- United States

- /

- IT

- /

- NasdaqGS:CRWV

Is CoreWeave’s Stock Drop a Growth Opportunity After Recent AI Partnerships?

Reviewed by Bailey Pemberton

- Wondering if CoreWeave is a hidden gem or just riding the AI hype train? You're not alone, and we're going to dig deep into what the numbers say about its current value.

- The stock's journey has been quite a ride, with shares soaring 186.1% year-to-date. However, there has been a -18.2% drop in the past week and a -14.5% decline in the last month.

- Much of this excitement is driven by recent headlines in the AI and cloud computing space as CoreWeave expands partnerships and attracts interest from major tech players. With speculation swirling about its role in powering cutting-edge applications, investor sentiment has been quick to react to both industry buzz and competitive announcements.

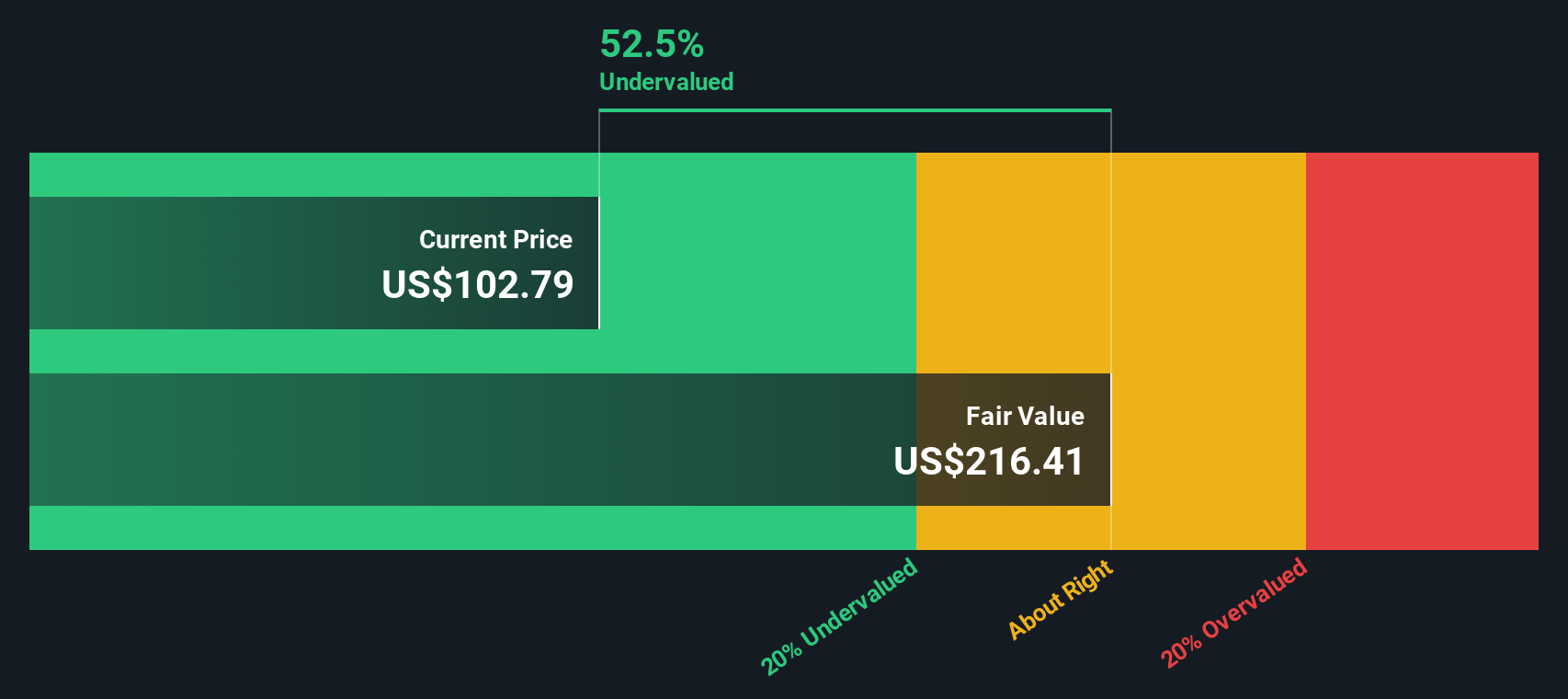

- When we put CoreWeave through our valuation checks, it scores a 4 out of 6 for undervaluation, which you can review in detail here. Let's break down what that really means, how typical valuation methods stack up for this fast-moving stock, and why you might want to wait until the end for a smarter way to look at value.

Approach 1: CoreWeave Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a stock’s intrinsic value by forecasting the company’s future cash flows and then discounting them back to today’s dollars. This approach attempts to answer one essential question: what is CoreWeave worth if you consider all the dollars it will make in the future, adjusted for time and risk?

Currently, CoreWeave’s latest twelve-month Free Cash Flow sits at negative $11.1 million, signaling significant cash burn as the company invests for rapid growth. Analyst forecasts show this figure improving markedly by 2029, expecting Free Cash Flow to swing positive to $5.66 million. Beyond that, extrapolation out to 2035 anticipates continued acceleration, with annual FCF reaching $27.91 million by the end of the projection window. Estimates past 2029 are based on extrapolations, not direct analyst forecast.

Based on this cash flow path and using a 2 Stage Free Cash Flow to Equity DCF model, CoreWeave’s estimated intrinsic value is $429.11 per share. This is 73.3% higher than the current market price, signaling the stock is substantially undervalued according to this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CoreWeave is undervalued by 73.3%. Track this in your watchlist or portfolio, or discover 835 more undervalued stocks based on cash flows.

