- United States

- /

- IT

- /

- NasdaqGS:KC

Why Kingsoft Cloud (KC) Is Up 37.6% After Nvidia CEO Meeting and US Chip Export Relaxation and What's Next

Reviewed by Simply Wall St

- The recent relaxation of US chip export controls to China and reports of Nvidia's CEO meeting with Kingsoft Cloud's Chairman have spotlighted new opportunities in the Chinese cloud computing sector.

- This meeting hints at possible collaborations and could enhance Kingsoft Cloud's access to advanced Nvidia AI chips, supporting further innovation.

- We'll examine how expanded access to Nvidia hardware may influence Kingsoft Cloud's investment narrative and AI-driven growth outlook.

Kingsoft Cloud Holdings Investment Narrative Recap

To be a shareholder in Kingsoft Cloud, you need confidence in the long-term potential of China's AI and cloud computing market and the company's ability to innovate and execute. The recent US relaxation of chip export controls and Nvidia's CEO meeting with Kingsoft Cloud's Chairman is significant for AI-related growth, but access to advanced chips alone does not resolve the ongoing challenge of sustaining profitability, which remains the biggest short-term risk to the business.

Among Kingsoft Cloud's recent announcements, the June equity offering stands out. By raising approximately HK$404.46 million, the company has strengthened its funding base, which could support expanded AI infrastructure investment, an area directly tied to its growth catalysts and amplified by improved access to Nvidia chips.

However, it is just as important for investors to remember that, despite new opportunities, supply-demand imbalances for AI hardware could still pose...

Read the full narrative on Kingsoft Cloud Holdings (it's free!)

Kingsoft Cloud Holdings' outlook forecasts CN¥13.2 billion in revenue and CN¥418.6 million in earnings by 2028. This is based on expected annual revenue growth of 19.3% and an earnings improvement of CN¥2.4 billion from the current earnings of CN¥-2.0 billion.

Exploring Other Perspectives

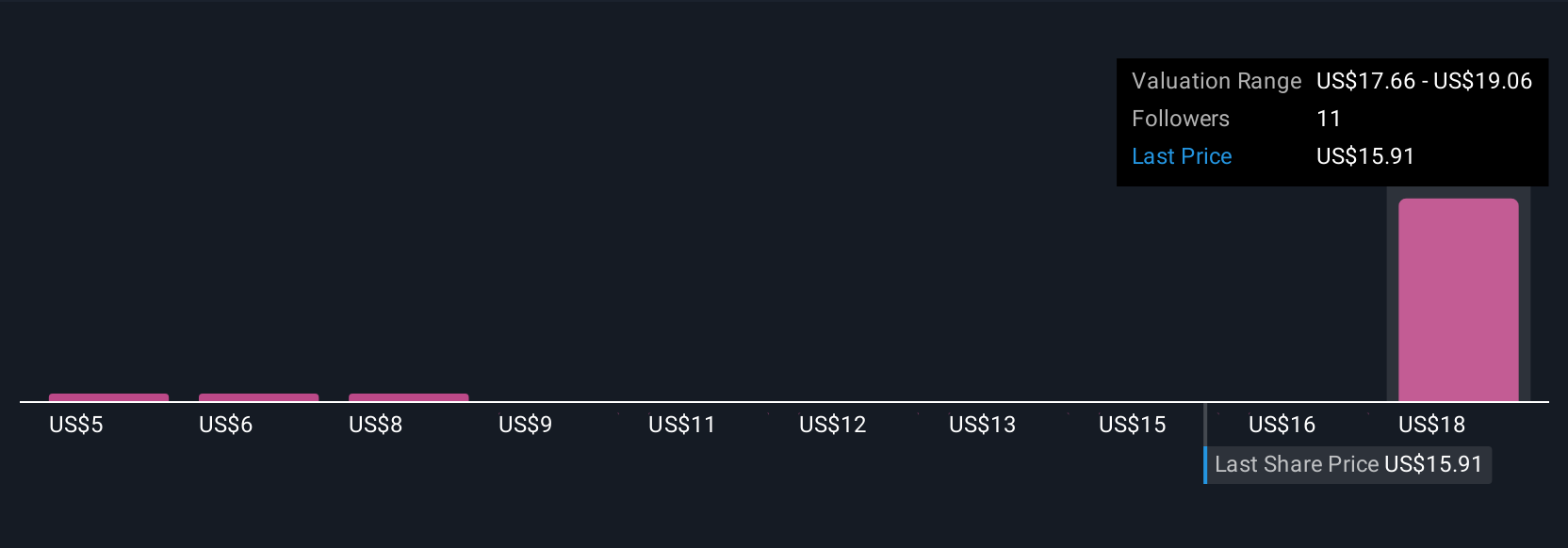

Simply Wall St Community members have offered fair value estimates on Kingsoft Cloud that span from CN¥5.05 to CN¥19.06, with five perspectives represented. While many see significant potential with ongoing AI partnerships, you should be aware that execution risk in this sector could have broader consequences for the company's future performance.

Build Your Own Kingsoft Cloud Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kingsoft Cloud Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Kingsoft Cloud Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kingsoft Cloud Holdings' overall financial health at a glance.

No Opportunity In Kingsoft Cloud Holdings?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingsoft Cloud Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KC

Kingsoft Cloud Holdings

Provides cloud services to businesses and organizations primarily in China.

Low with imperfect balance sheet.

Market Insights

Community Narratives