- United States

- /

- Software

- /

- NasdaqGM:APPF

How Investors Are Reacting To AppFolio (APPF) Raising 2025 Revenue Outlook After Strong Q3 Results

Reviewed by Sasha Jovanovic

- On October 30, 2025, AppFolio, Inc. raised its full-year 2025 earnings guidance, forecasting annual revenue between US$945 million and US$950 million, owing to strong adoption of its Plus and Max product tiers, customer growth, and new business initiatives.

- This upward revision was accompanied by third quarter results showing solid year-over-year revenue gains and continuing profits, reflecting ongoing demand for the company's cloud-based real estate management solutions.

- We will explore how AppFolio’s raised annual revenue outlook, driven by higher-tier product adoption and customer expansion, impacts its investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

AppFolio Investment Narrative Recap

To be a shareholder in AppFolio, you need to believe that the company's ability to drive customer growth and deeper adoption of its higher-priced Plus and Max tiers will sustain expanding revenues and margin improvement, despite competition among SaaS property management providers. The raised 2025 revenue guidance reinforces the nearer-term catalyst of premium tier adoption, but the most significant risk, pricing pressure from competitors as SaaS tools become more commoditized, remains largely unchanged by this update.

The most relevant recent announcement is AppFolio's updated annual revenue outlook, which now targets US$945 million to US$950 million for 2025, attributing the jump to growth in its higher-value product offerings and a larger customer base. This aligns directly with the company’s recent quarterly results, which showed annual and sequential revenue gains but highlight the need to keep distinguishing its products as more competitors add similar automation features.

However, investors should be aware that if competitors accelerate their rollout of AI-powered solutions and lower pricing, the company could face...

Read the full narrative on AppFolio (it's free!)

AppFolio's narrative projects $1.4 billion revenue and $192.0 million earnings by 2028. This assumes a 17.7% yearly revenue growth and a $11.1 million decrease in earnings from $203.1 million today.

Uncover how AppFolio's forecasts yield a $330.20 fair value, a 31% upside to its current price.

Exploring Other Perspectives

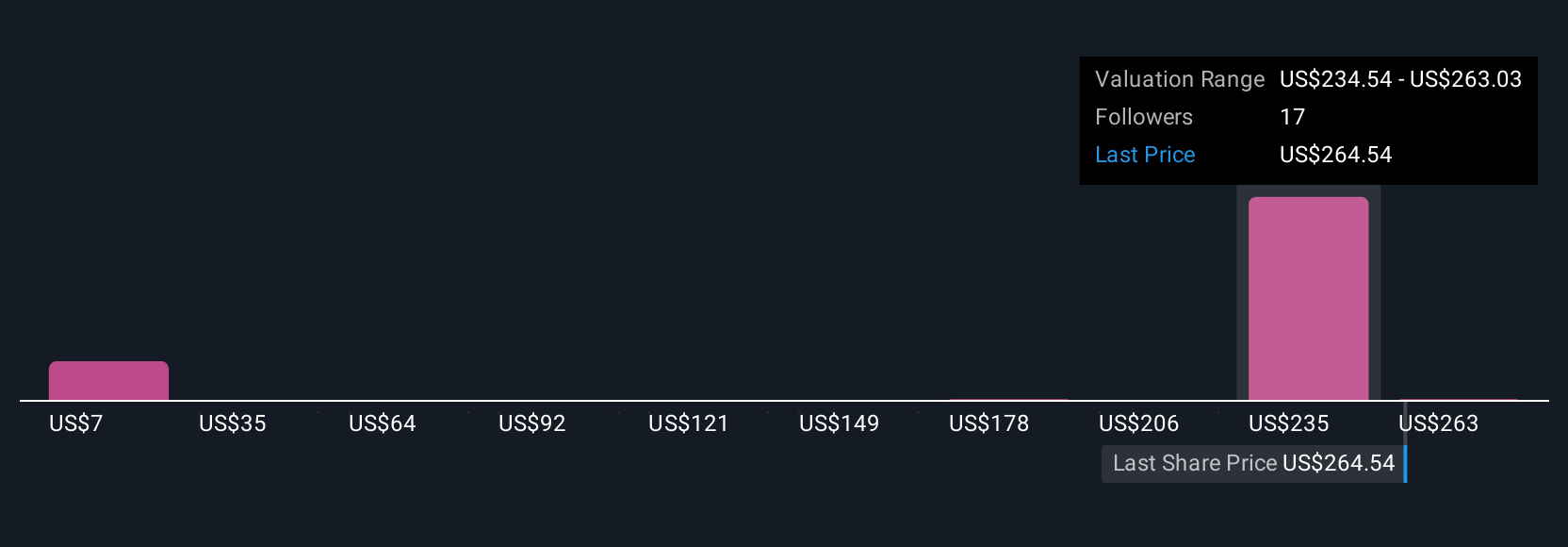

Fair value estimates from five Simply Wall St Community members span from US$192.61 to US$330.20, showing a wide range of opinions. While investors are weighing the impact of AppFolio’s higher guidance and premium tier momentum, differing views illustrate how competition in SaaS property management could shape future results, explore these alternative perspectives to broaden your understanding.

Explore 5 other fair value estimates on AppFolio - why the stock might be worth 24% less than the current price!

Build Your Own AppFolio Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AppFolio research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free AppFolio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AppFolio's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:APPF

AppFolio

Provides cloud-based platform for the real estate industry in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives