- United States

- /

- Software

- /

- NasdaqGS:HUT

Hut 8 (HUT) Surges in Q3 With Revenue and Net Income Growth Amid AI Infrastructure Push

Reviewed by Sasha Jovanovic

- Hut 8 Corp. recently reported third-quarter 2025 earnings, revealing a sharp year-over-year rise in revenue to US$83.51 million and a significant increase in net income to US$50.11 million.

- Ongoing development at the Corpus Christi and River Bend sites has attracted interest from AI and cloud firms, reflecting Hut 8's expanding role beyond Bitcoin mining.

- We'll explore how Hut 8's robust earnings growth and progress at key infrastructure sites shape its outlook within the current investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Hut 8 Investment Narrative Recap

To be a Hut 8 shareholder, you need to believe not only in the company's ability to drive recurring revenue from its power-first infrastructure model, but also in its long-term positioning as digital assets converge with AI and high-performance computing. The latest earnings reveal robust short-term growth, yet key risks, like heavy exposure to Bitcoin prices and ambitious infrastructure timelines, still weigh on the narrative; recent developments do not appear to materially change these near-term catalysts or challenges.

Among recent announcements, the planned buildout at the River Bend site stands out as particularly relevant, given its potential to scale energy capacity and diversify Hut 8's revenue base into cloud and AI partnerships. This expansion's success is closely linked to the company's efforts to reduce reliance on Bitcoin mining cycles, a fundamental point shaping future performance and investor confidence.

However, against strong earnings momentum, investors should watch for emerging headwinds around ...

Read the full narrative on Hut 8 (it's free!)

Hut 8 is projected to reach $767.3 million in revenue and $140.6 million in earnings by 2028. This outlook assumes a 76.9% annual revenue growth rate but anticipates a decrease in earnings of $13.4 million from the current $154.0 million.

Uncover how Hut 8's forecasts yield a $56.00 fair value, a 28% upside to its current price.

Exploring Other Perspectives

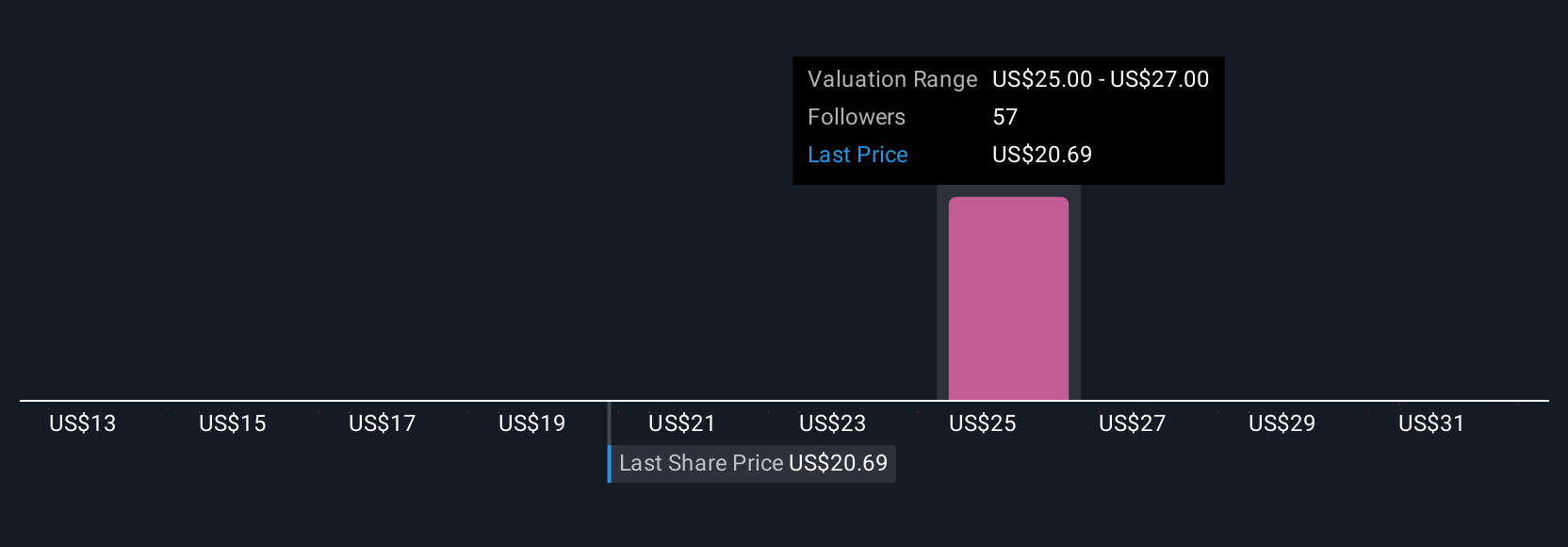

Private investors in the Simply Wall St Community have published six fair value estimates for Hut 8, ranging from US$13 to US$56 per share. These wide differences reflect competing views on whether Hut 8's revenue diversification beyond Bitcoin will prove resilient, underscoring why it is important to consider multiple perspectives before making any investment decisions.

Explore 6 other fair value estimates on Hut 8 - why the stock might be worth less than half the current price!

Build Your Own Hut 8 Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hut 8 research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Hut 8 research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hut 8's overall financial health at a glance.

No Opportunity In Hut 8?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hut 8 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HUT

Hut 8

Operates as a vertically integrated operator of energy infrastructure and Bitcoin miners in North America.

Slight risk with limited growth.

Similar Companies

Market Insights

Community Narratives