- United States

- /

- Software

- /

- NasdaqGS:APP

How AppLovin’s 18% Surge and AI Expansion Shape Its 2025 Valuation Outlook

Reviewed by Simply Wall St

Thinking about whether to buy, hold, or sell AppLovin stock right now? You're not alone. With AppLovin’s price jumping nearly 18% over the past month and a massive 363% surge in the past year, plenty of investors are trying to figure out what is driving this momentum. While past returns never guarantee future results, such strong performance can change how people perceive the company’s risk and growth potential.

AppLovin has benefited from surging demand in the mobile advertising and app ecosystem, and market optimism has only ramped up since its last earnings report. Of course, sharp rallies raise important questions. Is the stock still attractively valued, or are investors overpaying for the promise of more growth?

If you look at six common value checks, AppLovin scores a 2, meaning it appears undervalued on just two out of six valuation metrics. That is nothing to scoff at, but it also suggests caution is warranted if you are chasing the recent gains.

Next up, let’s break down exactly how AppLovin’s value has been assessed using the most popular valuation methods. And stay tuned, because near the end of this piece, we will highlight a smarter way to make sense of what AppLovin is really worth.

AppLovin delivered 363.3% returns over the last year. See how this stacks up to the rest of the Software industry.Approach 1: AppLovin Cash Flows

The Discounted Cash Flow (DCF) model calculates a company's value by projecting its future free cash flows and then discounting them back to today. This approach helps estimate what the stock might truly be worth at present.

For AppLovin, the latest twelve months’ Free Cash Flow is $2.89 billion. Analysts project that this figure will continue to grow, reaching approximately $10.81 billion by 2035. These estimates indicate consistent annual growth in the coming years, which suggests ongoing profitability.

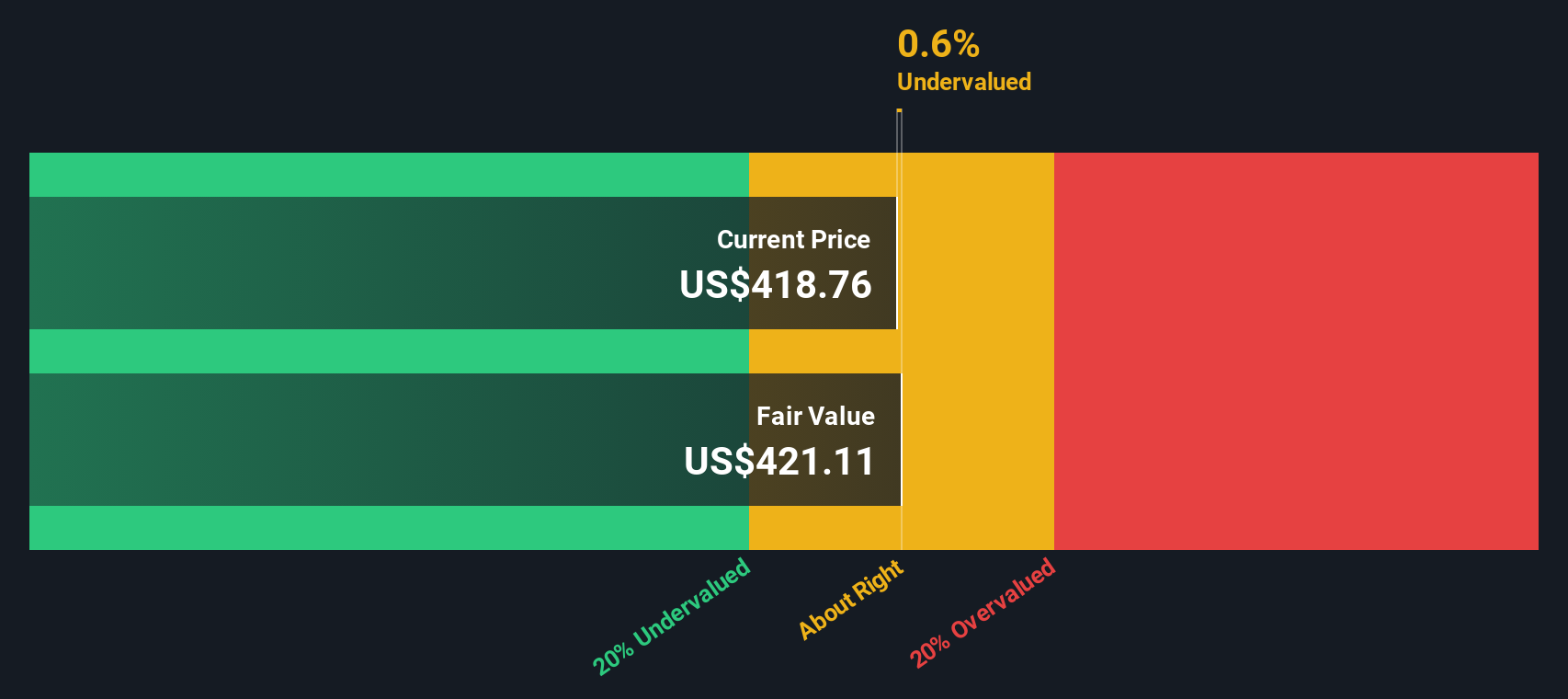

After factoring in all projected figures through a 2 Stage Free Cash Flow to Equity valuation, AppLovin’s intrinsic value is estimated at $420.97 per share. Comparing this to the current share price, the DCF suggests the company is about 2.0% undervalued. This is a narrow margin, implying the price is close to fair value given the expected future cash generation.

Result: ABOUT RIGHT

Approach 2: AppLovin Price vs Earnings (PE)

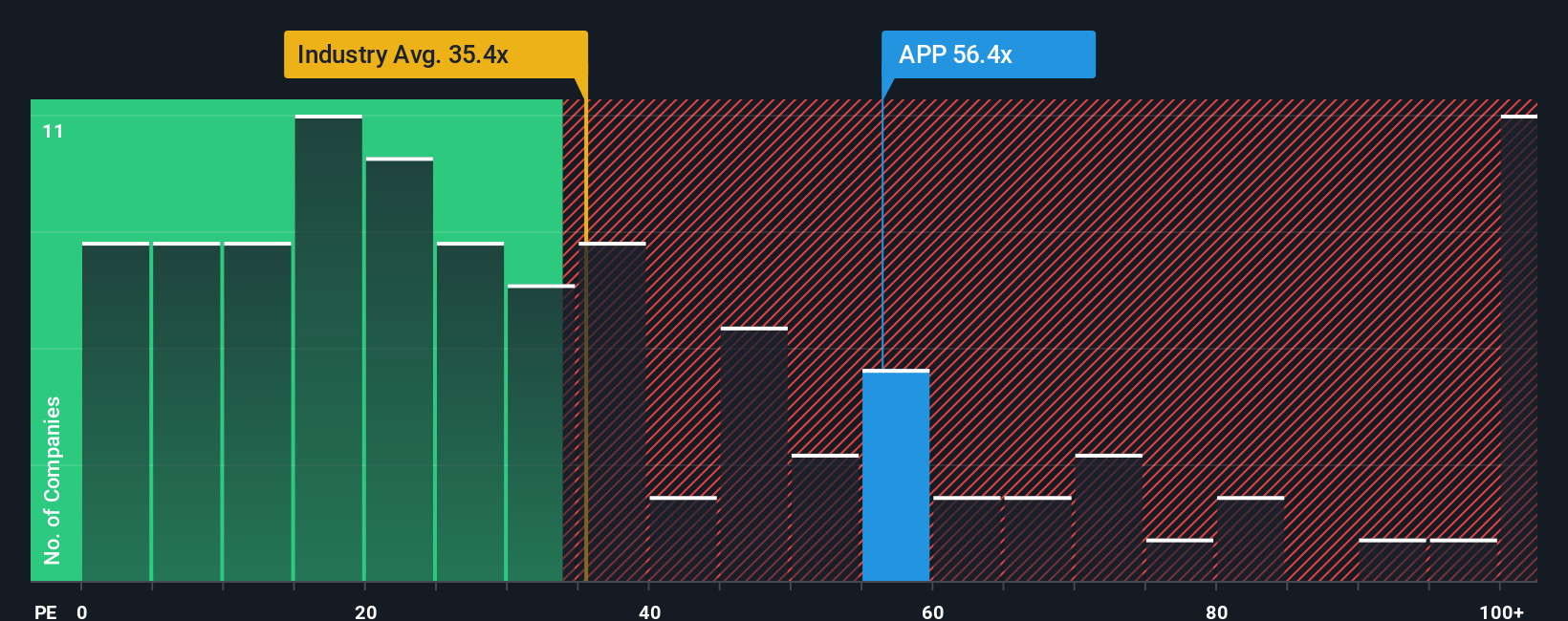

The Price-to-Earnings (PE) ratio is a popular tool for valuing profitable companies like AppLovin because it puts the current share price in the context of the company's actual earnings power. For investors, the PE ratio is especially relevant when the business is generating steady profits, as it provides a direct sense of how much they are paying for each dollar of profit.

