- United States

- /

- Insurance

- /

- NasdaqGM:YB

US Market's 3 Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As the United States market navigates a risk-off sentiment with major indices like the Dow Jones, S&P 500, and Nasdaq experiencing declines at the start of December, investors are increasingly cautious about big tech and cryptocurrency-tied shares. In such an environment, small-cap stocks often present intriguing opportunities for those looking to uncover potential growth stories that might be overlooked amidst broader market volatility. Identifying these undiscovered gems requires a keen eye for companies with solid fundamentals and unique positioning in their respective industries.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Yuanbao (YB)

Simply Wall St Value Rating: ★★★★★★

Overview: Yuanbao Inc. operates as an online insurance distribution and service provider in the People’s Republic of China, with a market capitalization of approximately $949.71 million.

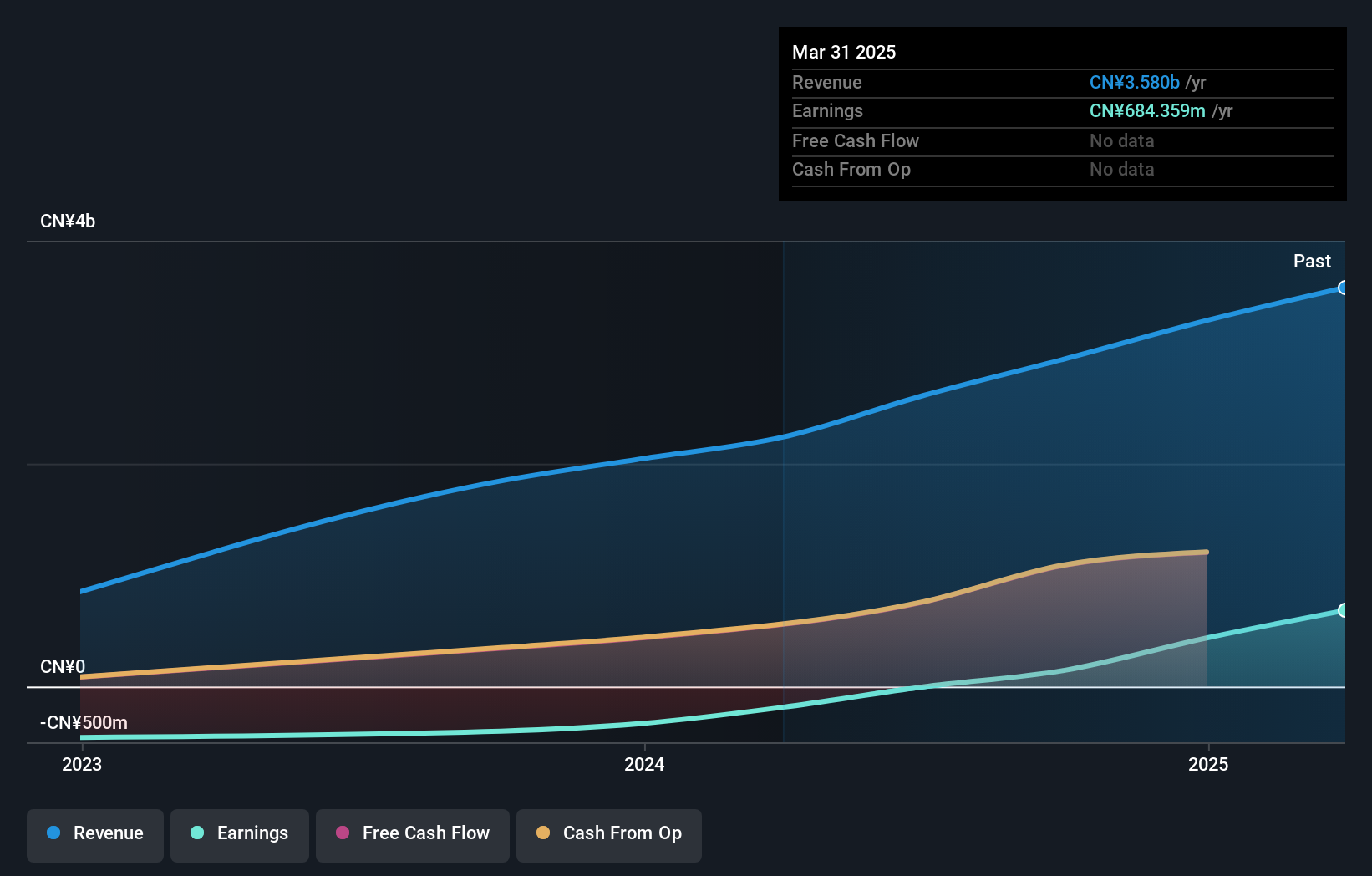

Operations: Yuanbao generates revenue primarily from its insurance broker segment, which reported CN¥3.80 billion. The company's net profit margin has shown notable fluctuations over recent periods.

Yuanbao, a nimble player in the market, has emerged as a debt-free entity with high-quality earnings. Trading at 78.4% below its estimated fair value, it presents an intriguing opportunity for investors seeking undervalued stocks. Over the past year, Yuanbao's levered free cash flow surged to US$1.2 billion by December 2024 from US$85 million in December 2022, showcasing significant financial improvement. Despite becoming profitable recently and outpacing industry growth rates of 10.3%, there remains insufficient data on its cash runway sustainability if free cash flow trends continue as they have historically.

- Click to explore a detailed breakdown of our findings in Yuanbao's health report.

Assess Yuanbao's past performance with our detailed historical performance reports.

Magic Software Enterprises (MGIC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Magic Software Enterprises Ltd. is a global provider of proprietary application development, vertical software solutions, business process integration, IT outsourcing services, and cloud-based services with a market cap of approximately $1.20 billion.

