- United States

- /

- Software

- /

- NasdaqGS:CVLT

Commvault Systems (CVLT): Assessing Valuation After Recent Share Price Weakness

Reviewed by Simply Wall St

Commvault Systems (CVLT) shares have been on investors' radars after a stretch of declining returns over the past few months. The company, known for its data management software, has seen its stock dip. This has raised questions about valuation and what might come next.

See our latest analysis for Commvault Systems.

Despite a tough stretch recently, Commvault Systems' 1-year total shareholder return is down 27.1%, reflecting fading momentum after several months of sharp declines. However, the long-term picture is much brighter, with a three-year total shareholder return of nearly 87.5% and an impressive 188% over five years. The recent price pullback suggests shifting risk perceptions or profit-taking following strong multi-year gains.

If you’re weighing next moves after these swings, now’s a great time to broaden your horizons and discover fast growing stocks with high insider ownership

With shares trading well below analyst price targets, but coming off such a strong long-term run, the key question is whether Commvault Systems is undervalued right now or if the market has already priced in its next phase of growth.

Most Popular Narrative: 41.7% Undervalued

Commvault Systems' narrative-implied fair value sits far above the last closing price, hinting at major upside if narrative assumptions play out. This valuation is built around the company’s momentum in cloud and data resilience solutions and strong analyst confidence.

Rapid expansion and successful cross-sell/upsell momentum within the SaaS (Metallic) platform, evidenced by 63% SaaS ARR growth, a 45% increase in multi-product customers, and 125% SaaS net dollar retention, point to continued improvement in the quality and predictability of future revenues. These factors directly support margin expansion and higher earnings visibility.

What’s really driving this bullish narrative? There is a powerful combination of high-margin recurring revenue, aggressive customer growth, and a profitability path usually reserved for the software elite. Ready to discover the surprising financial projections behind this valuation call? Click through—you might be shocked by the assumptions powering such a high fair value.

Result: Fair Value of $214.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on expanding existing subscriptions and the risk of margin compression following acquisitions could present challenges to Commvault's long-term growth outlook.

Find out about the key risks to this Commvault Systems narrative.

Another View: What Do Earnings Multiples Say?

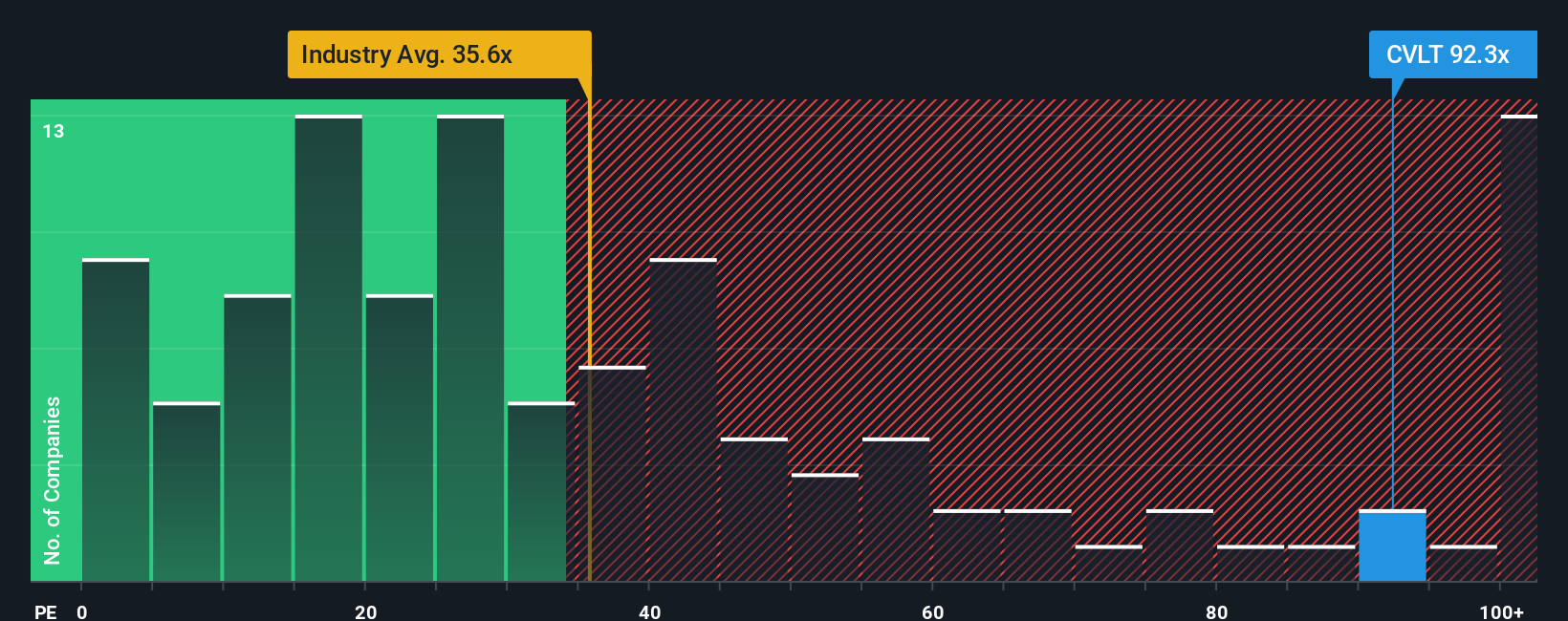

Looking through the lens of valuation ratios, Commvault Systems appears expensive. Its price-to-earnings ratio is 68.7x, which is almost double the US software industry average of 35.2x and far higher than its peer group at 24.6x. The fair ratio for Commvault, based on our analysis, would be around 34.2x, significantly below the current multiple. This suggests that, despite long-term optimism, there is valuation risk if market expectations reset. Could the premium be justified, or is a correction ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Commvault Systems Narrative

If you see the story differently, or want to dig into the data yourself, there's nothing stopping you from building your own perspective in under three minutes, and Do it your way.

A great starting point for your Commvault Systems research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know opportunity rarely waits. Use these powerful shortcuts to target your next big winner before everyone else is talking about them:

- Spot tomorrow’s tech leaders by checking out these 25 AI penny stocks, where AI-powered companies are transforming entire industries.

- Maximize income potential with these 17 dividend stocks with yields > 3%, focusing on robust stocks delivering attractive yields above 3%.

- Get ahead of the market by examining these 860 undervalued stocks based on cash flows, where reliable cash flows could point to underappreciated bargains hiding in plain sight.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVLT

Commvault Systems

Provides a cyber resilience platform for protecting and recovering data and cloud-native applications in the Americas and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives