- United States

- /

- Software

- /

- NasdaqGS:OTEX

Is There Now an Opportunity in Open Text After Recent Share Price Pullback in 2025?

Reviewed by Bailey Pemberton

- Wondering if Open Text is quietly trading below what it is really worth? This article will walk through the numbers behind the story so you can decide if it deserves a spot on your radar.

- Despite being up 18.9% year to date and 10.2% over the past year, the stock has pulled back around 12.0% over the last month and is roughly flat over the last week at $33.59. This can signal a shift in sentiment or a new entry point for patient investors.

- Recent headlines have focused on Open Text's ongoing push into cloud based information management and continued integration of past acquisitions, which aim to deepen its presence with large enterprise customers. At the same time, the broader software sector's rotations between risk on and risk off moods have added volatility that helps explain the recent share price swings.

- Right now, Open Text scores a 6/6 valuation check rating, suggesting it looks undervalued across all our standard metrics. Next we will unpack those valuation methods in detail while also hinting at a more powerful way to think about fair value that we will come back to at the end.

Approach 1: Open Text Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and then discounting those amounts back to today using a required rate of return. Put simply, it asks what all of Open Text's future cash generation is worth in dollars right now.

Open Text currently generates about $913.4 million in free cash flow. Based on a 2 Stage Free Cash Flow to Equity model, Simply Wall St uses analyst estimates for the next few years and then extrapolates further out, reaching projected free cash flows of around $1.57 billion in 2035. These future cash flows are then discounted back to the present to account for risk and the time value of money.