Approach 2: CoreWeave Price vs Sales

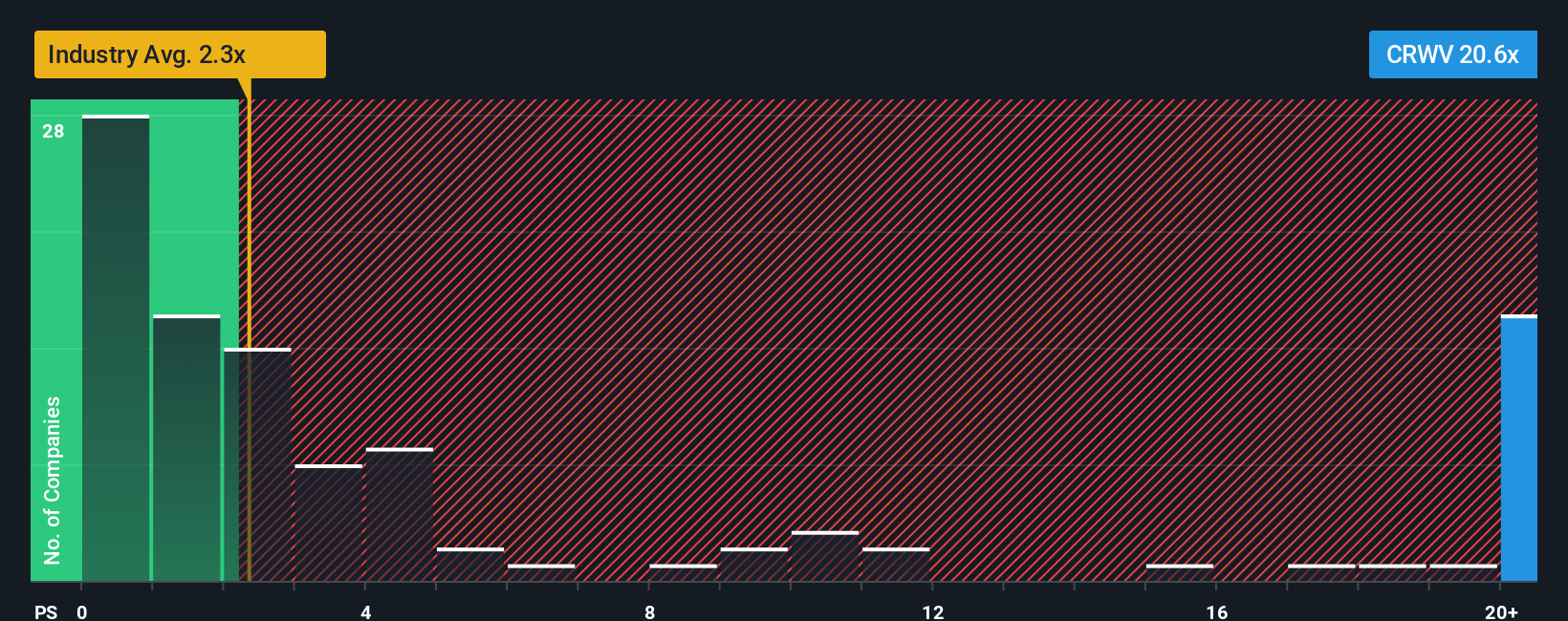

The Price-to-Sales (PS) ratio is a favored valuation tool for companies like CoreWeave that are in hyper-growth mode but not yet consistently profitable. It compares a company’s market capitalization to its annual sales, offering investors a clear view of how much they are paying for each dollar of revenue. This makes it especially relevant for high-growth technology firms that are reinvesting heavily rather than generating steady earnings.

Generally, a "normal" or fair PS ratio reflects both the company’s growth prospects and its risk profile. Fast-growing, innovative companies tend to command higher PS multiples, but that premium should only be paid when future revenue traction and scalable margins are likely, and company-specific risks are kept in check.

CoreWeave is currently trading at a PS ratio of 16.82x. This stands well above the IT industry average of 2.50x and the average among close peers, which is 22.08x. While these benchmarks provide helpful context, Simply Wall St offers a more tailored perspective through the proprietary Fair Ratio, which incorporates CoreWeave’s anticipated growth, risk factors, profit margin outlook, industry positioning, and market cap. For CoreWeave, the Fair Ratio is calculated at 49.41x.

The Fair Ratio is a more complete guide than traditional comparisons because it blends not just industry standards but also the unique characteristics and future trajectory of CoreWeave. With the current PS multiple well below this Fair Ratio, the data suggests the stock may actually be undervalued for its growth profile and potential, despite looking expensive relative to the broad industry.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CoreWeave Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. Simply put, a Narrative is your personal take on a company’s journey, connecting its story with real financial forecasts and a calculated fair value. Narratives let you blend numbers and assumptions, such as fair value and future growth estimates, with your perspective on what lies ahead, bringing context and meaning to the data.

On Simply Wall St’s Community page, millions of investors use Narratives to compare their own view of a stock’s outlook with others and see how their assumptions stack up. These Narratives help you decide when to buy, hold, or sell by making the link between your forecast and the current price crystal clear. The best part? They are automatically updated as fresh news or earnings arrive, ensuring your view always reflects the latest information.

For example, some CoreWeave investors see explosive future growth and assign a much higher fair value than peers who are cautious about competition and set more modest targets. Narratives help you understand these perspectives, refine your own, and invest more confidently in a way that matches your strategy.

Do you think there's more to the story for CoreWeave? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWV

CoreWeave

Operates a cloud platform that provides scaling, support, and acceleration for GenAI.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives