- United States

- /

- Software

- /

- NasdaqGS:CRWD

Is It Too Late to Consider CrowdStrike After Its Strong 2025 Share Price Run?

Reviewed by Bailey Pemberton

- If you are wondering whether CrowdStrike Holdings is still worth buying after its big run, or if the easy money has already been made, you are not the only one asking that question.

- The stock has climbed 47.7% year to date and 40.6% over the last year, even after a recent 3.9% pullback over the past month and a modest 2.3% gain in the last week.

- That performance sits against a backdrop of ongoing cybersecurity threats, high profile breaches, and rising enterprise security budgets. These factors keep CrowdStrike in the spotlight as a go to cloud security platform. At the same time, investors are closely watching how competitive dynamics and product expansion shape its long term growth story.

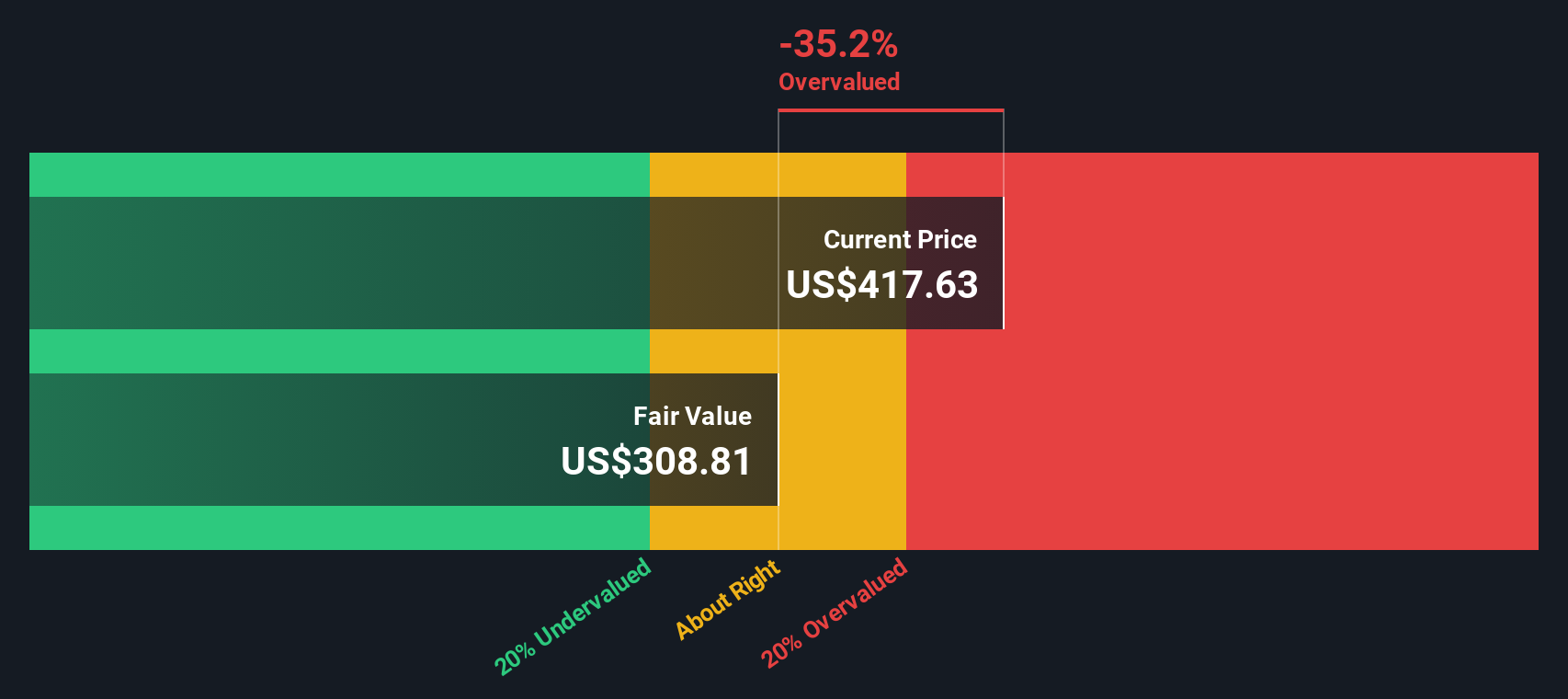

- Despite all that attention, CrowdStrike currently scores just 0/6 on our valuation checks. This means traditional metrics show little obvious undervaluation. Next we will walk through those valuation approaches and then finish with a more holistic way to think about what this stock might really be worth.

CrowdStrike Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: CrowdStrike Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and then discounting them back to today, using a required rate of return. For CrowdStrike Holdings, Simply Wall St applies a 2 stage Free Cash Flow to Equity framework, starting from last twelve months free cash flow of about $1.1 billion and using analyst forecasts for the next few years before extrapolating further out.