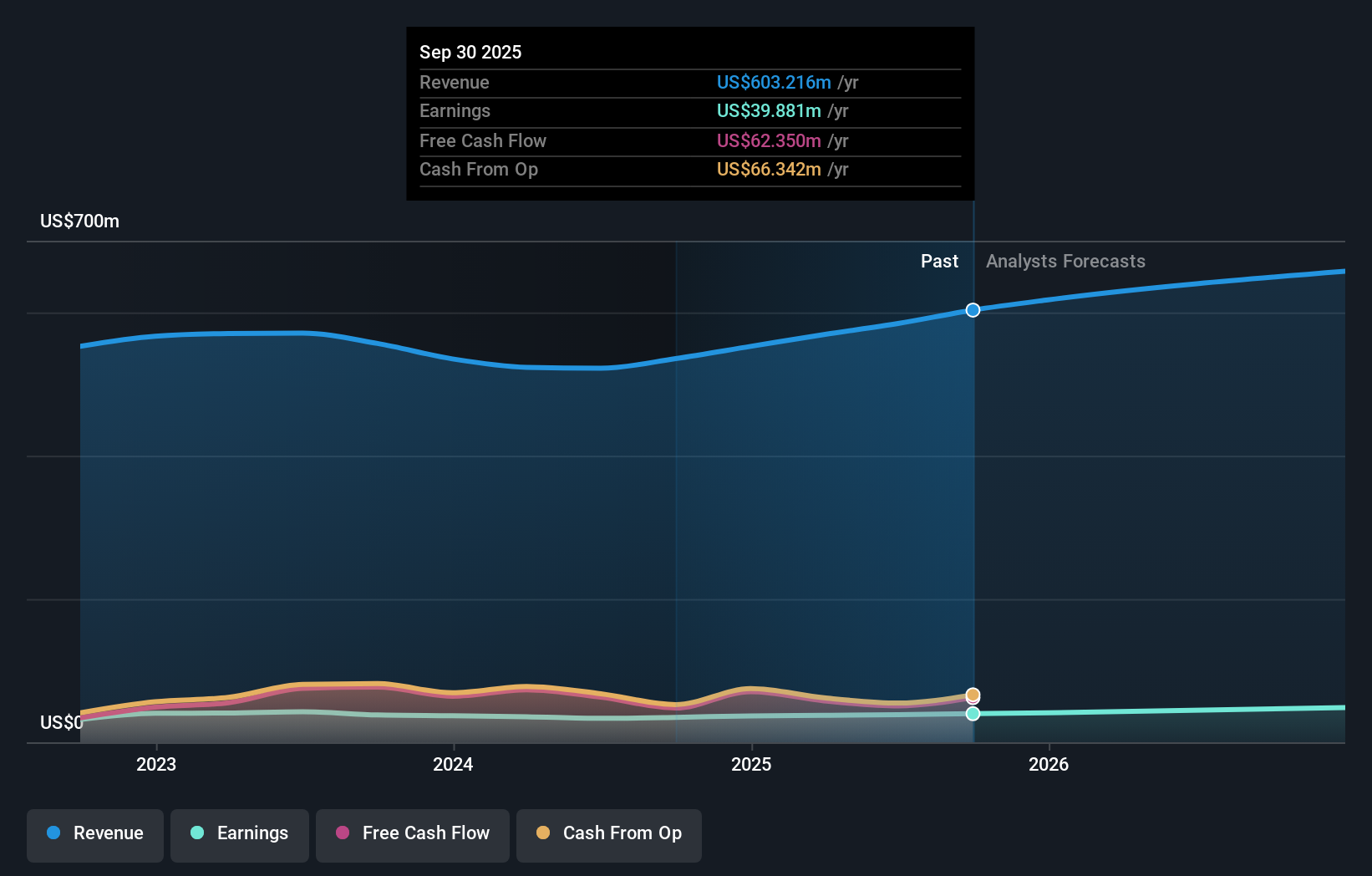

Operations: Magic Software generates revenue primarily through its proprietary software solutions and IT outsourcing services. The company has a market cap of approximately $1.20 billion.

Magic Software Enterprises is navigating the tech landscape with a focus on cloud and AI services, showing promising growth potential. Over the past five years, earnings have grown at a steady 10.4% annually, while recent figures reveal net income for Q3 2025 at US$9.86 million compared to last year's US$8.43 million. The company boasts a price-to-earnings ratio of 30.1x, slightly below the industry average of 32x, indicating room for valuation adjustment as it expands its offerings and integrates strategic mergers like that with Matrix. With EBIT covering interest payments 22.8 times over, financial stability seems robust amidst expansion efforts.

Exzeo Group (XZO)

Simply Wall St Value Rating: ★★★★★★

Overview: Exzeo Group, Inc. offers comprehensive insurance technology and operational solutions to carriers and agents, with a market capitalization of approximately $1.71 billion.

