- United States

- /

- Software

- /

- NasdaqGS:PANW

Is Palo Alto Networks’ (PANW) AI-Driven Prisma SASE 4.0 Transforming the Company’s Investment Narrative?

Reviewed by Simply Wall St

- On September 4, 2025, Palo Alto Networks announced Prisma SASE 4.0, an AI-driven secure access service edge solution designed to neutralize real-time web threats within enterprise browsers and continuously adapt protections for private applications, addressing gaps left by traditional cybersecurity platforms.

- This launch marks a substantial step as the browser becomes a primary enterprise operating system, with Prisma SASE’s pre-trained machine learning models and adaptive app protection reflecting an industry-wide shift toward integrated, automated AI security across cloud and connected environments.

- We'll now examine how Palo Alto Networks' leap in AI-driven browser security shapes its broader investment outlook and growth narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Palo Alto Networks Investment Narrative Recap

To own shares of Palo Alto Networks, you need to believe the company can maintain its edge as enterprises shift toward integrated, AI-powered cloud security, despite intensifying competition and ongoing product integration challenges. The leap with Prisma SASE 4.0 builds credibility for AI leadership but does not meaningfully reduce near-term integration risk around the large CyberArk acquisition, nor does it change the catalyst of growing demand for unified, automated cloud security platforms.

Among the recent developments, the CyberArk acquisition announcement stands out as particularly relevant, given it highlights the company's intent to consolidate its identity and access management portfolio, in step with client requirements for cohesive, multi-layered AI security. While Prisma SASE 4.0 supports the bullish narrative for platform expansion, big-ticket integrations remain a source of uncertainty for operational cohesion and customer retention.

But as Palo Alto Networks accelerates AI innovation, investors should also weigh the potential downside if...

Read the full narrative on Palo Alto Networks (it's free!)

Palo Alto Networks is projected to reach $13.3 billion in revenue and $2.0 billion in earnings by 2028. This outlook assumes a 13.1% annual revenue growth rate and an $0.9 billion increase in earnings from the current $1.1 billion.

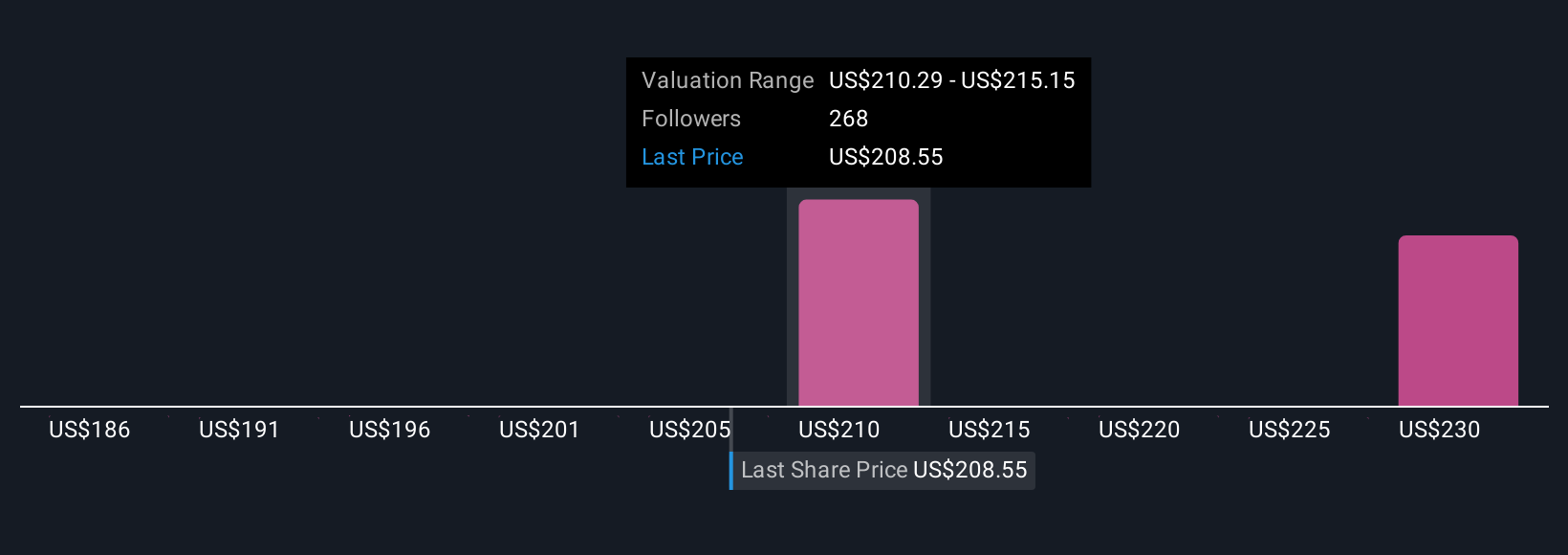

Uncover how Palo Alto Networks' forecasts yield a $213.99 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Eighteen Simply Wall St Community members estimated fair values between US$181 and US$240, suggesting wide-ranging views on Palo Alto Networks' market potential. Integration risk, especially from major acquisitions, remains top of mind and could affect whether these expectations are met, check out how other investors interpret the balance of AI-driven opportunity versus execution risk.

Explore 18 other fair value estimates on Palo Alto Networks - why the stock might be worth as much as 24% more than the current price!

Build Your Own Palo Alto Networks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Palo Alto Networks research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Palo Alto Networks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Palo Alto Networks' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PANW

Palo Alto Networks

Provides cybersecurity solutions the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.