Under this approach, free cash flow is projected to rise to roughly $4.8 billion by 2030, with subsequent years continuing to grow but at gradually slowing rates. All of these projected cash flows are converted into today’s dollars using a discount rate, then summed to estimate what the equity should be worth now. That exercise produces an intrinsic value estimate of around $444.78 per share.

Compared with the current market price, the DCF output suggests the stock is about 15.4% overvalued, implying investors are already paying a premium for CrowdStrike’s long term growth story.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CrowdStrike Holdings may be overvalued by 15.4%. Discover 909 undervalued stocks or create your own screener to find better value opportunities.

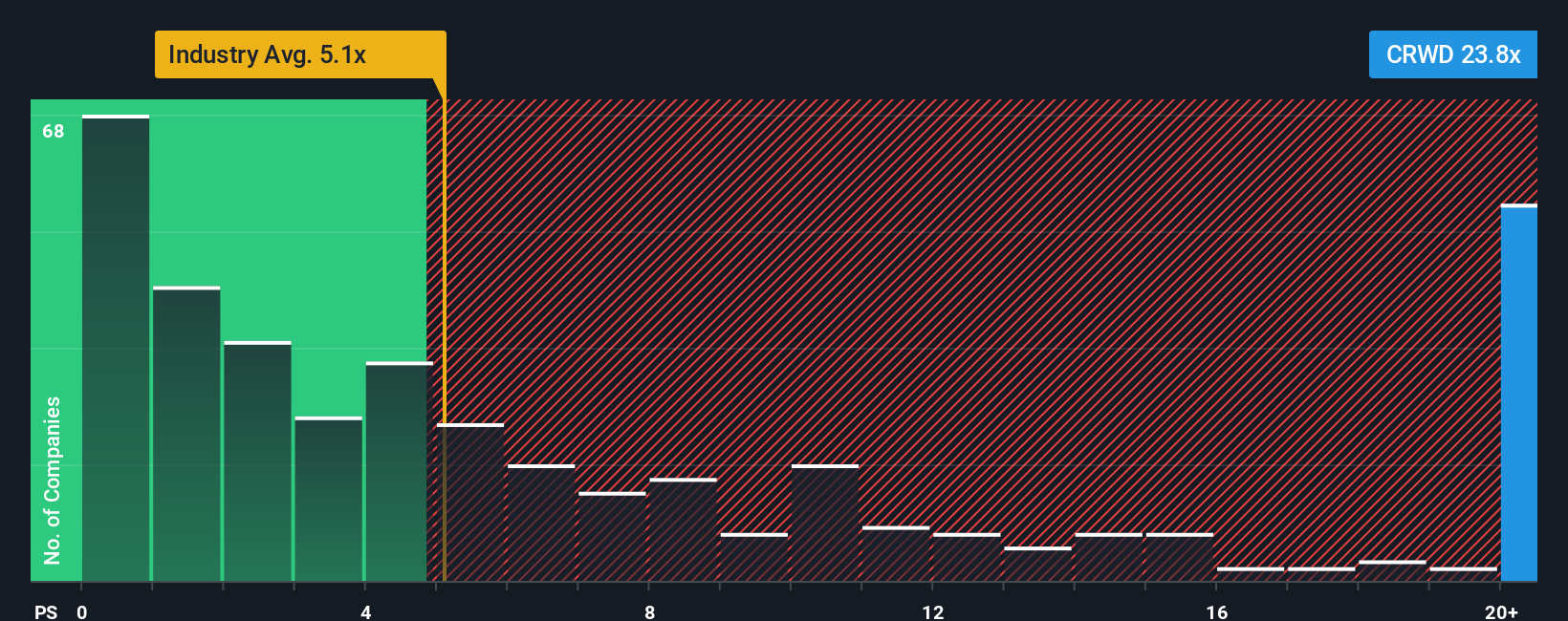

Approach 2: CrowdStrike Holdings Price vs Sales

For high growth software businesses that are still reinvesting heavily, revenue is often a cleaner yardstick than earnings. As a result, the price to sales ratio is a useful way to compare valuation across companies.

In general, faster and more predictable growth plus lower perceived risk can justify a higher normal or fair sales multiple. In contrast, slower growth, lumpier results or greater competitive and execution risk usually pull that multiple down.

CrowdStrike currently trades on a price to sales ratio of 28.34x, which is far richer than both the broader Software industry average of about 4.91x and the peer group average of 12.82x. To go a step further, Simply Wall St estimates a Fair Ratio of 15.81x for CrowdStrike. This is a proprietary view of what a reasonable multiple should be once you factor in its growth outlook, margins, size, industry position and risk profile.

