- United States

- /

- Software

- /

- NasdaqCM:MARA

Is Marathon Digital’s Recent Pullback a Sign of Value After Blockchain Partnership News?

Reviewed by Bailey Pemberton

- Ever wondered if MARA Holdings is actually worth its current price, or if there is untapped value waiting beneath the surface?

- Despite a recent dip with a 6.5% decline over the last week and 2.9% for the month, MARA Holdings has delivered a strong 13.4% return over the past year and an eye-catching 658.1% in five years. These kinds of moves often prompt a closer look.

- This latest volatility has investors talking, as it was triggered by industry-wide shifts in digital asset sentiment and the company's recent strategic moves into new blockchain partnerships. News of institutional interest and ongoing regulatory developments have also added to the buzz around MARA Holdings's long-term prospects.

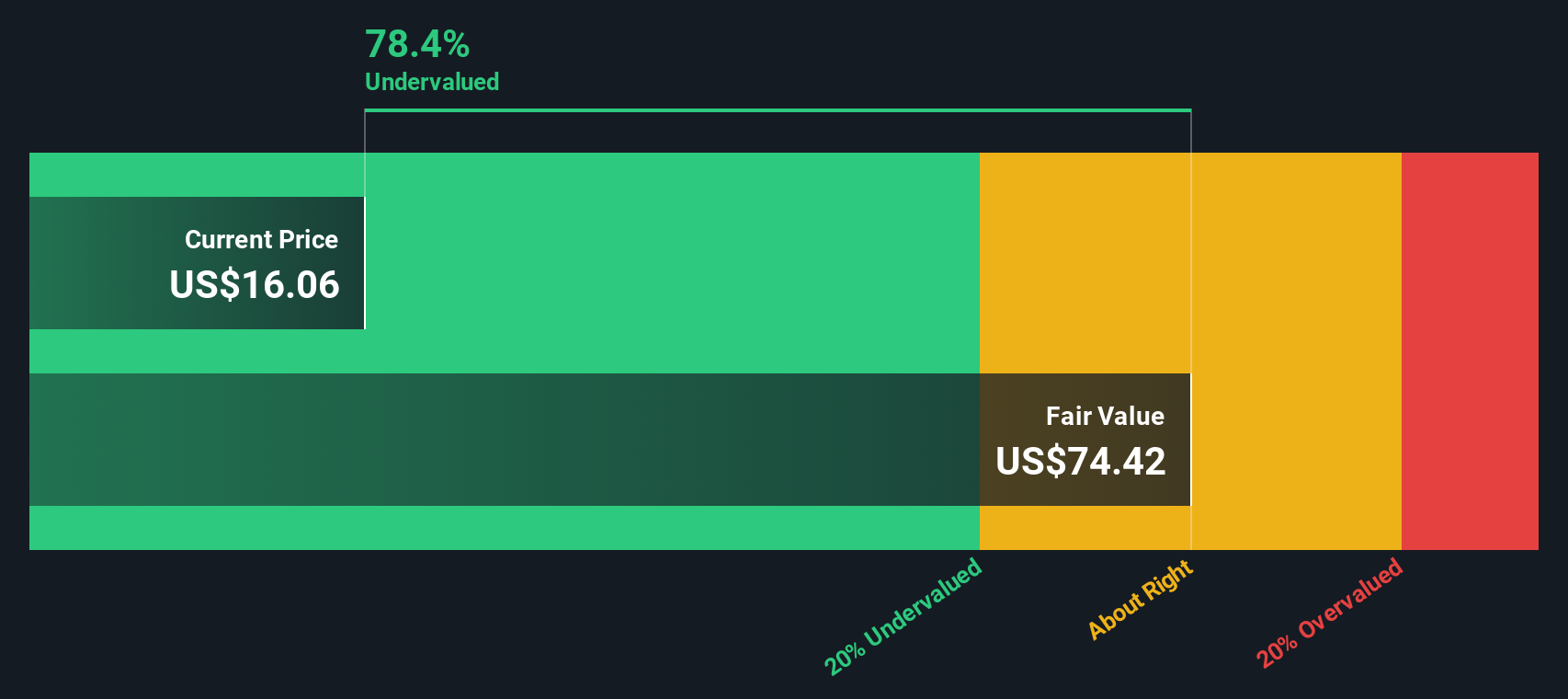

- According to our valuation checks, MARA Holdings scores a 4 out of 6 for being undervalued. This suggests there may still be value left on the table. Let's break down how MARA Holdings measures up against classic valuation methods, and hint at a smarter way to spot value that will be revealed at the end of the article.

Find out why MARA Holdings's 13.4% return over the last year is lagging behind its peers.