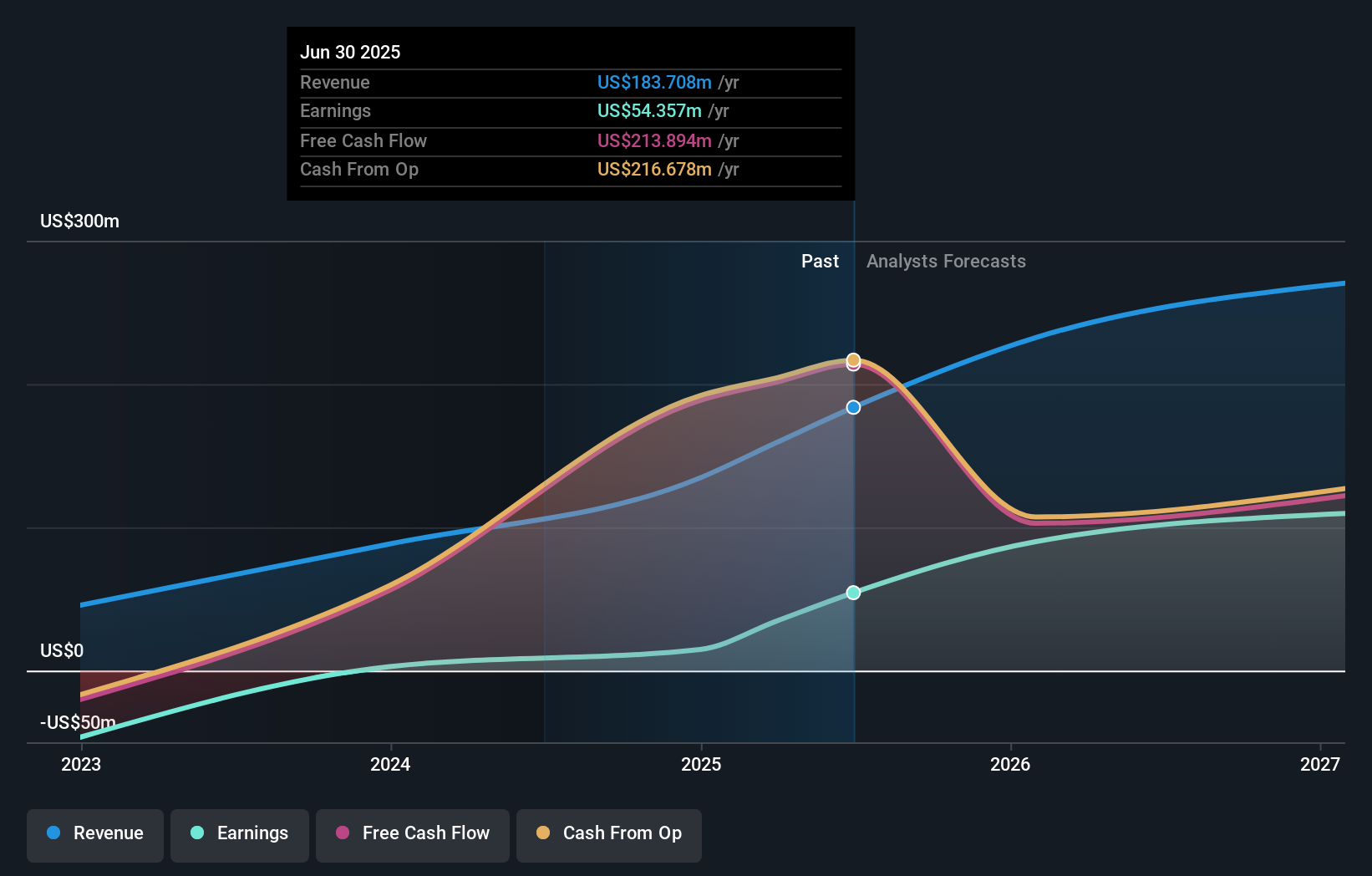

Operations: Exzeo Group generates revenue primarily from its insurance - property and casualty segment, totaling $183.71 million.

Exzeo Group, a promising player in the software industry, recently completed an IPO raising US$168 million with shares priced at US$21 each. Despite its illiquid shares, Exzeo boasts impressive earnings growth of 521.9% over the past year, significantly outpacing the industry average of 19%. The company is debt-free now compared to five years ago when its debt to equity ratio was 94.2%, indicating strong financial health. Trading at 15.5% below estimated fair value adds to its appeal as a potential investment opportunity with high-quality earnings and positive free cash flow enhancing its profile further.

- Unlock comprehensive insights into our analysis of Exzeo Group stock in this health report.

Examine Exzeo Group's past performance report to understand how it has performed in the past.

Key Takeaways

- Unlock more gems! Our US Undiscovered Gems With Strong Fundamentals screener has unearthed 295 more companies for you to explore.Click here to unveil our expertly curated list of 298 US Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:YB

Yuanbao

Through its subsidiaries, provides online insurance distribution and services in the People’s Republic of China.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Google Maps" of Cancer Biology – Data is the Moat

The "Rare Disease Monopoly" – Commercial Execution Play

The "Landlord of Orbit" – A Deep Value Play Ahead of the Starlab Era

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026