- United States

- /

- Software

- /

- NasdaqGS:CRWD

Are Investors Missing Something After CrowdStrike’s 52.5% Rally and New Partnerships in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if CrowdStrike is truly living up to all the buzz, or if the current price leaves room for fresh opportunity? Let’s dive into the numbers and see what investors might be missing.

- After a robust 52.5% rally so far this year and a stellar 54.5% gain over the past twelve months, the stock has caught the attention of skeptics and believers alike. This comes despite a slight 5.0% dip in the past week.

- Recent headlines have focused on CrowdStrike’s expanding partnerships and new product launches. These developments have helped fuel optimism despite short-term volatility, shifting sentiment and adding new layers to the company’s growth story.

- When you look at the company’s valuation score, it checks in at just 0 out of 6 criteria for being undervalued. We’ll break that down using a few common approaches in a moment, and stay tuned for a more insightful way of viewing value later in this article.

CrowdStrike Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: CrowdStrike Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. This allows investors to think about what a business is truly worth based on its ability to generate cash over the years ahead.

For CrowdStrike Holdings, the current Free Cash Flow is $1.04 Billion, an impressive figure for a company of its age in the software sector. Analysts estimate that annual Free Cash Flow will climb steadily, reaching approximately $4.58 Billion by 2030. The forecast for the next five years is based on analyst projections. Beyond that period, numbers are extrapolated using Simply Wall St’s models to provide a ten-year outlook.

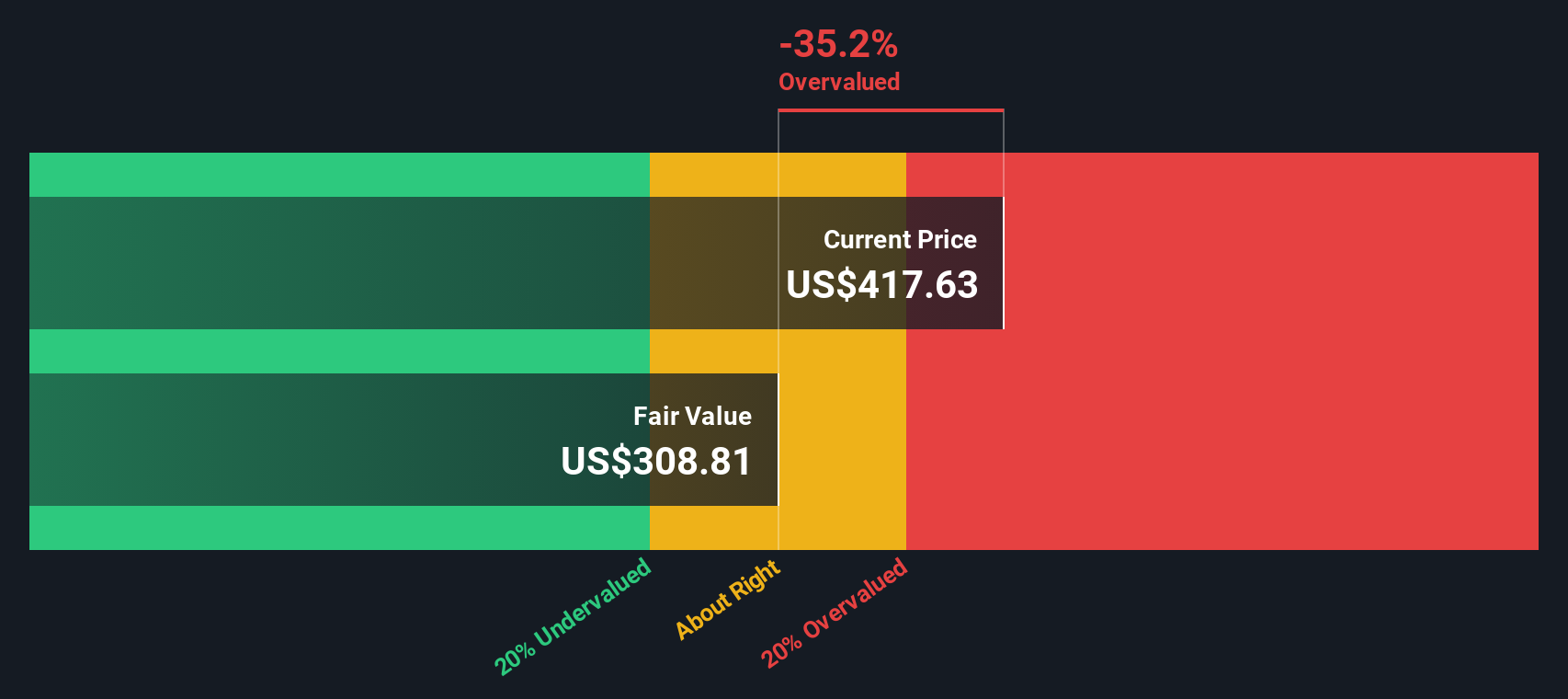

Based on all these projections and using the 2 Stage Free Cash Flow to Equity model, CrowdStrike’s estimated intrinsic value comes in at $427.37 per share. However, when compared with the current share price, the DCF suggests the stock is about 24% overvalued at this time.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CrowdStrike Holdings may be overvalued by 24.0%. Discover 906 undervalued stocks or create your own screener to find better value opportunities.