Approach 1: MARA Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and discounting them back to today's value. For MARA Holdings, this analysis relies on projected Free Cash Flow (FCF) in dollars, factoring in both near-term analyst forecasts and longer-term extrapolations.

Currently, MARA Holdings posted a last twelve months Free Cash Flow of -$1,706.72 Million, reflecting recent challenges. However, expectations are for a significant turnaround, with analysts forecasting positive cash flows as early as 2026 at $146.5 Million and further increasing to $890.29 Million by 2035. Projections over the coming decade shift from modest growth to steeper climbs, with the ten-year outlook using both analyst expectations and estimated growth rates from Simply Wall St.

Based on these cash flow projections, the DCF model calculates an estimated intrinsic value of $23.73 per share for MARA Holdings. Its current market price implies a 23.0% discount to intrinsic value, suggesting the stock is undervalued according to the DCF.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MARA Holdings is undervalued by 23.0%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

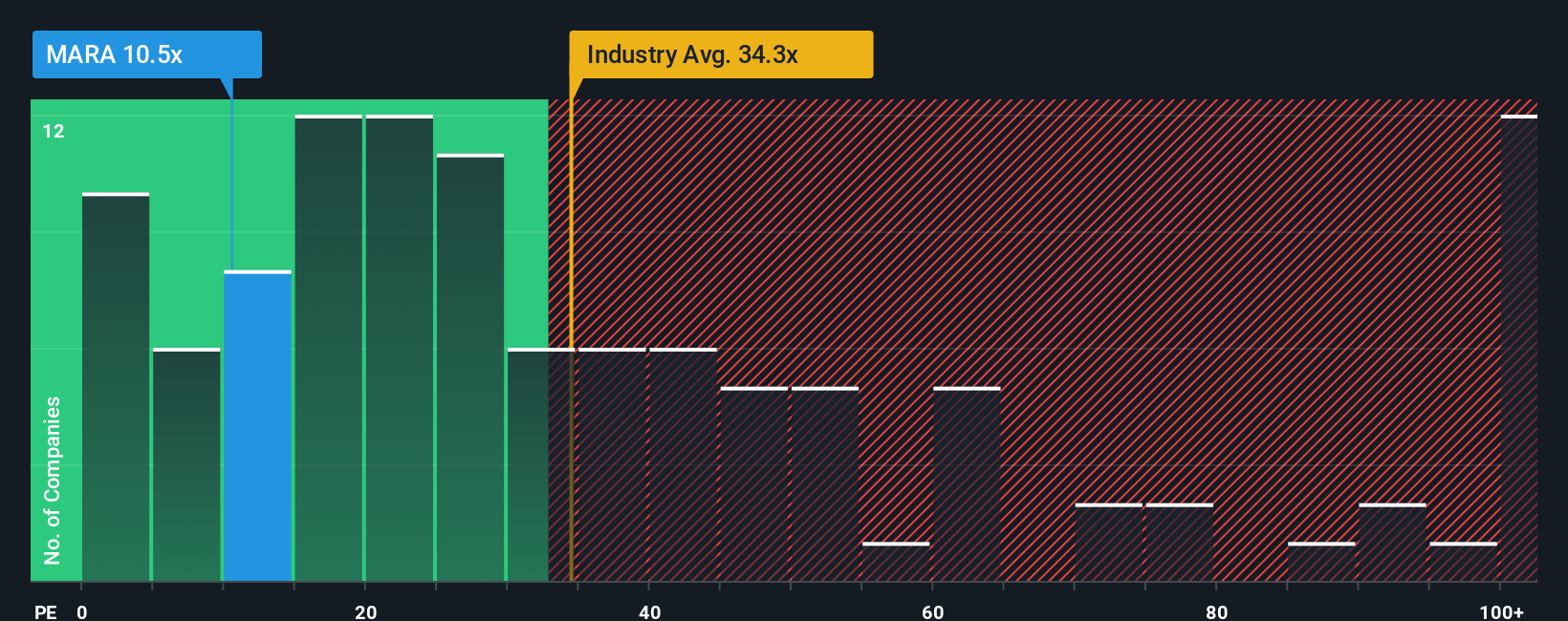

Approach 2: MARA Holdings Price vs Earnings

For companies that are generating consistent profits, the Price-to-Earnings (PE) ratio is one of the most popular valuation tools. It provides a quick view of how much investors are willing to pay for each dollar of earnings, making it especially useful for comparing profitable businesses like MARA Holdings.

What constitutes a “normal” or “fair” PE ratio, however, depends on several factors, including expectations for future growth, overall risk, and the company’s ability to sustain or expand its earnings. A high-growth, low-risk company typically commands a higher PE multiple, while slower growers or riskier firms deserve a lower one.