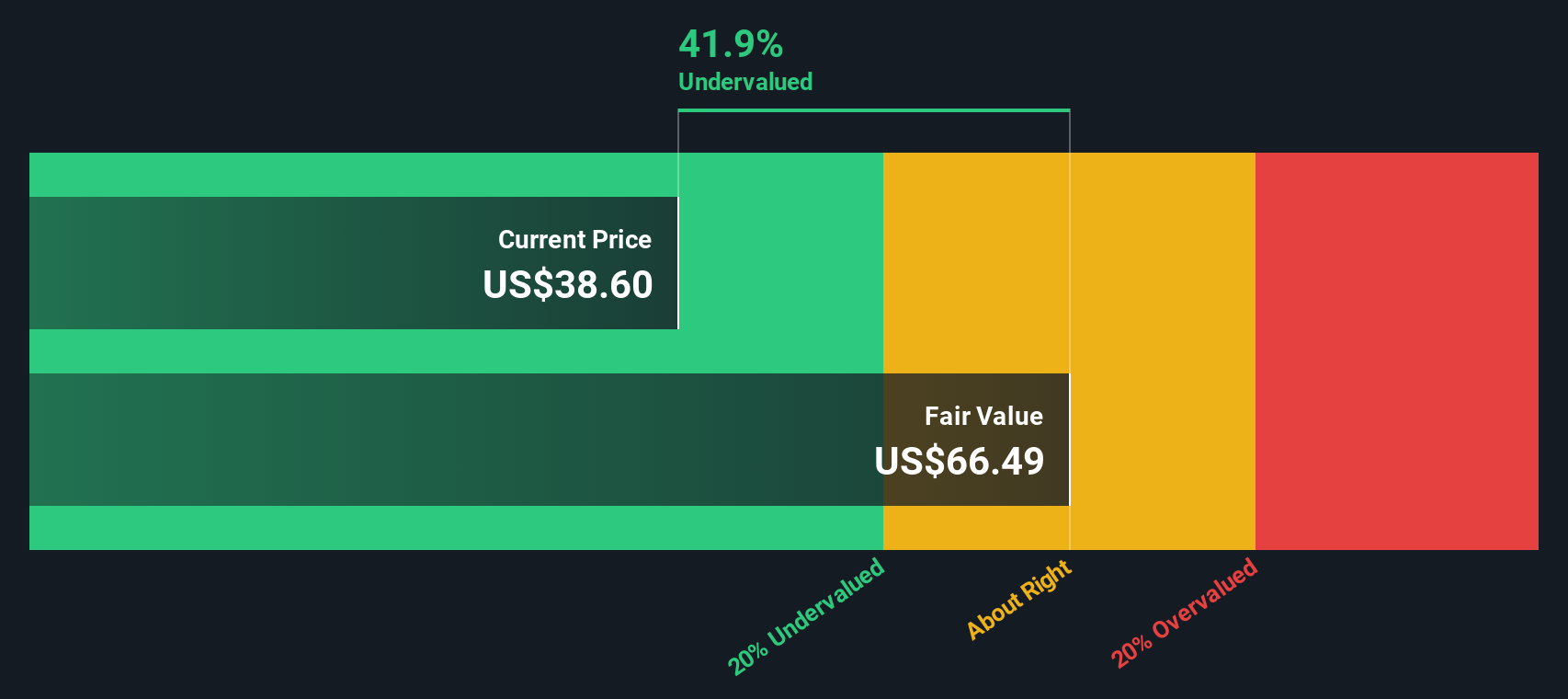

This process results in an estimated intrinsic value of roughly $68.21 per share versus the current price of about $33.59, implying the stock is around 50.8% undervalued on a DCF basis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Open Text is undervalued by 50.8%. Track this in your watchlist or portfolio, or discover 930 more undervalued stocks based on cash flows.

Approach 2: Open Text Price vs Earnings

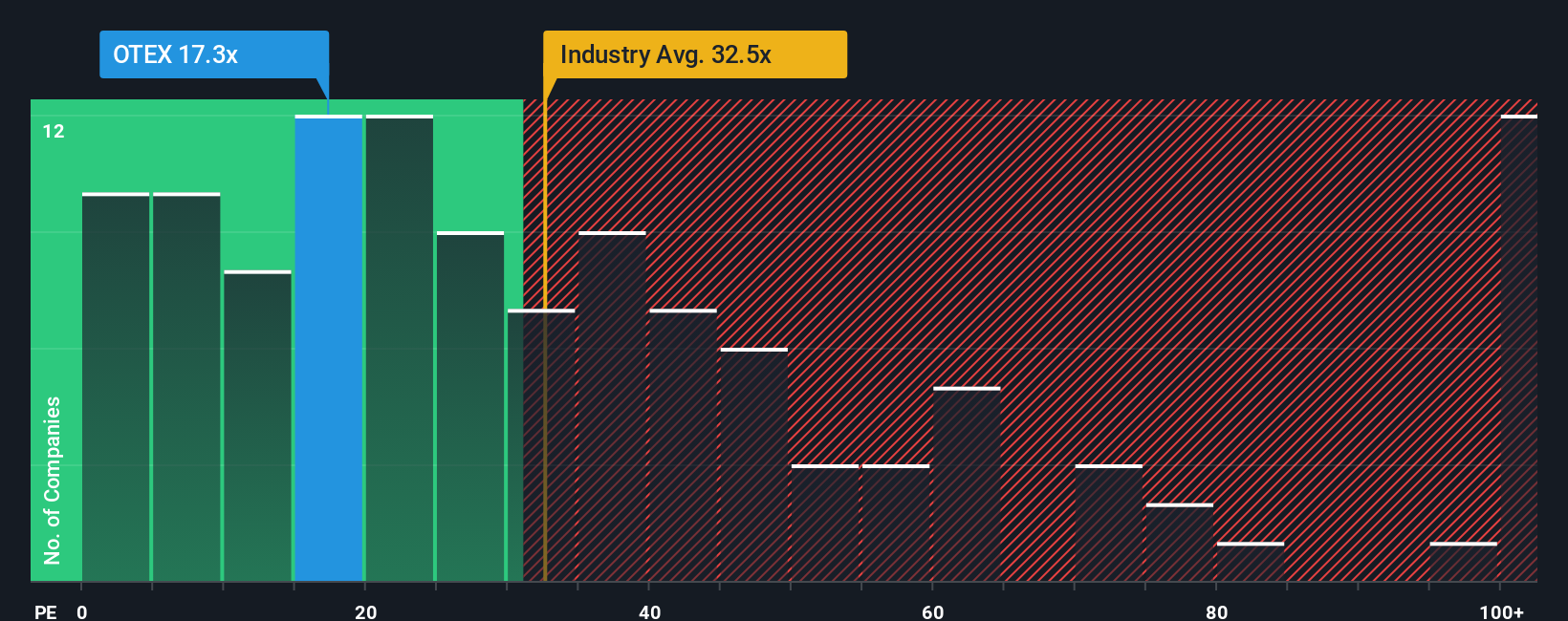

For consistently profitable companies like Open Text, the price to earnings, or PE, ratio is a useful yardstick because it links what investors pay for each share directly to the earnings that business is generating today.