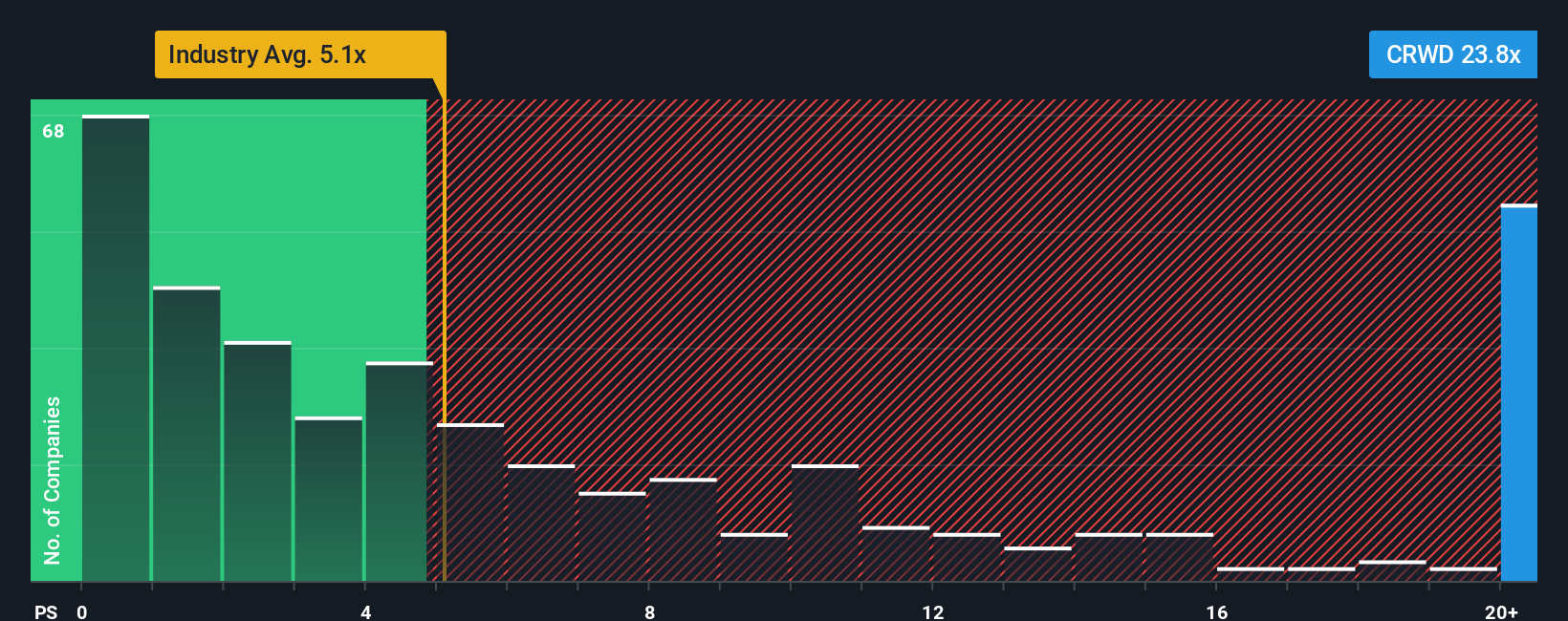

Approach 2: CrowdStrike Holdings Price vs Sales

For tech companies like CrowdStrike Holdings that are rapidly scaling revenue but not yet showing consistent profits, the Price-to-Sales (P/S) multiple gives a clearer window into valuation than earnings-based ratios. The P/S ratio is popular because it measures how much investors are willing to pay for each dollar of the company’s sales. This makes it useful for high-growth firms where profits may still be taking shape.

Expectations for future growth and the risks involved are big factors in what makes a “normal” or “fair” P/S ratio. Higher growth rates or industry leadership often command a premium. In contrast, elevated risks should pull the ratio down toward the industry average.

Right now, CrowdStrike’s P/S multiple stands at 30.63x, which is over twice the average of its software industry peers (13.84x) and far above the broader software industry average of 4.61x. At first glance, the premium looks substantial. However, Simply Wall St’s Fair Ratio for CrowdStrike, calculated using a proprietary model that weighs growth, margins, risks, and market cap, comes in at 18.24x.

Unlike basic peer or industry comparisons, the Fair Ratio digs deeper into what actually makes CrowdStrike unique. It factors in not just growth potential, but also profitability quality, business size, and individual risk profile. This results in a much more tailored and insightful benchmark for investors.

Comparing CrowdStrike’s actual P/S ratio (30.63x) to its Fair Ratio (18.24x) suggests the stock is currently priced above where fundamentals would justify, even accounting for its competitive strengths.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CrowdStrike Holdings Narrative

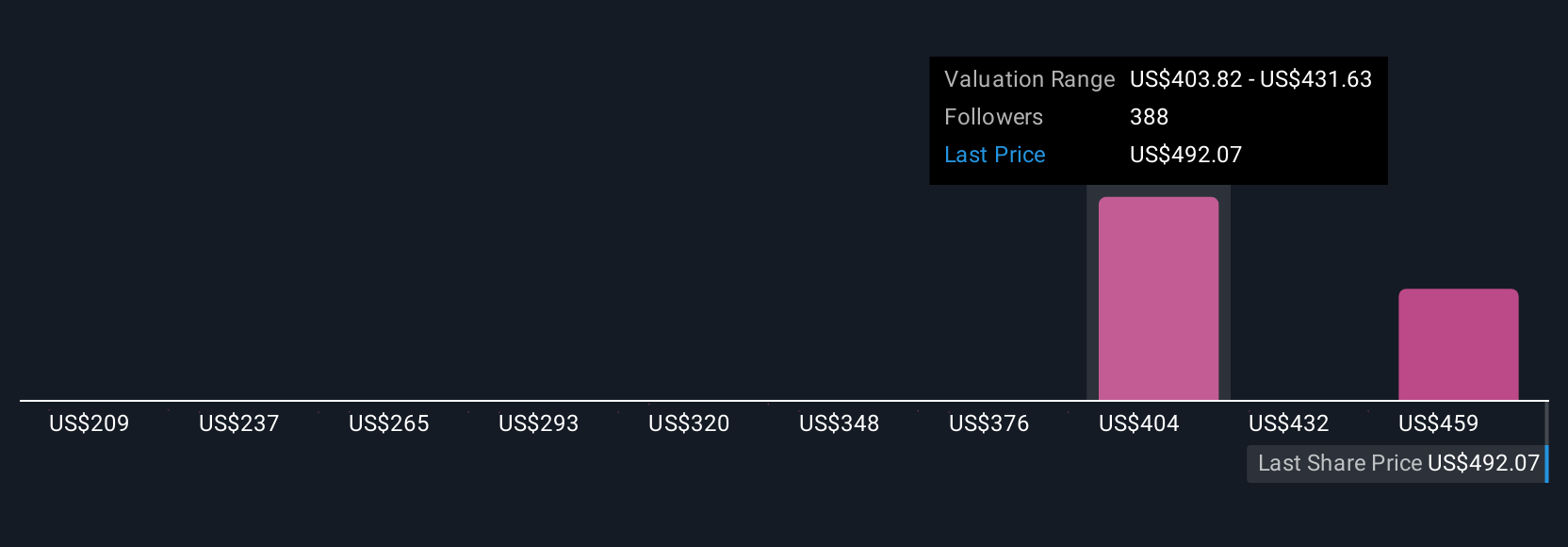

Earlier, we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is simply your story, your perspective on CrowdStrike Holdings, connecting what you know about the business to projected numbers like revenue, earnings, and margins, turning those beliefs into a data-driven fair value calculation.

Narratives help you think beyond spreadsheets by linking the company’s story to actual financial forecasts and then to an actionable fair value. This approach makes it simpler to see whether the current price is above or below what you believe is reasonable. On Simply Wall St's platform, Narratives are readily available in the Community page, used by millions of investors to share and compare these perspectives.

What makes Narratives powerful is that they update dynamically as new information emerges. Whether it is news, quarterly results, or industry-wide shifts, your Narrative and fair value estimate will always reflect the latest data. This means you can instantly gauge if now is a good time to buy or sell based on your evolving viewpoint and the market price.

For example, one investor’s Narrative might calculate CrowdStrike’s fair value as $431 per share based on strong cloud adoption, while another sees potential for even higher growth and arrives at a fair value near $519. This illustrates how individual beliefs about the company directly shape investing decisions.

Do you think there's more to the story for CrowdStrike Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.