- United States

- /

- Software

- /

- NYSE:HUBS

High Growth Tech Stocks to Watch in August 2024

Reviewed by Simply Wall St

In the last week, the United States market has been flat, but it has risen 25% over the past 12 months and earnings are expected to grow by 15% per annum in the next few years. In this favorable environment, identifying high growth tech stocks that align with these trends can offer significant opportunities for investors.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| TG Therapeutics | 28.62% | 43.05% | ★★★★★★ |

| Ardelyx | 27.44% | 65.50% | ★★★★★★ |

| Super Micro Computer | 20.76% | 28.05% | ★★★★★★ |

| Iris Energy | 70.63% | 125.09% | ★★★★★★ |

| G1 Therapeutics | 24.26% | 51.62% | ★★★★★★ |

| Invivyd | 42.85% | 71.50% | ★★★★★★ |

| Amicus Therapeutics | 20.45% | 61.85% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 250 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Cellebrite DI (NasdaqGS:CLBT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cellebrite DI Ltd. develops solutions for legally sanctioned investigations across various regions including Europe, the Middle East, Africa, the Americas, and the Asia-Pacific with a market cap of $3.46 billion.

Operations: Cellebrite DI Ltd. generates revenue primarily from its Internet Software & Services segment, which accounted for $346.76 million. The company focuses on developing solutions for legally sanctioned investigations across multiple regions globally.

Cellebrite DI, known for its AI-driven Case-to-Closure platform, reported Q2 2024 revenue of $95.71 million, a 24.85% increase from $76.68 million the previous year. Despite a net loss reduction to $23.81 million from $32.35 million, the company forecasts annual revenue growth of 14.7%, outpacing the US market's 8.8%. Cellebrite's R&D expenses are substantial at approximately 25% of revenue, reflecting its commitment to innovation in digital forensics and cybersecurity solutions for high-profile clients like U.S federal agencies which generated around 19% of its annual recurring revenue in public sector last year.

- Dive into the specifics of Cellebrite DI here with our thorough health report.

Gain insights into Cellebrite DI's past trends and performance with our Past report.

SpringWorks Therapeutics (NasdaqGS:SWTX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SpringWorks Therapeutics, Inc. is a commercial-stage biopharmaceutical company focused on developing and commercializing medicines for underserved patients with rare diseases and cancer, with a market cap of $2.93 billion.

Operations: SpringWorks Therapeutics focuses on developing and commercializing treatments for rare diseases and cancer. The company operates in the biopharmaceutical sector, aiming to address unmet medical needs.

SpringWorks Therapeutics reported Q2 2024 revenue of $59.73 million, reflecting a strong year-over-year growth trajectory. Despite a net loss reduction to $39.92 million from $77.93 million, the company is investing heavily in R&D, with expenses accounting for approximately 42.9% of revenue, underscoring its commitment to innovation in rare disease treatments like mirdametinib for NF1-PN. The forecasted annual earnings growth rate of 71.24% and expected revenue increase of 42.9% per year highlight its potential in the biotech sector despite recent shareholder dilution.

HubSpot (NYSE:HUBS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: HubSpot, Inc., along with its subsidiaries, offers a cloud-based customer relationship management (CRM) platform for businesses across the Americas, Europe, and the Asia Pacific with a market cap of $25.43 billion.

Operations: HubSpot generates revenue primarily from its cloud-based CRM platform, with Internet Software & Services contributing $2.39 billion. The company operates across multiple regions, including the Americas, Europe, and the Asia Pacific.