Of course, what is considered a “normal” or “fair” PE ratio depends on factors such as expected earnings growth and the company’s risk profile. Fast-growing, innovative companies typically have higher PE ratios, while more mature or riskier businesses generally trade at lower multiples.

Currently, AppLovin trades at a PE ratio of 55.49x. This is well above the Software industry average of 36.73x but slightly below the peer group average of 63.37x. To offer deeper context, Simply Wall St’s Fair Ratio model estimates AppLovin’s fair PE to be 53.51x, taking into account growth potential, profitability, industry trends, and risks. With the actual PE just slightly above the Fair Ratio and the difference less than 0.10, AppLovin appears to be valued about right based on current expectations.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your AppLovin Narrative

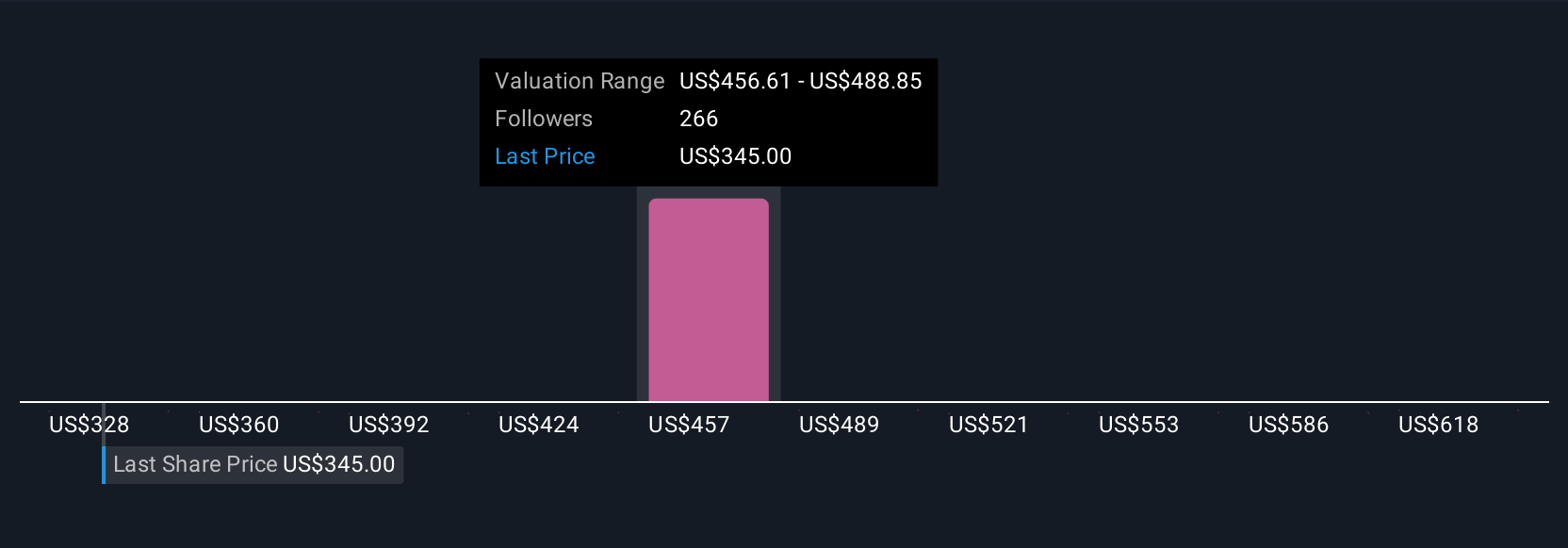

If you want to go beyond the numbers, Narratives provide a smarter and simpler way to invest. A Narrative is your own story or perspective about a company, linking what you believe about its future to clear, personalized forecasts for revenue, earnings, and profit margins. Narratives help ground your investment decisions by connecting a company’s unique story, such as strategic bets, new technologies, or market trends, with how that story is likely to unfold in financial terms and ultimately what the fair value might be.

The best part, especially on Simply Wall St, is that Narratives are easy to create and share thanks to the platform’s tools and its vibrant investor community. Narratives update automatically as new data, news, or earnings are released, so your analysis stays current with the market. This makes it easier to compare your estimated fair value to the current share price and can help you decide when to buy, hold, or sell based on your convictions, not just the crowd.

For example, one investor might be bullish and value AppLovin at $650 per share based on rapid global expansion. Another could be much more cautious and estimate just $250, focusing on regulatory threats and competition.

Do you think there's more to the story for AppLovin? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APP

AppLovin

Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026