- United States

- /

- Software

- /

- NasdaqGS:BSY

Bentley Systems (BSY): Valuation Insights Following Dividend, Buyback Expansion, and Infrastructure AI Developments

Reviewed by Simply Wall St

Bentley Systems (BSY) made headlines after announcing a $0.07 dividend for the fourth quarter, expanding its share repurchase plan, and reporting healthy double-digit revenue growth. Management also highlighted new AI-powered infrastructure solutions, which are fueling optimism about future performance.

See our latest analysis for Bentley Systems.

Bentley Systems has seen its share price retreat about 18% over the past month and slide more than 21% over the last quarter, reflecting a shift in market sentiment despite robust revenue growth and shareholder-friendly moves like the dividend and buyback expansion. While the 1-year total shareholder return is down 15%, the longer-term picture still shows meaningful gains, with total returns of 11% over three years and 24% over five years. Momentum has clearly faded lately, but the company’s renewed focus on AI and capital returns could help restore investor confidence going forward.

If Bentley’s evolving strategy has you rethinking where to look next, now’s a good time to discover fast growing stocks with high insider ownership.

With the stock trading nearly 40% below the average analyst price target, investors are left to consider whether Bentley Systems is trading at a true bargain or if the market is rightly factoring in every aspect of future growth.

Most Popular Narrative: 28.1% Undervalued

The most widely followed narrative places Bentley Systems' fair value at $58.21, which is well above the last close of $41.85. The narrative relies on technology transformation and sector tailwinds as key drivers for this valuation premium.

Sustained global investment in infrastructure, driven by government initiatives in the US, UK, EU, and high-growth regions like India and the Middle East, continues to expand Bentley's addressable market and supports durable double-digit ARR and revenue growth. Large-scale productivity challenges, such as the shortage of skilled engineers, are leading the sector to accelerate digital transformation. This elevates demand for Bentley's AI-driven, cloud-based, and digital twin solutions, which could drive both revenue expansion and a higher-margin product mix.

Want to unpack the financial leap behind this bullish valuation? The real story lies in the narrative’s ambitious earnings and profit margin assumptions. Can Bentley’s market position and digital capabilities justify a price typically associated with top-tier tech disruptors? Get the details shaping this fair value projection and see what numbers the analysts are really relying on.

Result: Fair Value of $58.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition from cloud-native rivals and uncertainty in emerging markets could challenge the sustainability of Bentley’s positive outlook.

Find out about the key risks to this Bentley Systems narrative.

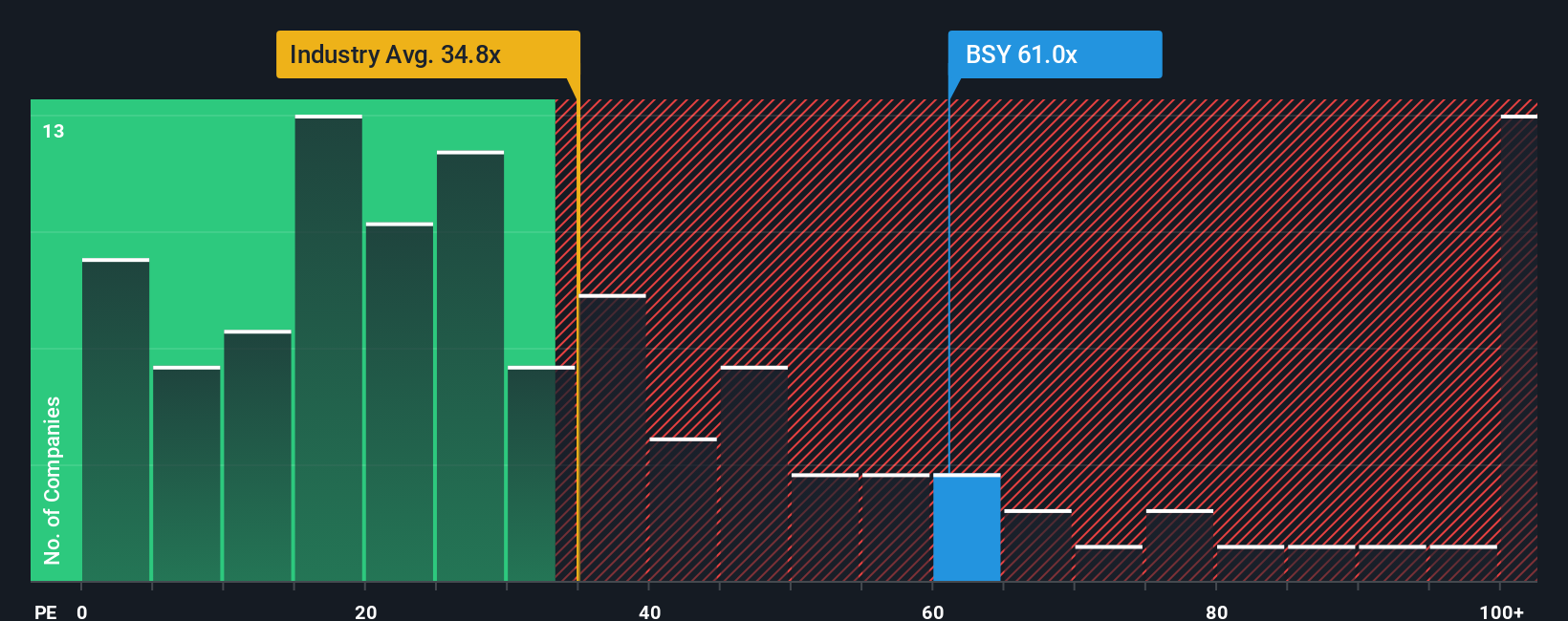

Another View: Multiples Point to a Premium

Looking at Bentley Systems through the lens of price-to-earnings, the shares are trading at 48.8 times earnings, which is a noticeable premium compared to both the US Software industry average of 32x and the peer average of 45.7x. The fair ratio is estimated at 32.5x, suggesting investors are paying up for perceived growth. Does the market see something the models do not, or is risk creeping in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bentley Systems Narrative

If you see things differently or want to draw your own conclusions from the numbers, why not craft your own take on Bentley Systems in under three minutes—Do it your way.

A great starting point for your Bentley Systems research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Smart Investment Moves?

There has never been a better time to get ahead. Use the powerful Simply Wall Street Screener to uncover standout opportunities beyond the obvious and make confident choices for your portfolio.

- Unlock fresh income streams by targeting high-yield companies through these 14 dividend stocks with yields > 3%, offering some of the most attractive payout prospects available today.

- Spot overlooked tech innovators making real breakthroughs by tapping into these 25 AI penny stocks, where AI-driven advancements could power the next wave of growth.

- Capitalize on market disconnects with these 929 undervalued stocks based on cash flows and find companies trading for less than their intrinsic value, setting the stage for potential upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bentley Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BSY

Bentley Systems

Provides infrastructure engineering software solutions in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026