- United States

- /

- IT

- /

- NasdaqGS:CRWV

Is CoreWeave at a Turning Point After Major Venture Capital Investment and Price Swings?

Reviewed by Bailey Pemberton

- Thinking about whether CoreWeave is worth adding to your watchlist, or wondering if you're missing out on an opportunity? You're in the right place for a clear breakdown of where its value truly stands.

- CoreWeave's share price has seen high volatility lately, dropping 0.7% in the last week and an eye-catching 45.3% over the past month. It is still up a remarkable 82.8% year-to-date.

- Several major headlines have contributed to these price swings, including news of substantial venture capital investments and expanded partnerships with cloud infrastructure leaders. These developments have sparked both optimism and caution among investors, illustrating just how fast sentiment around CoreWeave can shift.

- When it comes to valuation, CoreWeave scores just 2 out of 6 on our undervaluation checks, so it's vital to look beyond surface numbers. Up next, we'll dive into the key approaches for valuing a stock like this. At the end, we'll introduce an even better way to spot real opportunities.

CoreWeave scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: CoreWeave Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) is a valuation method that estimates a company’s intrinsic value by projecting its future dividend payments and discounting them back to the present. For CoreWeave, this approach focuses on whether the company’s dividend track record and financial health can support growth in shareholder payouts over time.

According to the model, CoreWeave’s most recent annual dividend per share sits at $0.0078. However, the company’s return on equity is an exceptionally negative -87.97%, and its payout ratio is also negative at -7.45%. These indicators reflect a lack of earnings stability and signal that dividend sustainability is a significant concern. The calculated dividend growth rate is -94.5%, based on the company’s current earnings and payout situation. These negative growth projections suggest that, at least for now, CoreWeave’s dividend outlook is not only poor but also continuing to decline.

The DDM output places the stock’s intrinsic value at just $0.0075, which is far below its current market price. In fact, this approach suggests CoreWeave is 980039.6% overvalued relative to its fair value based on dividends alone.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests CoreWeave may be overvalued by 980039.6%. Discover 916 undervalued stocks or create your own screener to find better value opportunities.

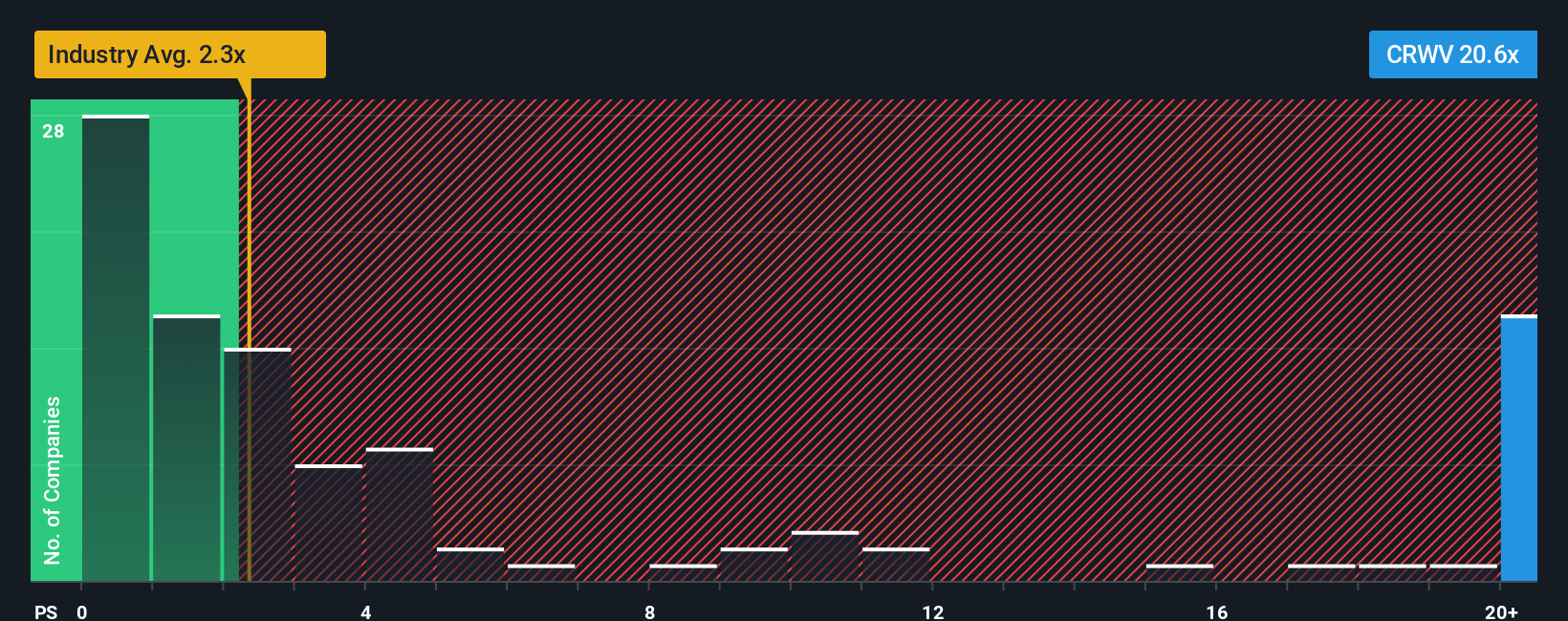

Approach 2: CoreWeave Price vs Sales

The Price-to-Sales (P/S) ratio is a widely used valuation metric, especially for companies in high-growth phases or those not yet generating profits. It compares a company’s market capitalization to its total sales, making it particularly suitable for evaluating technology businesses like CoreWeave that may be reinvesting earnings aggressively to fuel expansion rather than focusing on short-term profits.

