- United States

- /

- Software

- /

- NasdaqGS:CLBT

Cellebrite DI (NasdaqGS:CLBT): Reassessing Valuation After Well‑Received Earnings and Guardian Platform Growth

Reviewed by Simply Wall St

Cellebrite DI (NasdaqGS:CLBT) just delivered a quarterly update that the market clearly liked, with shares jumping about 20% as investors responded to stronger execution and accelerating momentum in its Guardian investigative platform.

See our latest analysis for Cellebrite DI.

That earnings pop sits on top of a 1 month share price return of 18.7% and a 90 day gain of 7%, even though the year to date share price return is still negative and the 1 year total shareholder return is slightly in the red. At the same time, the 3 year total shareholder return above 300% shows how powerful the longer term story has been and suggests momentum is rebuilding as investors refocus on Guardian growth, Corellium integration, and potential federal and NATO related upside.

If Cellebrite’s run has you rethinking your opportunity set, this could be a smart moment to explore high growth tech and AI stocks that are shaping the next wave of digital investigation and defense technology.

With revenue and earnings still compounding and the stock trading at a sizeable discount to analyst targets, the key question now is whether this reset leaves CLBT undervalued or if markets are already pricing in the next leg of growth.

Most Popular Narrative Narrative: 26% Undervalued

With the narrative fair value sitting at $24.71 against a last close of $18.28, the valuation case leans heavily on faster growth and higher margins.

The continued transition to a recurring, subscription-based revenue model, with over 90% of revenues now from subscriptions and growing SaaS/cloud penetration, improves revenue visibility, predictability, and operating leverage. This is already translating into higher EBITDA and free cash flow margins and is likely underappreciated in current valuations.

To see the math behind that confidence gap, including the growth runway, margin expansion, and the future earnings multiple incorporated in this story, explore the full narrative.

Result: Fair Value of $24.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy dependence on US federal contracts and intensifying competition in lawful access tools could slow ARR growth and compress the premium valuation case.

Find out about the key risks to this Cellebrite DI narrative.

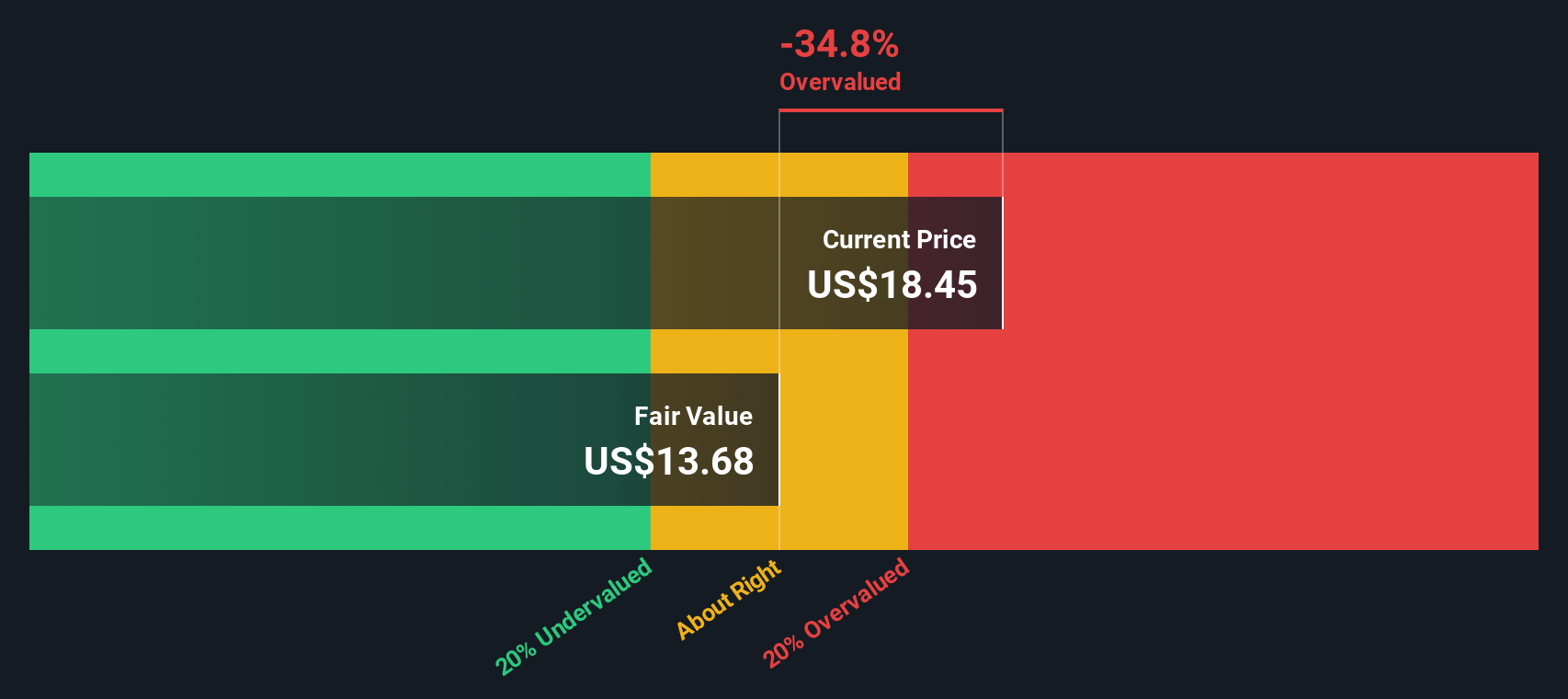

Another Way to Look at Value

While the narrative suggests Cellebrite is 26% undervalued, our SWS DCF model sees things differently, with a fair value closer to $13.51 versus the $18.28 share price. This implies the stock is actually overvalued. Which lens do you trust more for the next move?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cellebrite DI for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cellebrite DI Narrative

If this outlook does not fully align with your own views, dive into the numbers yourself and build a tailored narrative in minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Cellebrite DI.

Ready for more investment ideas?

Before the market’s next big move leaves you watching from the sidelines, put your research to work and line up your next opportunity using targeted screeners.

- Capitalize on potential mispricing by reviewing these 907 undervalued stocks based on cash flows that pair strong fundamentals with attractive valuations before sentiment fully catches up.

- Explore structural growth trends by focusing on these 30 healthcare AI stocks that support diagnostics, patient outcomes, and hospital efficiency in the coming decade.

- Prepare for financial innovation by evaluating these 81 cryptocurrency and blockchain stocks that build real businesses around blockchain infrastructure, payments, and digital asset networks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CLBT

Cellebrite DI

Develops solutions for legally sanctioned investigations in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026