Although the broader US Software industry returned 26.1%, Palo Alto Networks saw fluctuations, partly due to its efforts in scaling AI-driven initiatives and platformization, which are projected to increase profitability and deal sizes. Analysts expect revenue growth of 12.5% annually, surpassing the US market's 9% growth rate, suggesting a potential positive impact on earnings.

With a current share price of US$196.28 and a price target of US$212.20, the news of strategic collaborations could influence future share prices, aligning with analysts' expectations. However, the forecasted price target remains under 20% higher than the current share price, highlighting manageable expectations from analysts. As Palo Alto continues its AI and cloud expansion, these advancements could potentially elevate revenue and earnings projections, supporting both the narrative and the price target.

Assess Palo Alto Networks' future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PANW

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives