- United States

- /

- Software

- /

- NasdaqGS:CORZ

Is Institutional Buying And AI Colocation Growth Altering The Investment Case For Core Scientific (CORZ)?

Reviewed by Sasha Jovanovic

- In recent months, asset manager VR Advisory Services accumulated over 1.2 million Core Scientific shares as the company reported stronger high-density colocation and AI infrastructure results alongside improved gross profit.

- This combination of institutional buying, analyst optimism and insider purchases highlights growing investor interest in Core Scientific’s shift away from volatile digital asset mining toward more data-center-like revenue streams.

- Next, we’ll examine how this institutional accumulation, alongside progress in high-density colocation and AI infrastructure, may influence Core Scientific’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Core Scientific Investment Narrative Recap

To own Core Scientific, you have to believe its pivot from Bitcoin mining to high-density colocation and AI infrastructure can offset shrinking digital asset revenue and past losses. Recent institutional buying and positive analyst sentiment support the idea that this transition is gaining traction, but they do not materially change the key near term catalyst, which is ramping new HPC contracts, or the biggest risk, which is executing that shift while still carrying balance sheet and concentration pressures.

The most relevant development here is Core Scientific’s reported growth in high-density colocation and AI infrastructure revenue, along with improved gross profit in recent results. This progress ties directly into the CoreWeave HPC contract and broader capacity expansions, which are central to the company’s plan to replace volatile mining income with more data center like revenue and to make better use of its strengthened, post restructuring capital position.

However, investors should also weigh how reliant this new direction is on a single large client and what happens if CoreWeave’s demand...

Read the full narrative on Core Scientific (it's free!)

Core Scientific's narrative projects $1.5 billion revenue and $334.4 million earnings by 2028. This requires 60.9% yearly revenue growth and a $929.6 million earnings increase from $-595.2 million today.

Uncover how Core Scientific's forecasts yield a $27.65 fair value, a 62% upside to its current price.

Exploring Other Perspectives

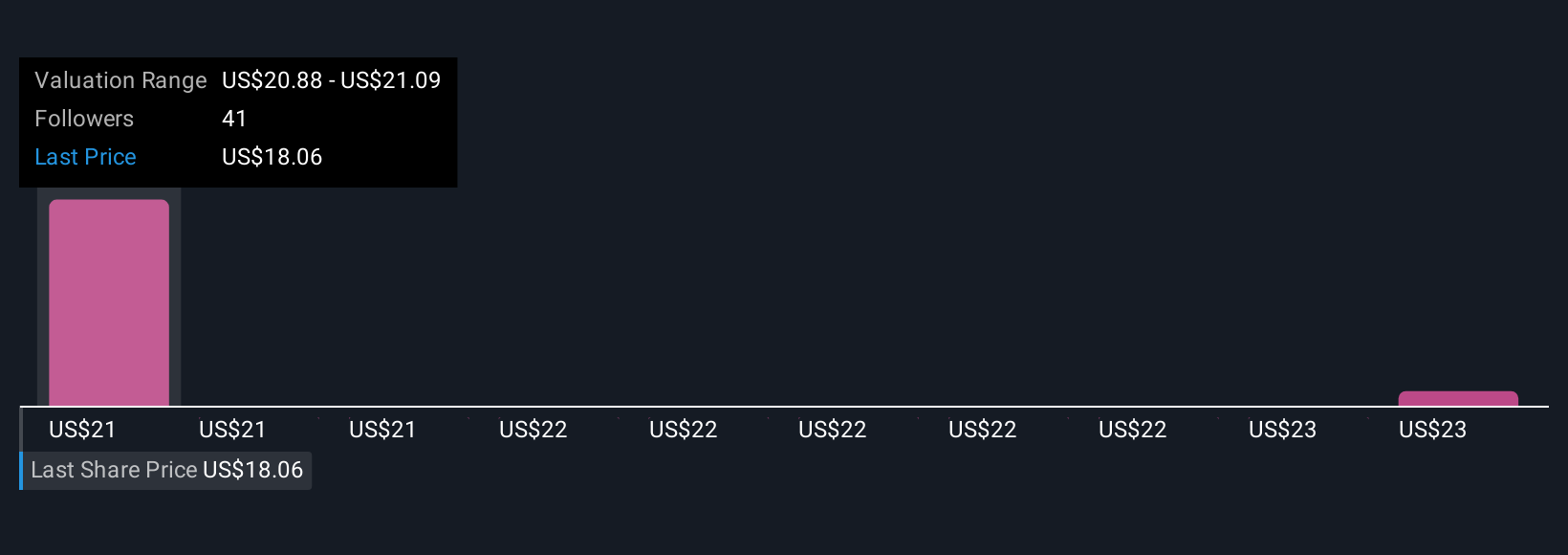

Four members of the Simply Wall St Community value Core Scientific between US$23.00 and about US$27.65 per share, reflecting a fairly tight cluster of views. You can weigh those against the dependence on the CoreWeave contract as a key earnings driver and consider what a change in that relationship could mean for the business over time.

Explore 4 other fair value estimates on Core Scientific - why the stock might be worth just $23.00!

Build Your Own Core Scientific Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Core Scientific research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Core Scientific research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Core Scientific's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CORZ

Core Scientific

Provides digital asset mining services in the United States.

High growth potential with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026