This Fair Ratio is more informative than a simple peer or industry comparison because it adjusts for the company’s specific strengths and risks rather than assuming one size fits all. Set against today’s 28.34x, the 15.81x Fair Ratio points to the shares trading at a premium that looks hard to justify on fundamentals alone.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

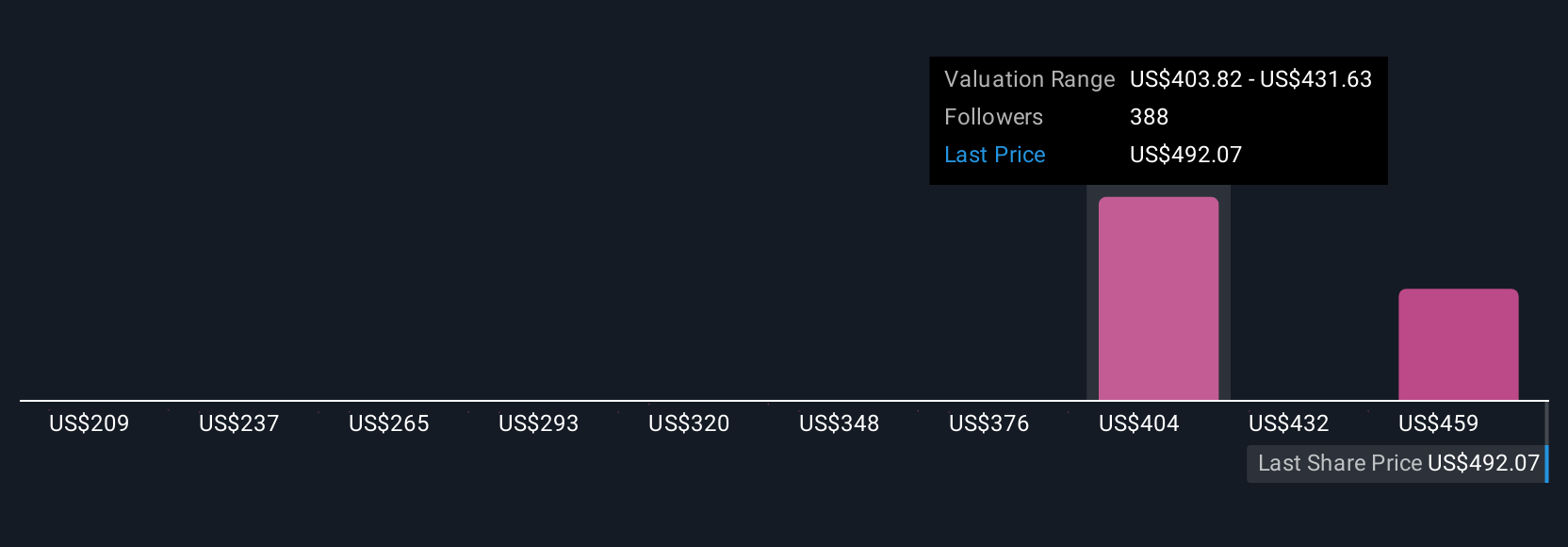

Upgrade Your Decision Making: Choose your CrowdStrike Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of CrowdStrike Holdings to hard numbers like future revenue, earnings, margins and an estimated fair value. A Narrative is your investment story for a company, captured in a few key assumptions that translate directly into a financial forecast and then into what you believe the stock is really worth. On Simply Wall St, Narratives are an easy to use tool on the Community page, where millions of investors share their perspectives and compare their Fair Value to the current market price to decide whether a stock is a buy, hold or sell. Because Narratives update dynamically as new news, earnings and guidance arrive, your story and valuation can evolve with the facts. For example, some CrowdStrike investors currently see fair value closer to about $431 per share while others are closer to $533, reflecting very different expectations about AI, growth and risk, and those differences are exactly what Narratives are designed to make visible and comparable.

For CrowdStrike Holdings however we will make it really easy for you with previews of two leading CrowdStrike Holdings Narratives:

🐂 CrowdStrike Holdings Bull Case

Fair value: $533.26

Implied undervaluation vs last close: -3.8%

Revenue growth assumption: 21.55%

- Analysts expect AI driven products, Falcon Flex, and deep cloud partnerships to sustain strong double digit revenue growth and margin expansion.

- The narrative focuses on growing annual recurring revenue, improving profit margins, and expanding platform adoption across cloud, identity, and next generation SIEM.

- Analyst targets cluster around $469 to $610 with a central fair value of about $533, assuming robust earnings growth and a very high future PE multiple.

🐻 CrowdStrike Holdings Bear Case

Fair value: $431.24

Implied overvaluation vs last close: 18.9%

Revenue growth assumption: 18.0%

- This narrative sees CrowdStrike as an exceptional product and business, but argues that the current share price already more than reflects its growth prospects.

- It highlights strong ARR growth, high returns on equity, and a solid balance sheet, yet still concludes fair value is closer to the low $400s.

- On these assumptions, buying at today’s price implies only around a 10% annual return, which the author views as too modest given execution and competitive risks.

Do you think there's more to the story for CrowdStrike Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026