- United States

- /

- Software

- /

- NasdaqGS:DDOG

How Investors Are Reacting To Datadog (DDOG) Analyst Optimism on AI-Native Customer Momentum

Reviewed by Sasha Jovanovic

- In the past week, Datadog received positive analyst attention, with several firms highlighting the company's strong outlook due to robust cloud consumption trends and a reduced risk profile from AI-native customers. Analysts also pointed to Datadog's AI-driven growth opportunities, signaling ongoing confidence in its positioning within the cloud observability and security market.

- A particularly important insight is that analysts are increasingly recognizing Datadog's expanding AI-native customer base as a key growth driver, which may be underappreciated in current market expectations.

- We'll examine how heightened analyst optimism around Datadog's AI-native customer momentum may influence its long-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Datadog Investment Narrative Recap

To invest confidently in Datadog, one needs conviction in the ongoing shift to cloud-based infrastructure and the company’s ability to innovate in observability and security for AI-driven applications. The recent wave of analyst optimism, fueled by robust cloud consumption trends and Datadog’s expanding AI-native customer base, reinforces its growth narrative but does not fundamentally alter the biggest near-term catalyst, enterprise adoption of AI workloads, or the lingering risk of revenue concentration in key customers.

Among recent company announcements, the release of the 2025 State of Cloud Security report stands out, spotlighting the urgent need for improved access controls and continuous verification across cloud environments. This directly ties into Datadog’s opportunity to address heightened security concerns as more organizations scale their cloud and AI deployments, which could bolster customer expansion and platform adoption.

In contrast, it’s worth noting that one key risk investors should be aware of is how concentrated revenue among large AI-native clients means...

Read the full narrative on Datadog (it's free!)

Datadog's outlook anticipates $5.2 billion in revenue and $406.8 million in earnings by 2028. This is based on an annual revenue growth rate of 19.9% and a $282.2 million increase in earnings from the current $124.6 million.

Uncover how Datadog's forecasts yield a $162.08 fair value, in line with its current price.

Exploring Other Perspectives

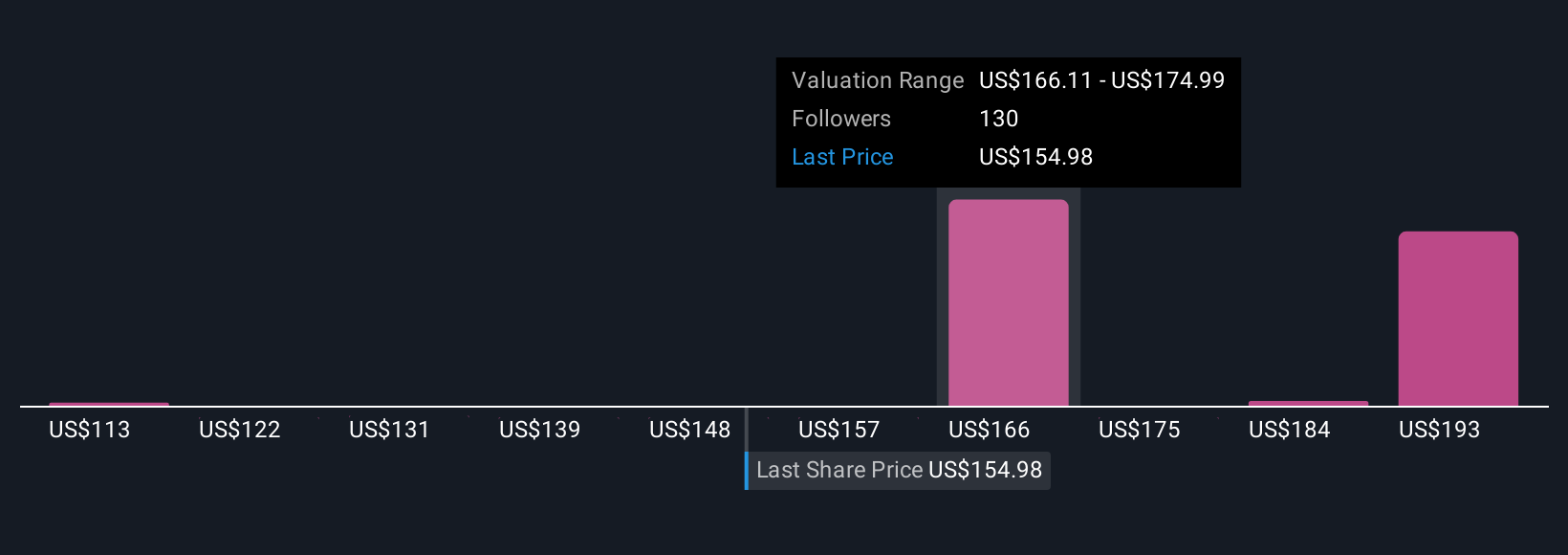

Simply Wall St Community members have estimated Datadog’s fair value anywhere from US$112.84 to US$190.35 based on 11 different models. While consensus sees robust demand driven by cloud and AI adoption, you can find a wide spectrum of opinions here reflecting diverse expectations for revenue growth and risk exposure.

Explore 11 other fair value estimates on Datadog - why the stock might be worth as much as 16% more than the current price!

Build Your Own Datadog Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Datadog research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Datadog research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Datadog's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DDOG

Datadog

Operates an observability and security platform for cloud applications in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026