Typically, investors expect a higher P/S ratio for companies with strong revenue growth prospects or unique competitive advantages. Higher risk or slowing growth tends to drag the normal range lower. Looking at CoreWeave, its current P/S ratio stands at 8.46x. This is quite a bit lower than the peer group average of 20.52x and the broader IT industry average of 2.68x.

Simply Wall St’s proprietary Fair Ratio incorporates not just peer and industry multiples but also factors in the company’s growth outlook, profit margins, scale, and any notable risks. This results in a more nuanced benchmark for valuation. For CoreWeave, the Fair Ratio is calculated at 26.82x, indicating where its P/S ratio should be given all these unique characteristics. Because this figure is well above the current multiple and comfortably clears the 0.10x threshold, the analysis suggests CoreWeave is undervalued on a sales basis.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CoreWeave Narrative

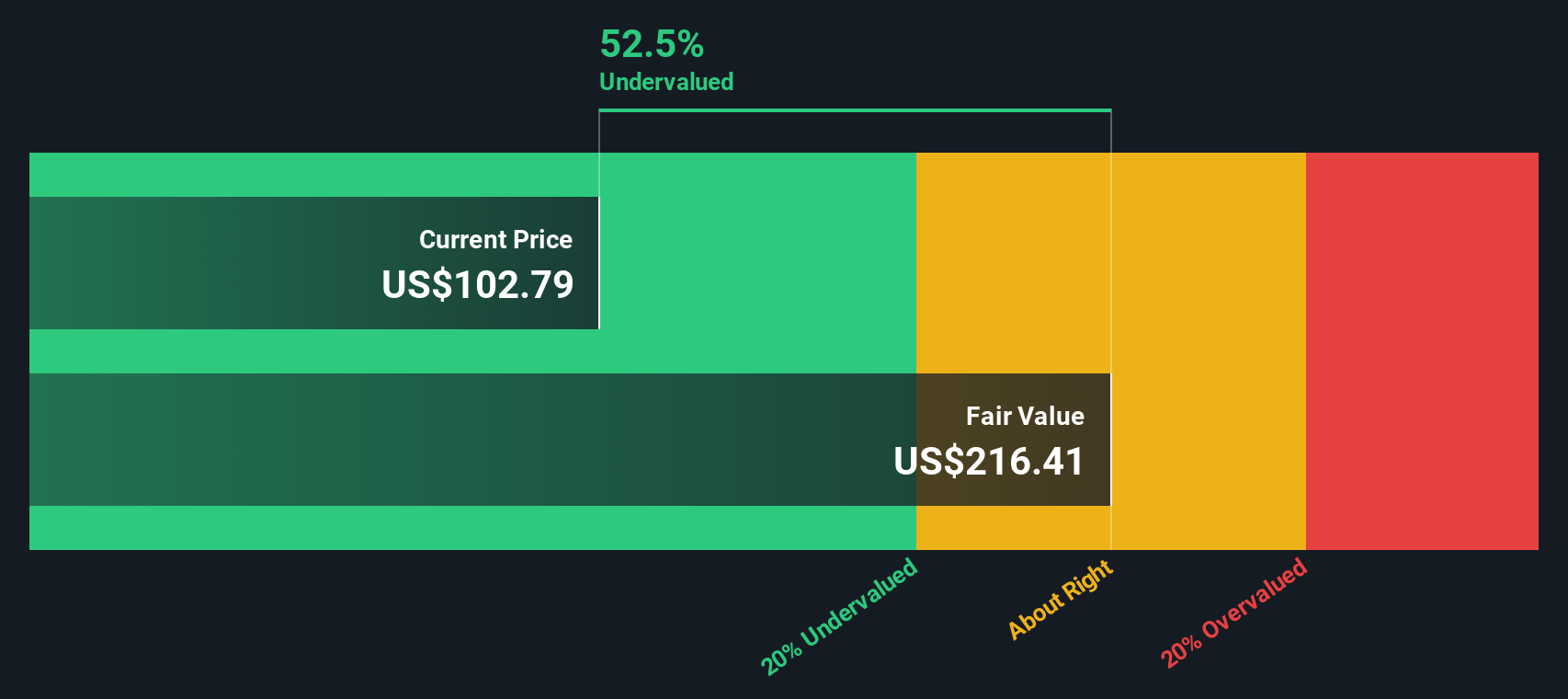

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is simply your story or perspective about a company, combining your assumptions about its future revenue, earnings, and margins to calculate your own fair value. Narratives help you connect what’s happening in the real world to financial forecasts and ultimately provide an actionable insight into whether a stock is undervalued or overvalued.

On Simply Wall St’s Community page, millions of investors use Narratives to share and update their views instantly as new news or earnings are announced. It is an accessible tool where you can compare your fair value estimate to the current market price and decide if it’s time to buy, hold, or sell. For example, some investors project a much higher fair value for CoreWeave based on aggressive sales growth, while others take a more cautious view and land at a lower estimate. With Narratives, you get to see the range of perspectives and make your own informed decisions, backed by both numbers and real-world stories that evolve over time.

Do you think there's more to the story for CoreWeave? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWV

CoreWeave

Operates a cloud platform that provides scaling, support, and acceleration for GenAI.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026