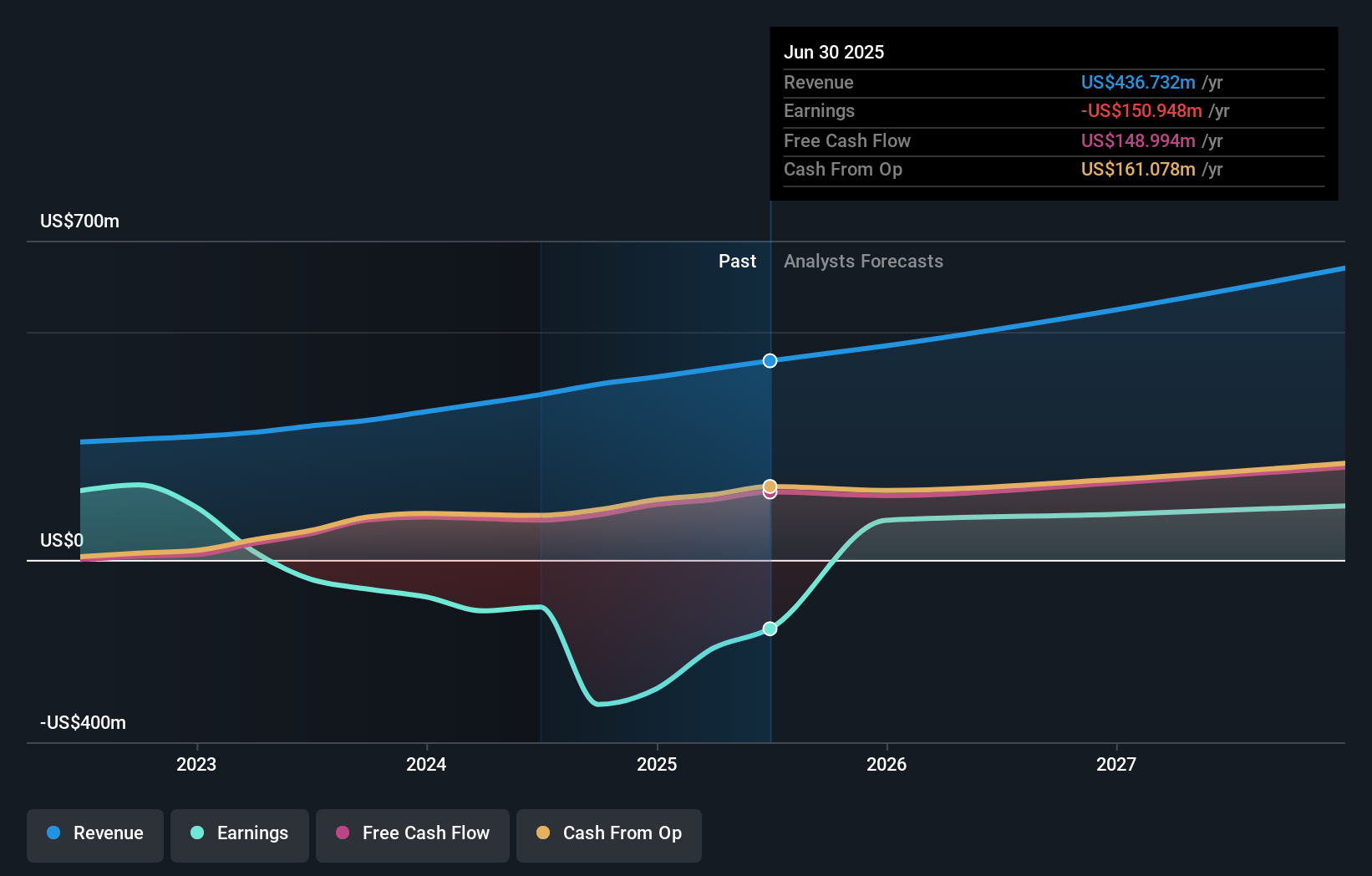

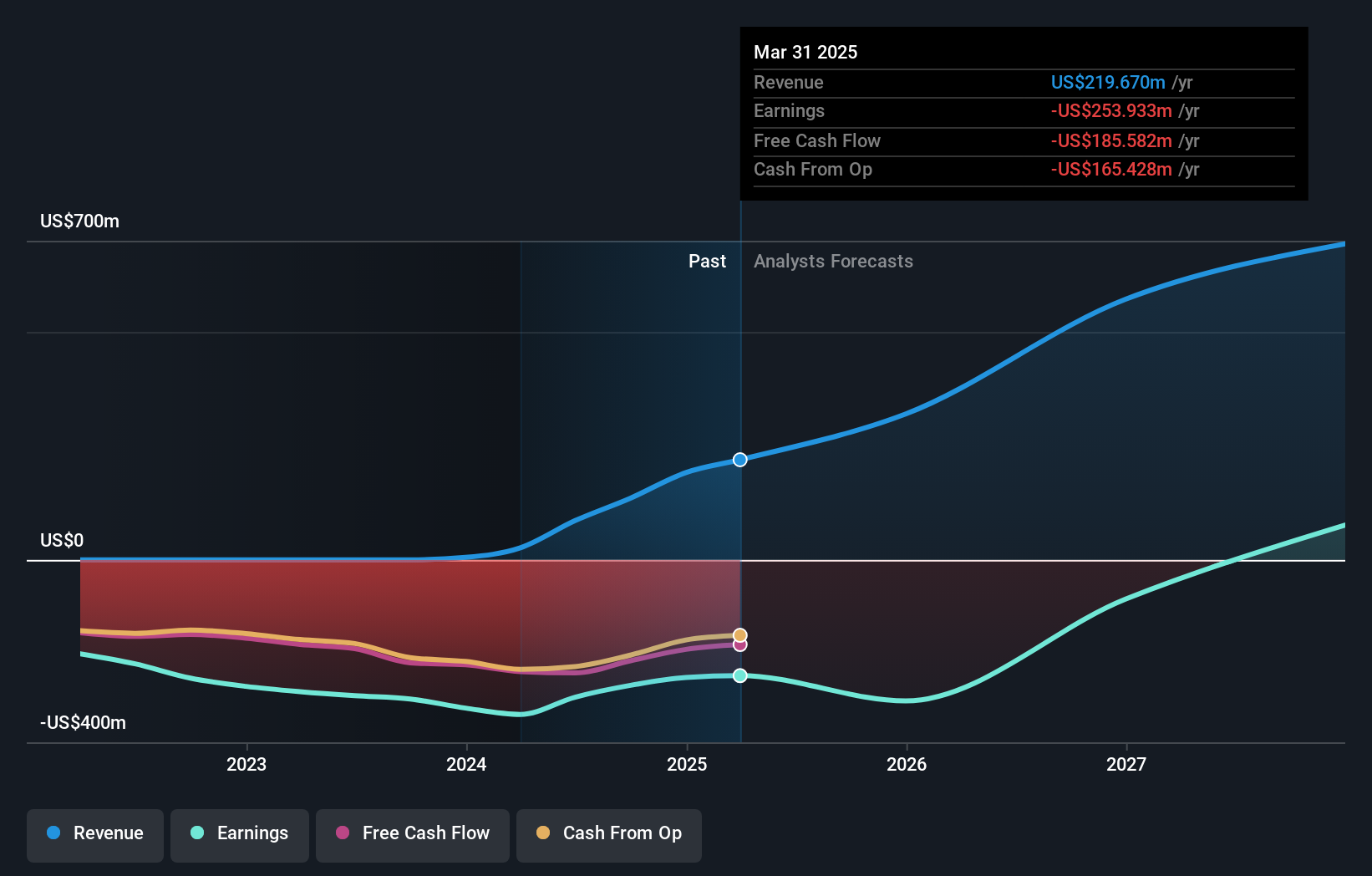

HubSpot's Q2 2024 revenue increased to $637.23 million, a notable rise from $529.14 million the previous year, with net loss narrowing significantly to $14.44 million from $111.8 million. The company’s R&D expenses reflect its commitment to innovation, accounting for 20% of revenue in the recent quarter, driving advancements in its CRM solutions and SaaS offerings. Revenue is projected to grow at 14.9% annually, outpacing the US market average of 8.8%, highlighting strong future prospects despite past shareholder dilution concerns and recent M&A speculations involving Alphabet Inc., which caused fluctuations in stock value.

- Unlock comprehensive insights into our analysis of HubSpot stock in this health report.

Explore historical data to track HubSpot's performance over time in our Past section.

Next Steps

- Explore the 250 names from our US High Growth Tech and AI Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HubSpot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUBS

HubSpot

Provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific.

Flawless balance sheet with high growth potential.