In general, faster growing and lower risk companies deserve a higher PE, while slower growth or higher risk businesses tend to command lower multiples. So a fair or normal PE should reflect not just current profits, but also how durable and fast growing those profits are expected to be.

Open Text currently trades on a PE of about 16.7x, which is well below the Software industry average of roughly 32.0x and also below the broader peer group average of around 34.9x. Simply Wall St’s proprietary Fair Ratio for Open Text is 33.3x, which is the PE the company might reasonably trade at once its earnings growth prospects, margins, industry, size and specific risks are all factored in.

Because the Fair Ratio builds in these company specific drivers, it provides a more tailored benchmark than simple peer or industry comparisons. Lining up 16.7x against a Fair Ratio of 33.3x suggests Open Text is trading at a meaningful discount on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

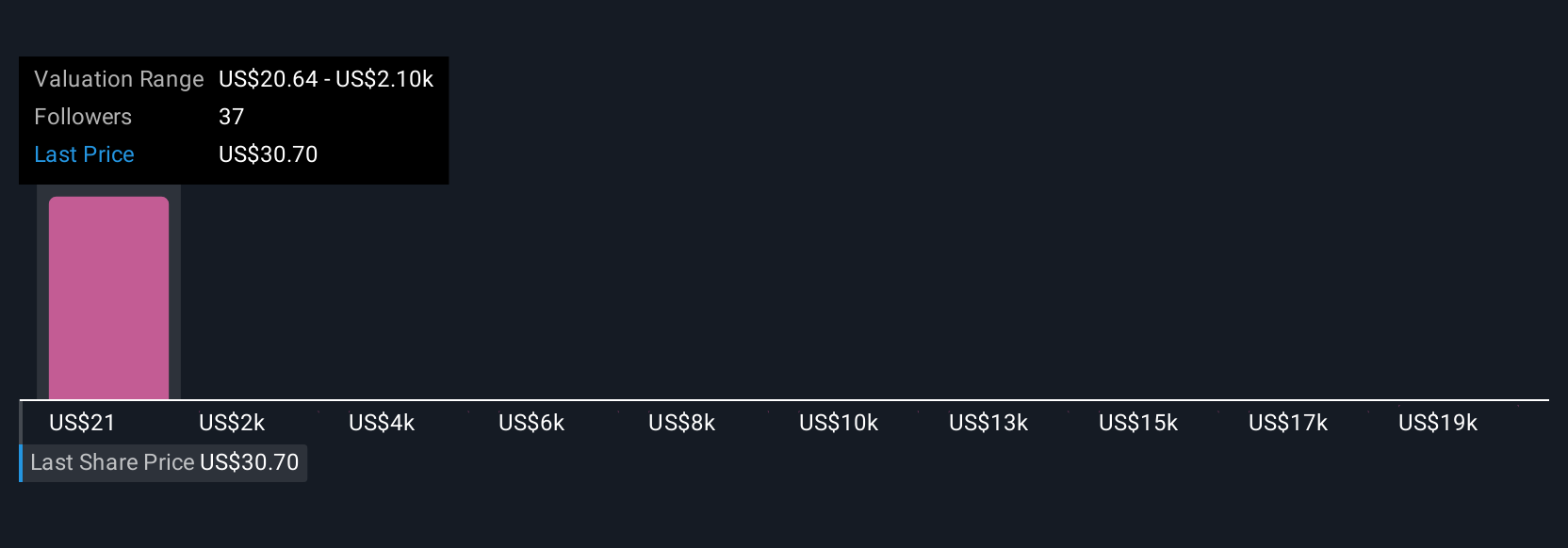

Upgrade Your Decision Making: Choose your Open Text Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you connect your view of Open Text’s story to a financial forecast and a fair value. You can then compare that fair value to the current price to help decide whether to buy or sell, with the numbers automatically updating as new news or earnings arrive. For example, one investor might build a bullish Open Text Narrative around accelerating AI adoption, rising margins and a fair value closer to the most optimistic analyst target of around 48 dollars. Another could create a more cautious Narrative that assumes slower cloud growth, execution risks and a fair value nearer the most conservative target of about 31 dollars. This gives you an accessible, evolving framework to express your own view rather than simply accepting a single static price target.

Do you think there's more to the story for Open Text? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OTEX

Open Text

Designs, develops, markets, and sells information management software and solutions in North, Central, and South America, Europe, the Middle East, Africa, Australia, Japan, Singapore, India, and China.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026