- United States

- /

- IT

- /

- NasdaqGS:OKTA

Okta (OKTA): Assessing Valuation After Recent Share Price Drift

Reviewed by Simply Wall St

See our latest analysis for Okta.

Zooming out, Okta’s share price has notched an 8.9% gain year-to-date. Some momentum earlier in 2024 is now fading as recent losses weigh on sentiment. However, its 11.3% total shareholder return over the past year still points to longer-term resilience, even as investors weigh valuation against growth potential.

If you’re searching for what else the market is rewarding right now, this could be the perfect moment to discover fast growing stocks with high insider ownership

With Okta trading well below analyst price targets, but after a period of mixed performance, the key question is whether an attractive entry point has emerged or if the market is fairly factoring in future prospects.

Most Popular Narrative: 28.7% Undervalued

Based on the most widely tracked narrative, Okta’s fair value is set at $120.37, which is significantly higher than the last closing price of $85.87. This difference highlights what many see as a sizable disconnect between the company’s future prospects and how the market currently prices it.

The proliferation of AI agents and nonhuman identities is creating new, urgent security use cases that require sophisticated identity governance, privileged access management, and policy controls. Okta is innovating in these areas, including Cross App Access, Auth0 for AI Agents, and the Axiom acquisition. These initiatives are opening incremental growth avenues and potential margin expansion through higher value and differentiated products.

Want to know what’s fueling that bold price target? Explore the narrative’s details, including future margins, aggressive profit forecasts, and the growth assumptions that could redefine Okta’s market strategy. Discover the financial reasoning the market may be overlooking.

Result: Fair Value of $120.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as intensifying competition or new integration challenges could quickly change Okta's outlook and put pressure on its long-term growth narrative.

Find out about the key risks to this Okta narrative.

Another View: How Do the Numbers Stack Up?

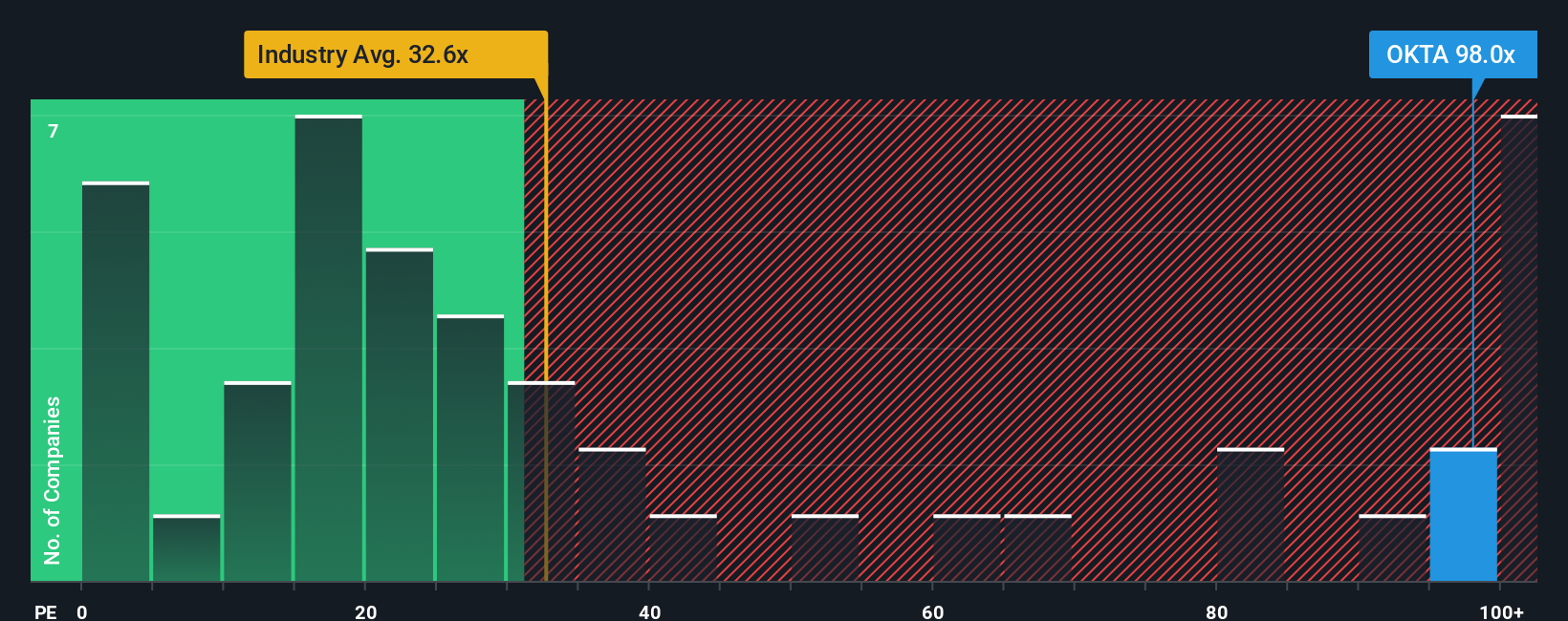

Okta is currently trading at a price-to-earnings ratio of 90.1x, which is well above both the industry average of 31.2x and its estimated fair ratio of 40.9x. This suggests the stock is priced at a significant premium, raising questions about whether market optimism outweighs potential valuation risks. Could this gap narrow, or does it signal caution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Okta Narrative

If you have different insights or want to dig into the data yourself, creating your own perspective is fast and easy. It only takes a few minutes to get started. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Okta.

Looking for More Investment Ideas?

Smart investors stay curious, and the Simply Wall St Screener helps you spot unique opportunities you might otherwise miss. See what the market is rewarding next.

- Target steady income by checking out these 17 dividend stocks with yields > 3%, which offers attractive yields above 3 percent and proven financial strength.

- Power up your portfolio with the innovators transforming healthcare through artificial intelligence by reviewing these 32 healthcare AI stocks.

- Catch the next wave of undervalued potential by tracking stocks flagged as bargains based on their future cash flows with these 860 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OKTA

Okta

Operates as an identity partner in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives