- United States

- /

- Software

- /

- NasdaqCM:CLSK

CleanSpark (CLSK) Is Up 19.1% After FY 2025 Profit Swing and AI Pivot - Has the Narrative Shifted?

Reviewed by Sasha Jovanovic

- CleanSpark, Inc. recently reported full-year earnings for fiscal 2025, disclosing revenue of US$766.31 million and net income of US$364.46 million, a substantial turnaround from the prior year's loss.

- This shift in profitability coincides with the company’s ongoing diversification away from solely Bitcoin mining, as it moves to expand its AI and high-performance computing operations.

- We’ll explore how CleanSpark’s renewed focus on AI data centers and infrastructure expansion shapes its current investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

CleanSpark Investment Narrative Recap

For shareholders, the key belief driving CleanSpark’s investment case is whether its pivot toward AI and high-performance computing can meaningfully reduce its dependency on Bitcoin mining. The recent full-year results highlight a return to profitability, but the company’s near-term trajectory still hinges on acquiring large AI compute contracts, while exposure to Bitcoin volatility remains the biggest risk. Overall, these latest results do not materially change this dynamic for the most important short-term catalyst or risk right now.

A standout recent announcement was CleanSpark’s acquisition of 271 acres in Texas to develop a next-generation data center campus. This move directly connects to the company's effort to tap new growth markets beyond cryptocurrency mining; the site is positioned to meet emerging demand from AI, cloud, and enterprise clients. For investors, such infrastructure projects directly support the company’s narrative around future revenue catalysts tied to AI and data center expansion.

By contrast, one piece of information investors should be aware of is that CleanSpark’s earnings and cash flow remain subject to sharp swings if Bitcoin prices move against...

Read the full narrative on CleanSpark (it's free!)

CleanSpark's narrative projects $1.5 billion in revenue and $319.0 million in earnings by 2028. This requires 32.5% yearly revenue growth and a $26.5 million earnings increase from $292.5 million today.

Uncover how CleanSpark's forecasts yield a $23.98 fair value, a 70% upside to its current price.

Exploring Other Perspectives

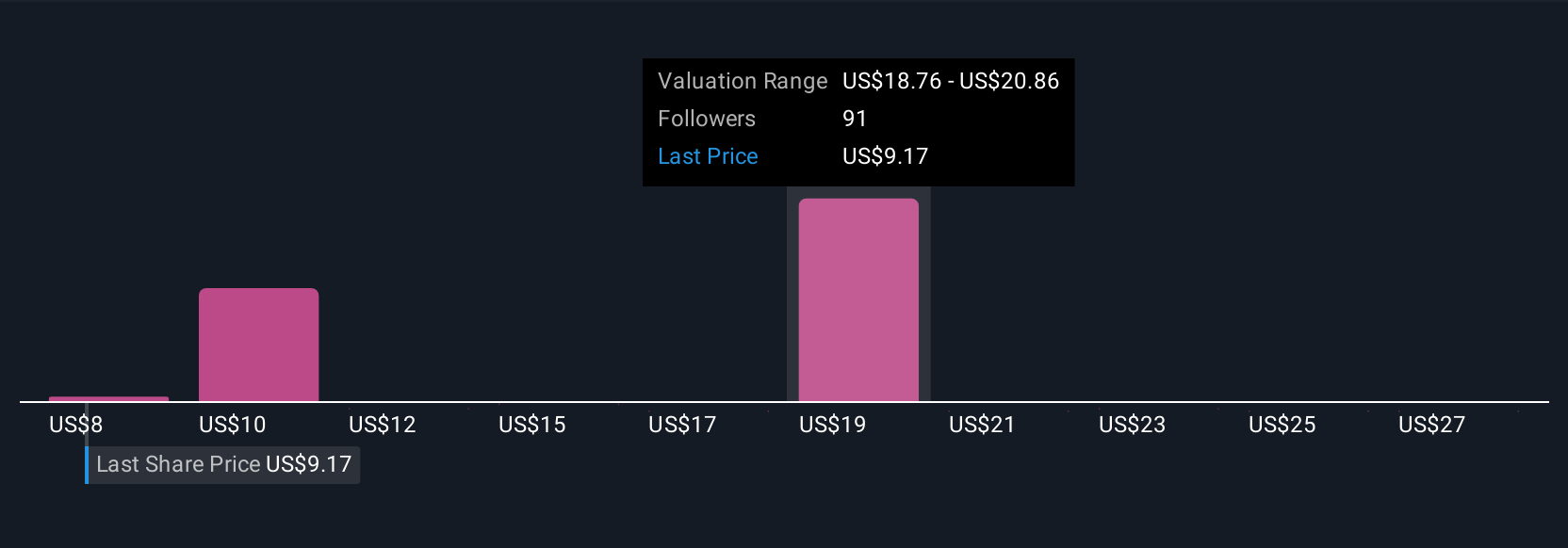

Nineteen fair value estimates from the Simply Wall St Community for CleanSpark span a wide range, from US$5.15 to US$29.26 per share. While opinions vary, CleanSpark’s push into scalable AI data centers is front of mind for many, raising questions about future growth drivers and potential revenue diversification.

Explore 19 other fair value estimates on CleanSpark - why the stock might be worth less than half the current price!

Build Your Own CleanSpark Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CleanSpark research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free CleanSpark research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CleanSpark's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CLSK

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026