- United States

- /

- Software

- /

- NasdaqGS:AVPT

A Look at AvePoint (AVPT) Valuation Following Q3 Earnings Beat and Raised Outlook

Reviewed by Simply Wall St

AvePoint (AVPT) shares have been catching investors’ attention this week thanks to the release of third quarter results showing a sharp jump in both revenue and net income, along with a raised full-year outlook.

See our latest analysis for AvePoint.

The recent surge in AvePoint’s share price was driven by strong third quarter results and a raised outlook. However, momentum has been mixed, with a 4.88% jump in the last day offsetting a steeper share price retreat over the past month and year. While the 1-year total shareholder return is still down 19.3%, the long-term picture is much brighter. A 165% total return over three years hints at underlying growth potential despite recent volatility and management’s ongoing strategic moves.

If this earnings-driven rebound caught your attention, now’s the perfect opportunity to broaden your search and discover fast growing stocks with high insider ownership

With shares climbing on upbeat results and Wall Street maintaining bullish ratings, the key question now is whether AvePoint remains undervalued given its forecast-beating growth and analyst targets, or if future gains are already reflected in the price.

Most Popular Narrative: 39.7% Undervalued

Compared to the latest close, the most popular narrative sees a valuation considerably above the current share price. A significant discount highlights major upside potential if the narrative’s forecasts come true.

The accelerating enterprise adoption of AI tools like Microsoft Copilot, alongside increasing security and data governance challenges, is positioning AvePoint's data management and governance solutions as mission-critical. This is driving robust customer expansions and higher spending per customer, which serves as a catalyst for sustained revenue growth and stronger net retention rates.

Want to know the logic behind this ambitious price target? This narrative’s bold projections rest on unusually rapid improvement in margins and earnings, with future growth rates that could surprise even optimists. Discover which forecasting levers unlock such a large gap between price and fair value. Full details await in the full narrative.

Result: Fair Value of $21.02 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, AvePoint’s progress could stumble if its reliance on Microsoft continues, or if growing compliance costs erode the benefits of expanding margins.

Find out about the key risks to this AvePoint narrative.

Another View: Are Multiples Sending a Warning?

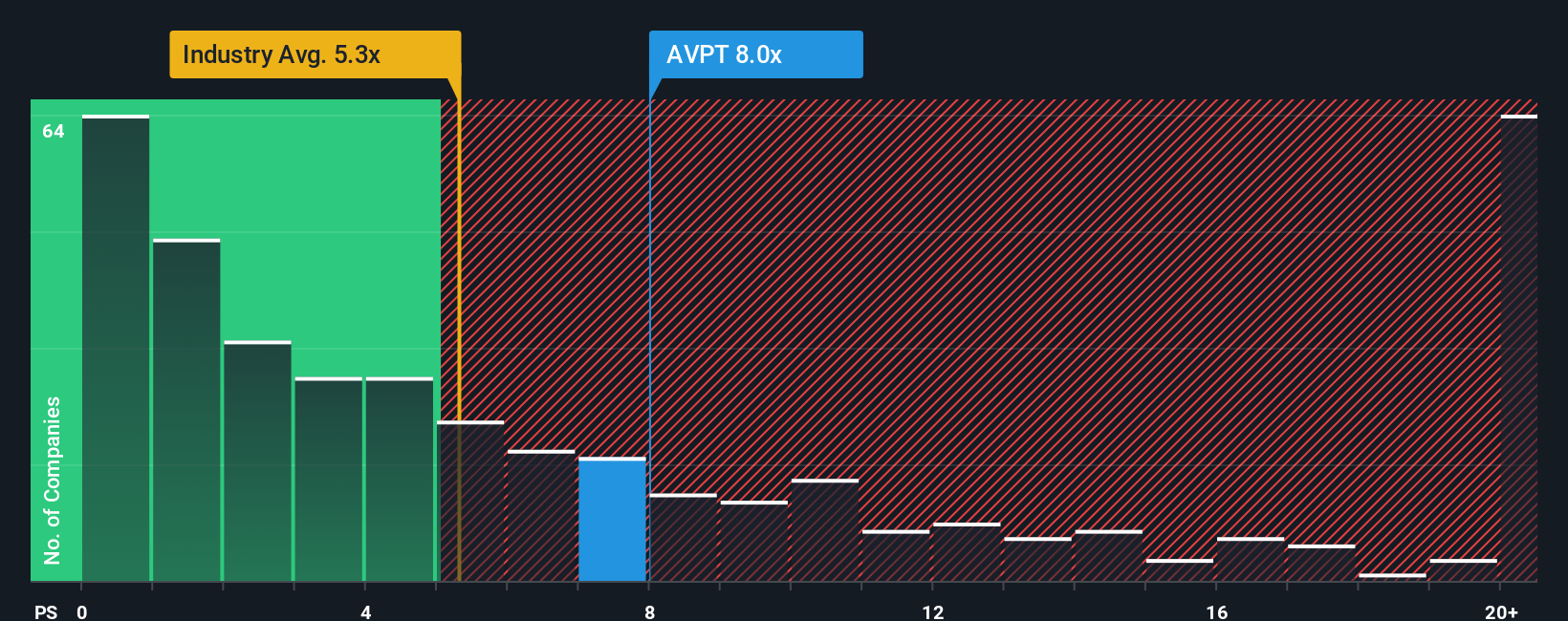

Looking beyond the narrative’s optimism, AvePoint is currently valued at 6.9 times sales. That is noticeably higher than both the software industry average of 4.8 and its peer group at 4.9, and even above its fair ratio of 5.6. This premium suggests that the market may already be pricing in a lot of future growth; could this signal elevated risk if expectations are not met?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AvePoint Narrative

If you see things differently or want to dig into the numbers yourself, it only takes a few minutes to craft a narrative based on your own research. Do it your way

A great starting point for your AvePoint research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for one opportunity. Broaden your horizons and pinpoint standout stocks that align with your goals using the Simply Wall Street Screener. Don’t let the best opportunities pass you by.

- Capture fast-growing tech trends by tapping into the surge of these 25 AI penny stocks. This positions you at the forefront of the AI wave.

- Secure resilient long-term returns by targeting these 16 dividend stocks with yields > 3% offering yields above 3%. These are suitable for income-focused portfolios.

- Seize overlooked value with these 865 undervalued stocks based on cash flows to make the most of market inefficiencies and find gems priced below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVPT

AvePoint

Provides cloud-native data management software platform in North America, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives