- United States

- /

- Software

- /

- NasdaqGS:CRWD

Revisiting CrowdStrike (CRWD) Valuation After Its Strong Multi‑Year Share Price Run

Reviewed by Simply Wall St

CrowdStrike Holdings (CRWD) has been on a strong multiyear run, with the stock up about 345% over the past 3 years, even as recent month performance has cooled slightly.

See our latest analysis for CrowdStrike Holdings.

At a share price of $512.03, CrowdStrike’s recent pullback, including a 1 month share price return of minus 4.14%, sits against a much stronger backdrop, with a roughly 47% year to date share price return and a powerful 3 year total shareholder return nearing 345%. This suggests momentum is cooling, but the longer term growth story still looks very much intact.

If CrowdStrike’s run has piqued your interest in the wider space, this could be a good moment to explore other high growth tech and cybersecurity names through high growth tech and AI stocks.

With shares still climbing and analysts penciling in more upside, the key question now is simple: is CrowdStrike still trading below its true potential, or has the market already priced in years of future growth?

Most Popular Narrative Narrative: 4% Undervalued

With CrowdStrike trading at $512.03 against a most popular narrative fair value of about $533, the story here hinges on aggressive, long term growth ambitions.

The strategic focus on Next Gen SIEM, cloud native security, and large scale partnerships, along with CrowdStrike's expansive data capabilities for AI development, positions the company for robust demand growth, which can drive revenue and contract value higher in future periods.

Want to see what powers that optimism? The narrative builds around rapid revenue expansion, rising margins, and a future profit multiple usually reserved for elite software names.

Result: Fair Value of $533.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative could unravel if emerging products underperform or if competitive pressures in cloud security lead to higher costs and weaker margins.

Find out about the key risks to this CrowdStrike Holdings narrative.

Another Angle on Valuation

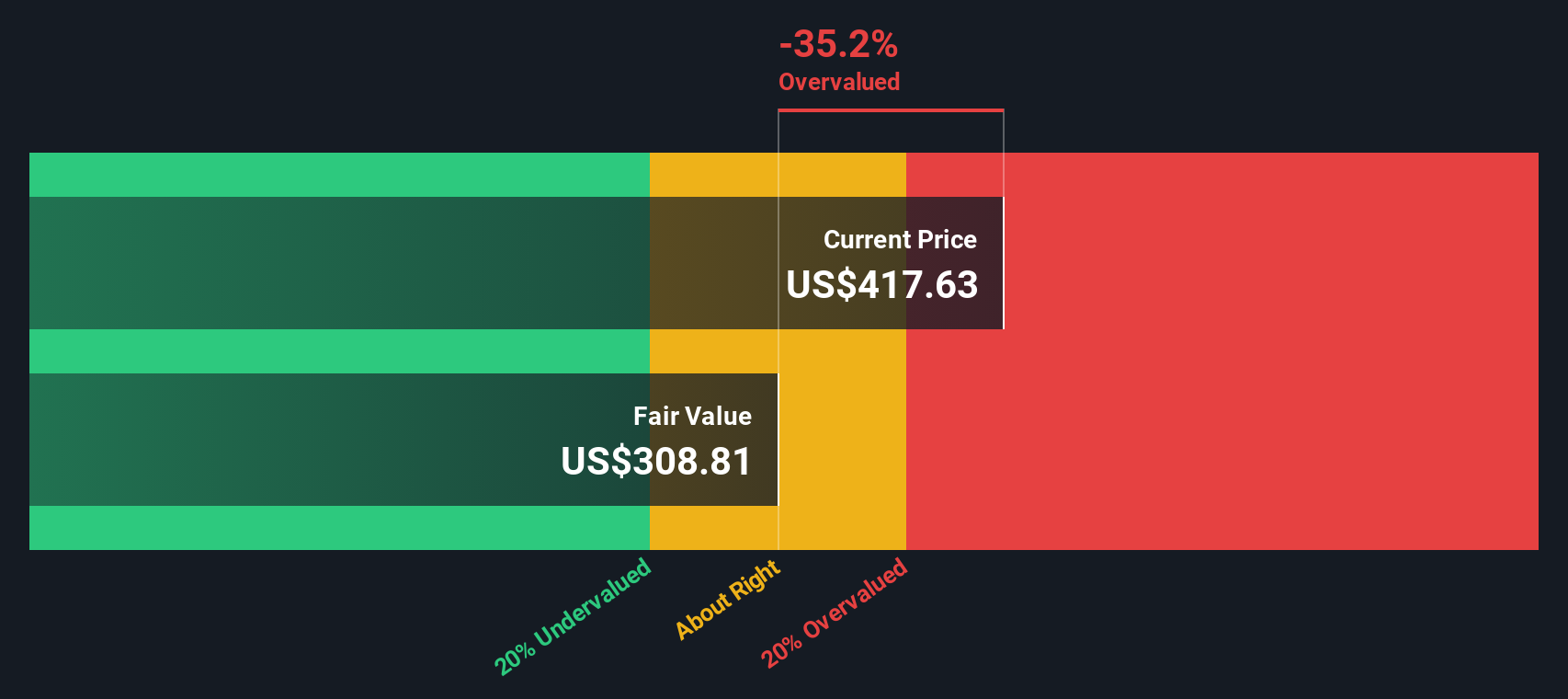

Our DCF model suggests a fair value of about $441.75 per share, which is below today’s $512.03 price and points to CrowdStrike looking overvalued on this view. If cash flows are already priced in, how much upside is really left for new buyers?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CrowdStrike Holdings Narrative

If you are not fully aligned with these views or simply prefer to dig into the numbers yourself, you can build a custom narrative in just a few minutes, Do it your way

A great starting point for your CrowdStrike Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, put Simply Wall Street’s screener to work so you are not relying on just one stock when better opportunities may be waiting.

- Capture potential upside in overlooked names by targeting these 906 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Capitalize on technological disruption by focusing on these 26 AI penny stocks positioned at the heart of automation, data, and intelligent software.

- Strengthen your income stream by zeroing in on these 15 dividend stocks with yields > 3% that may offer steady cash returns alongside capital growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026