- United States

- /

- IT

- /

- NasdaqGM:GDS

Is GDS Holdings (NasdaqGM:GDS) Undervalued After Profitable Quarter and Revenue Growth?

Reviewed by Simply Wall St

GDS Holdings (NasdaqGM:GDS) released its third-quarter financial results, reporting a transition from net loss to net profit, along with higher revenue compared to last year. The company also reaffirmed its revenue guidance for 2025, signaling stability.

See our latest analysis for GDS Holdings.

Shares of GDS Holdings have caught investors' attention this year, with a 46.6% year-to-date share price return and a 71.6% total shareholder return over 12 months. The transition from loss to profit and confirmation of revenue guidance appear to be fueling that momentum, even as some short-term price swings persist. Over a longer horizon, however, the stock remains well below its five-year highs.

If you’re interested in finding other fast-moving names, now is a great time to broaden your horizons and discover fast growing stocks with high insider ownership

With strong analyst support and solid financial results driving recent gains, the key question for investors now is whether GDS Holdings remains undervalued or if the recent rally means that future growth is already reflected in the price.

Most Popular Narrative: 29.5% Undervalued

With the fair value set at $48.21, which is notably above the last close price of $33.97, the prevailing narrative sees meaningful upside potential for GDS Holdings if forecasts prove out. This view has gained traction as recent financial adjustments have slightly improved margin outlook and reduced net debt, setting the backdrop for what could be a pivotal period for the company.

The successful implementation of China's first data center ABS and C-REIT IPOs has pioneered a pathway for GDS to repeatedly recycle capital at cap rates (and multiples) well above the company's own market valuation. This allows the company to fund new growth while improving leverage and enhancing ROIC, supporting stronger net earnings over time.

Want to know how aggressive capital moves and inventive financing power this bullish price target? There’s a surprising financial engine, combining future margins, capital recycling, and big AI bets, just beneath the surface. Think you can guess the bold call on future profitability? Only the full narrative reveals the numbers that could rewrite GDS’s valuation story.

Result: Fair Value of $48.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing declines in average service revenue and persistent high leverage could quickly dampen the optimism around GDS Holdings' future profitability outlook.

Find out about the key risks to this GDS Holdings narrative.

Another View: High Valuation Signals Caution

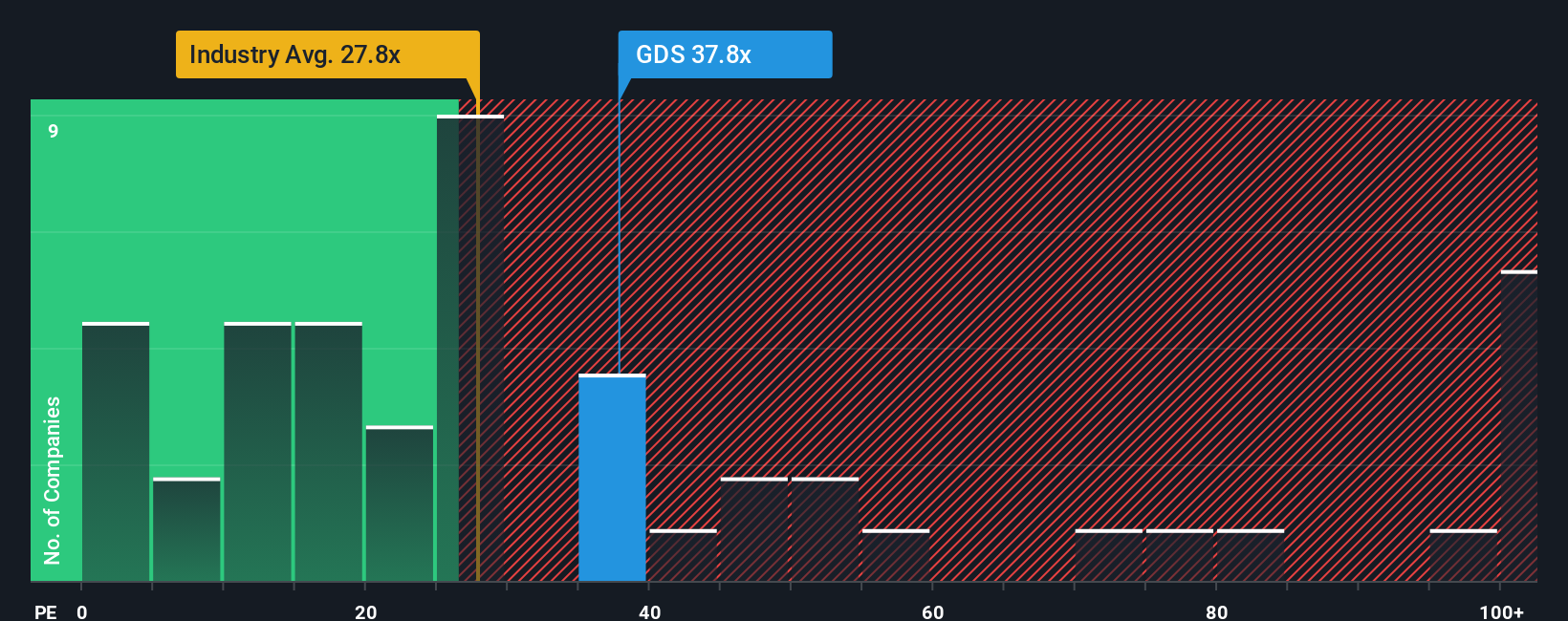

Looking at GDS Holdings through the lens of its price-to-earnings ratio, the stock appears much more expensive than both its peers and the wider US IT industry. GDS trades at 41.3x earnings, compared to the industry average of 28.1x and a fair ratio of 23.3x. This suggests a significant premium is reflected in the current price. That kind of gap often signals more risk if the company stumbles, but it could also imply investors expect more rapid growth or a surprise on profitability.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GDS Holdings Narrative

If you see the story differently or want to test your own perspective against the numbers, you can quickly build your own narrative and see how it compares. Do it your way

A great starting point for your GDS Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take charge of your portfolio by seeking out the next wave of standouts. The right opportunities could be just one smart move away, so don't let them pass you by.

- Uncover hidden bargain opportunities by checking out these 914 undervalued stocks based on cash flows with strong upside potential based on cash flow fundamentals and undervalued prices.

- Target reliable income growth when you browse these 15 dividend stocks with yields > 3% offering yields over 3% for investors who want consistent cash returns.

- Get ahead in the AI revolution and find innovation leaders using these 25 AI penny stocks that are reshaping technology and driving market excitement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GDS

GDS Holdings

Develops and operates data centers in the People's Republic of China.

Low risk with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026