- United States

- /

- Software

- /

- NasdaqGS:CRWD

New AI Security Alliances and Google Recognition Might Change the Case for Investing in CrowdStrike (CRWD)

Reviewed by Sasha Jovanovic

- In recent weeks, CrowdStrike announced several significant developments, including its selection as an inaugural partner in the Google Unified Security Recommended program and the launch of alliances with F5, CoreWeave, and Nvidia to enhance AI-driven and cloud security solutions across multiple environments.

- These initiatives highlight the company's increasing focus on unified, AI-powered cybersecurity that spans endpoint, network, and cloud, drawing industry recognition and strengthening its partner ecosystem.

- We'll explore how CrowdStrike's expanding AI and partnership ecosystem may influence its investment narrative and growth prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

CrowdStrike Holdings Investment Narrative Recap

To own shares of CrowdStrike, you generally need to believe in the ongoing adoption of unified, AI-powered security platforms as organizations look to consolidate and modernize their cyber defenses. The recent partnership announcements, including the Google Unified Security Recommended program, underline this direction, but do not materially impact the biggest short-term catalyst: the Falcon Flex subscription model accelerating adoption and growth. The largest current risk remains the potential for growing competition and innovation pressure to weigh on profitability and execution.

Among the latest headlines, CrowdStrike’s alliance with F5 stands out as most directly tied to recent news about ecosystem expansion. Embedding CrowdStrike Falcon Sensor and OverWatch into F5 BIG-IP enables customers to implement advanced security at the network perimeter, reinforcing CrowdStrike’s position in providing integrated, scalable solutions and supporting customer stickiness, a key factor behind the firm’s growth catalysts.

However, while these advances generate industry momentum, investors should be aware that elevated operational costs and competitive intensity could…

Read the full narrative on CrowdStrike Holdings (it's free!)

CrowdStrike Holdings' outlook anticipates $7.9 billion in revenue and $691.1 million in earnings by 2028. This scenario is based on a 22.1% annual revenue growth rate and a $988.1 million improvement in earnings from the current -$297.0 million.

Uncover how CrowdStrike Holdings' forecasts yield a $505.91 fair value, a 6% downside to its current price.

Exploring Other Perspectives

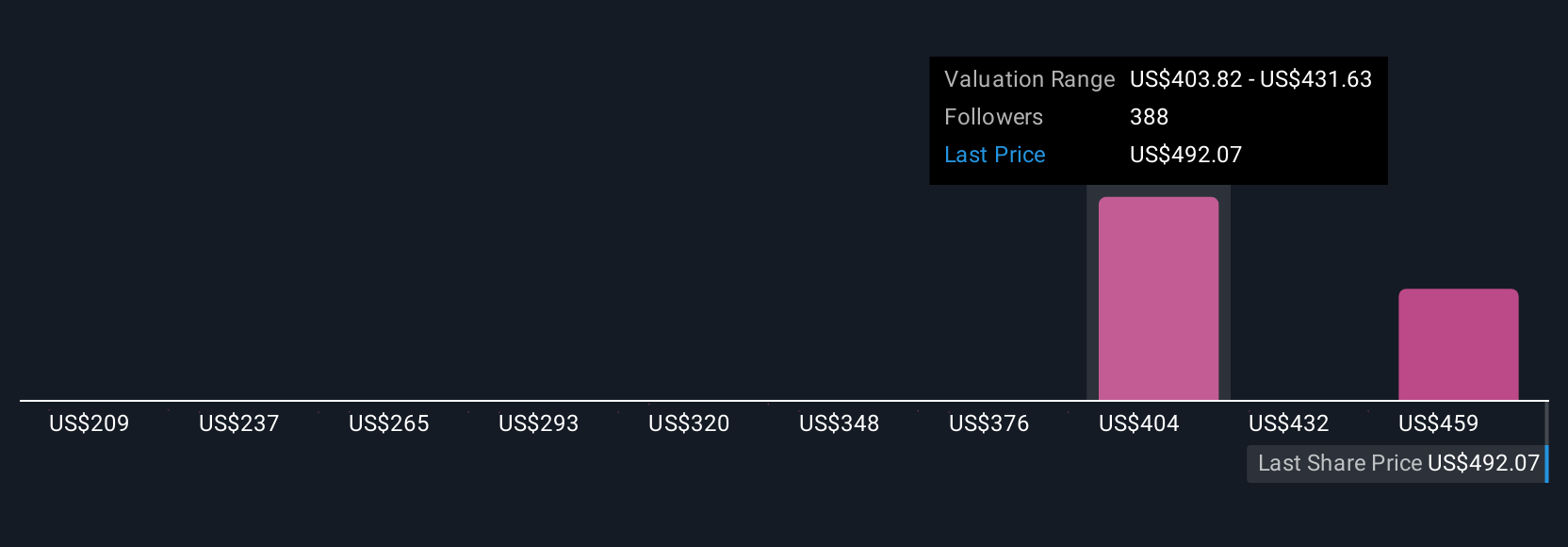

Fair value estimates for CrowdStrike from 27 Simply Wall St Community members range widely, from US$288.95 to US$600.50. While many see upside in growing AI partnerships, others see risks to margins and profitability, making these viewpoints essential for understanding the company’s prospects.

Explore 27 other fair value estimates on CrowdStrike Holdings - why the stock might be worth 46% less than the current price!

Build Your Own CrowdStrike Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CrowdStrike Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free CrowdStrike Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CrowdStrike Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives