- United States

- /

- Software

- /

- NasdaqGS:BRZE

BrazeAI Studio Launch on Google Cloud Marketplace Could Be a Game Changer for Braze (BRZE)

Reviewed by Sasha Jovanovic

- Braze announced that its BrazeAI Decisioning Studio is now available on Google Cloud Marketplace, allowing customers to streamline procurement and deployment of AI-powered decisioning capabilities directly within Google Cloud environments.

- This move significantly expands access to Braze’s AI personalization tools, integrating reinforcement learning and first-party data use for more effective customer engagement across enterprise martech stacks.

- We'll explore how Braze's integration with Google Cloud Marketplace strengthens its AI-driven offerings and their influence on the company's investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Braze Investment Narrative Recap

To be a shareholder in Braze, it is important to believe in the company's ability to lead in AI-powered customer engagement as brands shift towards personalized marketing at scale. The availability of BrazeAI Decisioning Studio on Google Cloud Marketplace is a plus for distribution and partner alignment but is unlikely to materially change the near-term top catalyst: how quickly Braze can show meaningful revenue growth from newly acquired and enterprise customers. The key risk remains Braze’s complex client implementation and its potential to hinder effective revenue scaling and margin improvement, which should be closely monitored in upcoming reports.

Among Braze’s recent product news, the September 2025 launch of BrazeAI Decisioning Studio stands out as a pivotal move. This product, built around reinforcement learning and first-party data, aligns directly with the broader industry catalyst of legacy vendor replacement and martech consolidation, trends that, if captured, could enhance Braze’s competitive position and boost customer-driven revenue.

By contrast, investors should also be aware of the practical challenges in scaling high-touch, AI-intensive marketing solutions such as...

Read the full narrative on Braze (it's free!)

Braze's narrative projects $1.0 billion revenue and $133.0 million earnings by 2028. This requires 17.9% yearly revenue growth and a $236.9 million increase in earnings from the current earnings of -$103.9 million.

Uncover how Braze's forecasts yield a $45.11 fair value, a 59% upside to its current price.

Exploring Other Perspectives

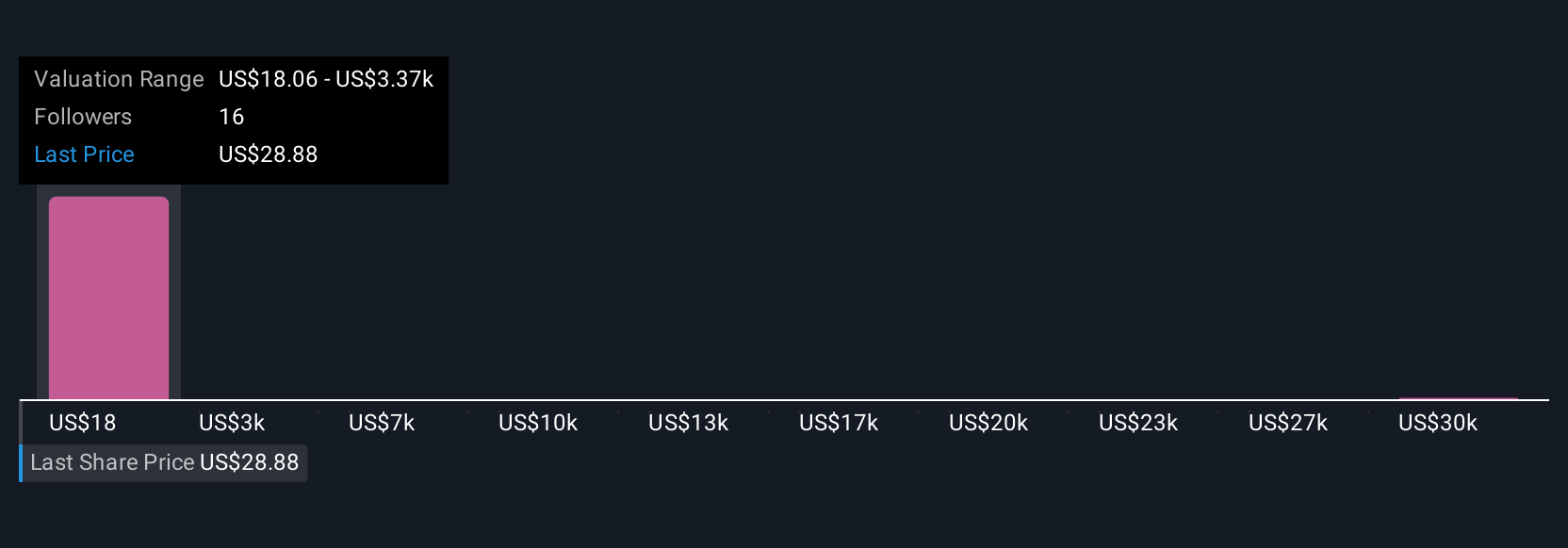

Five community-sourced fair value estimates for Braze range from US$25.85 to an extreme US$33,504.83, highlighting substantial divergence among Simply Wall St Community members. While some focus on product catalysts and expanding integrations, many are keenly aware that Braze’s ability to scale its AI-driven solutions amid implementation risks may shape its performance, explore these contrasting views before making your own assumptions.

Explore 5 other fair value estimates on Braze - why the stock might be a potential multi-bagger!

Build Your Own Braze Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Braze research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Braze research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Braze's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Braze might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BRZE

Braze

Operates a customer engagement platform that provides interactions between consumers and brands worldwide.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026