- United States

- /

- Software

- /

- NasdaqGS:APP

AppLovin (APP): Assessing Valuation After Strong Q3 Results and AI-Driven Growth Momentum

Reviewed by Simply Wall St

AppLovin (APP) delivered a strong set of third-quarter results that surpassed expectations on both revenue and profitability. The momentum was driven by progress in AI and automation, as well as its expanding gaming and advertising businesses.

See our latest analysis for AppLovin.

Investors have taken notice of AppLovin’s outsized growth and product momentum. The stock’s 75.4% year-to-date share price return and a 78% total shareholder return over the past year signal building confidence around its AI-driven strategy. Several well-received product launches and consistently strong earnings beats have fueled this enthusiasm, even as minor pullbacks occurred amid profit-taking and broader tech volatility.

If AppLovin’s rapid climb caught your attention, it might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

The company’s rapid climb and upbeat forecasts have attracted attention. With shares trading near all-time highs, investors are left to wonder whether there is still potential for growth or if future prospects have already been priced in.

Most Popular Narrative: 16.6% Undervalued

AppLovin's most widely followed narrative suggests its shares could be trading well below their fair value, with the fair value significantly outpacing the last close of $599.48. Savvy investors are paying attention as bullish catalysts and upbeat forecasts drive future growth expectations higher.

Continuous advancements and adoption of the AXON machine learning platform are improving ad targeting, campaign ROI, and automation. These developments are enhancing advertiser outcomes and enabling higher net margins through increased operating efficiency.

Ready to see what sets this valuation apart from the crowd? What if one platform upgrade could change everything? Discover which future-facing assumptions underpin this eye-catching estimate and what analysts believe could supercharge AppLovin’s financials. Are you curious about the bold projections and industry shifts fueling this narrative’s target?

Result: Fair Value of $718.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened regulatory scrutiny and AppLovin’s reliance on mobile gaming could challenge growth assumptions and test the bullish case presented by analysts.

Find out about the key risks to this AppLovin narrative.

Another View: Is the Current Price Justified?

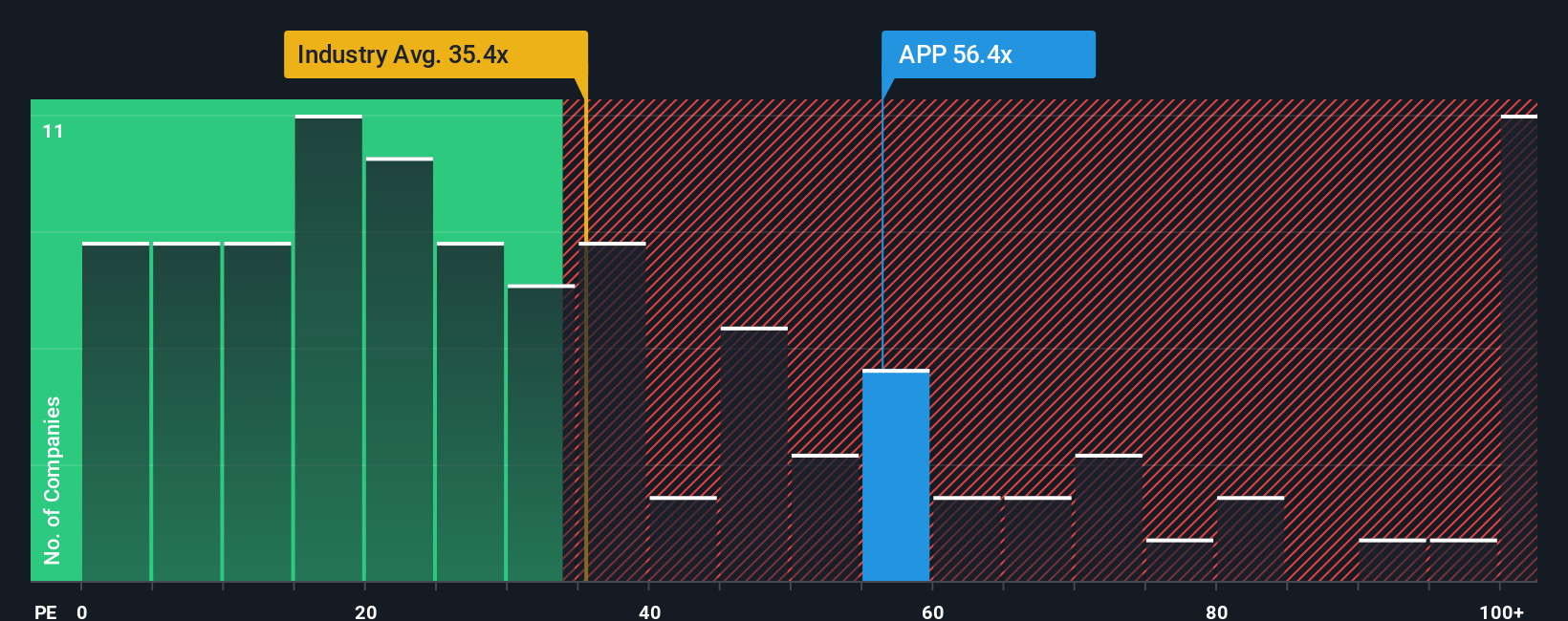

While the consensus points to AppLovin trading below fair value, a quick look at its price-to-earnings ratio reveals a more expensive reality. The company trades at 69.5 times earnings, which is higher than the US Software industry average of 31.8x and also above the peer group average of 43.8x. Even the fair ratio estimate of 60x suggests the market is paying a premium. Does this heightened valuation signal confidence, or does it set the stage for risk if expectations are not met?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AppLovin Narrative

If you see things differently or want to dig into the numbers on your own terms, you can put together your own analysis in just minutes. Do it your way

A great starting point for your AppLovin research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next move count. Act now to find incredible growth stories and unique opportunities beyond AppLovin using the Simply Wall Street Screener. Miss this, and you might miss your next winner.

- Capture explosive opportunities in the world of AI by reviewing these 25 AI penny stocks, which stand out for rapid innovation and smart automation.

- Unlock hidden value by targeting outstanding companies trading below their intrinsic worth when you scan these 914 undervalued stocks based on cash flows in the market.

- Collect reliable income by checking out these 15 dividend stocks with yields > 3% offering generous yields to strengthen your portfolio for the long term.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APP

AppLovin

Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026