MARA Holdings currently trades at a PE ratio of 10.0x, which is notably lower than the Software industry average of 34.9x and well below the average of its peers at 56.7x. On the surface, this might suggest that the stock is trading at a steep discount compared to the broader sector.

However, instead of solely comparing to industry or peer averages, Simply Wall St calculates a “Fair Ratio” for each stock. This proprietary metric considers not just the industry backdrop, but also MARA Holdings’s unique combination of growth forecasts, profit margins, risk profile, and market capitalization. By weighing all these factors, the Fair Ratio provides a targeted benchmark of what would truly be a reasonable multiple for the company, offering a more holistic, company-specific perspective than basic comparisons.

For MARA Holdings, the Fair Ratio is 3.6x, meaning the market is currently pricing its earnings higher than what would be justified by its fundamentals. This suggests the share price may be ahead of itself at present levels.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1414 companies where insiders are betting big on explosive growth.

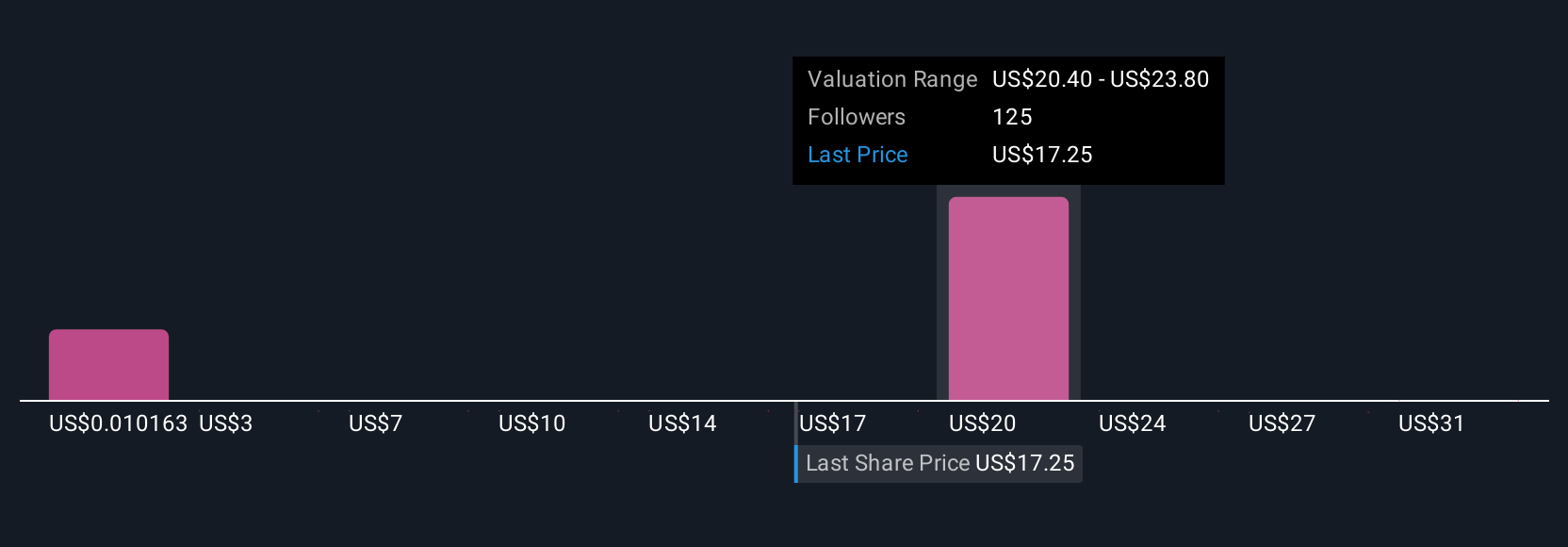

Upgrade Your Decision Making: Choose your MARA Holdings Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. In simple terms, a Narrative is your story or perspective on a company that goes beyond the numbers. It is where you connect your beliefs about MARA Holdings's future (such as its revenue growth, profit margins, and risks) to a financial forecast, which then leads to your own fair value estimate.

Unlike traditional models, Narratives empower you to explain the “why” behind the numbers you choose, making your investment thesis transparent and tailored to your view. On Simply Wall St’s Community page, used by millions of investors, Narratives are an easy and accessible tool that help you decide when to buy or sell by dynamically comparing your Fair Value to the latest market Price.

In addition, Narratives automatically update when new news or earnings are released, so your investment thesis adapts as conditions change. For example, with MARA Holdings, one investor might build a Narrative around rapid global expansion and forecast a bullish $28 price target, while another may focus on volatile bitcoin margins and assign a more cautious $18 target. Each Narrative transparently shows the story and data behind these differing outlooks.

Do you think there's more to the story for MARA Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MARA

MARA Holdings

Operates as a digital asset technology company in the United States and Europe.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives